Vhy dividend calculator

Looks you are already a member. Please enter your password to proceed. Forgotten password?

This dividend calculator is a simple tool that lets you calculate how much money you will get from a dividend when you invest in a dividend-paying stock. In this article, you will find out what a dividend is and how to calculate dividends. We'll also walk you through a simple dividend example to demonstrate how to use our tool. A stock dividend, or dividend for short, is a payment made by a company to its shareholders. Dividend payments are usually made from the corporation's profit, i.

Vhy dividend calculator

Looks you are already a member. Please enter your password to proceed. Forgotten password? Click here. Please make sure your payment details are up to date to continue your membership. Please contact Member Services on support investsmart. It may take a few minutes to update your subscription details, during this time you will not be able to view locked content. If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in. Registration for this event is available only to Eureka Report members. View our membership page for more information. Registration for this event is available only to Intelligent Investor members. Already a member?

Registration for this event is available only to Eureka Report members.

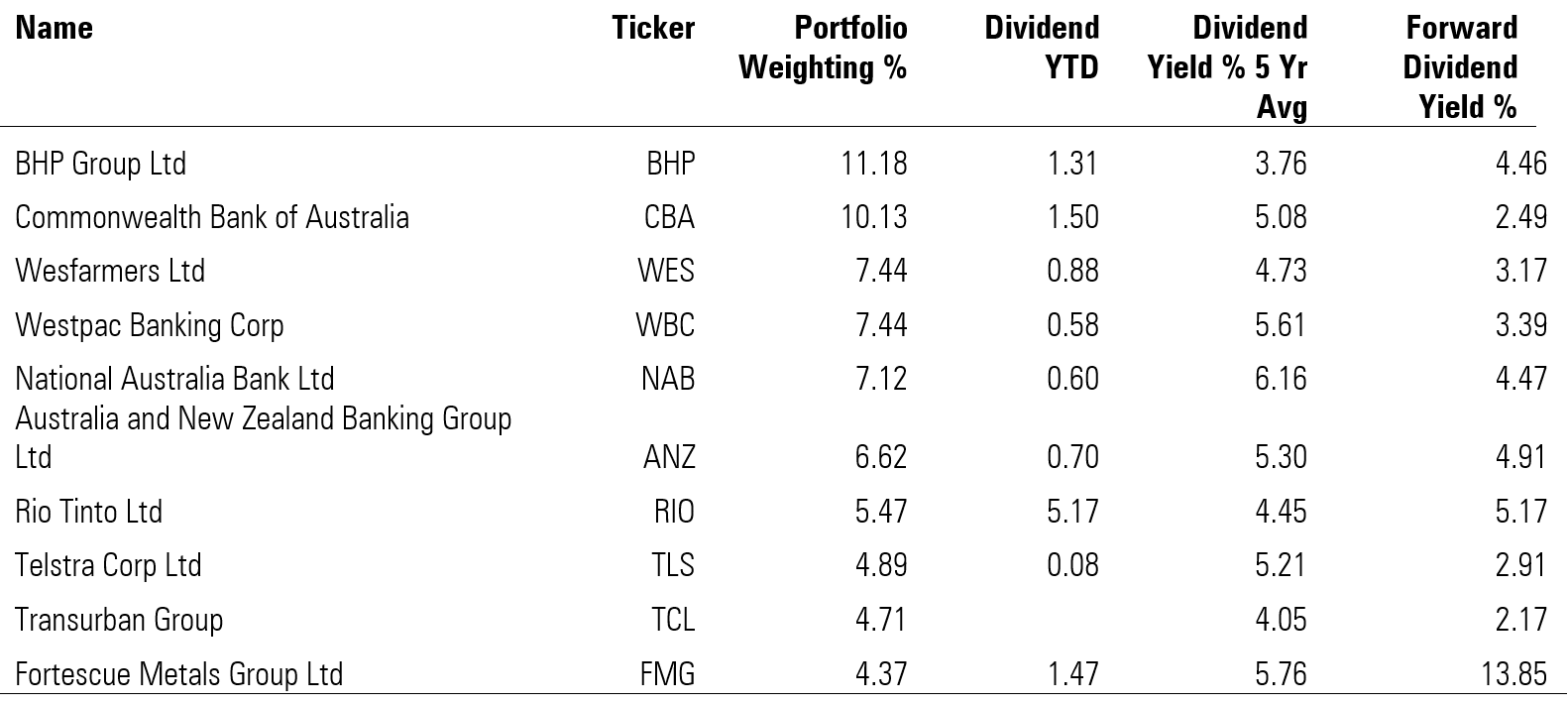

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. But no one should dive into an investment without first understanding exactly how it works and what they are actually investing in. These shares are selected for their ability to offer "higher forecast dividends relative to other ASX-listed companies". The fund is structured in such a way as to prevent too much concentration in one particular sector. Among those 72 shares, you will find virtually all of the ASX's biggest dividend names. As you might expect from an ASX dividend-focused fund though, financials shares , mining or materials stocks , and energy shares make up most of the weighted portfolio.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As most of us would be aware, hasn't exactly been the kindest start to a year that ASX shares have faced. That's despite it gaining some ground since bottoming out on 27 January. Since then, the ASX is up a solid 5. But that's still not enough to drag it into positive territory for the year.

Vhy dividend calculator

You can use this chart to visualise how the ETF responds to different market environments. The chart compares price return only. You could buy all of these companies yourself using a share brokerage account, but that would be a very expensive and time-consuming process. These companies are likely to pay regular tax-effective dividends to their shareholders, including franking credits.

Dennis wolf wikipedia

The shorter your timeframe the more conservative you should be with your investments. You've recently updated your payment details. Now that you know "what is a dividend", let's go into more detail. Time is the most critical aspect of investing. Get Investment Plan. Scott Phillips just released his 5 best stocks to buy right now and you could grab the names of these stocks instantly! Payment date date: Date the distribution is paid to the unit holder. These shares are selected for their ability to offer "higher forecast dividends relative to other ASX-listed companies". Please contact Member Services on support investsmart. Compare our membership packages. Purchase order.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more.

These shares are selected for their ability to offer "higher forecast dividends relative to other ASX-listed companies". Get Investment Plan. What emails do members receive? No Morningstar-affiliated company or any of their employees is providing you with personalised financial advice. People also viewed See all. Consequently, the more the FCF, the more dividends you could receive. Market capitalisation is equal to the market price per share or unit multiplied by the number of shares or units outstanding. There — you have your dividend yield in percent. Card Details Edit. Verification code is required. Dividend yield is the ratio of the annual dividend to share price.

I consider, that you are mistaken. Let's discuss it.

It is remarkable, rather valuable information