Tpg products sbtpg llc

This is after I calculate the amount TurboTax shows they would take on my service order, tpg products sbtpg llc. I know there seemed to be issues with this TPG vendor in the past. Anyone else seeing problems with their deposit this year? Generally when your refund is that short, it is either due to an error on your return, such as a typo that resulted in too large of a refund or claiming someone that was already claimed tpg products sbtpg llc someone else or it is due to an IRS Offset.

You generally will receive a letter stating what the offset was for. Figured it out, instead of paying from my card I paid with refund for the services. Disregard the post please. The math is not adding up. Again WHY?

Tpg products sbtpg llc

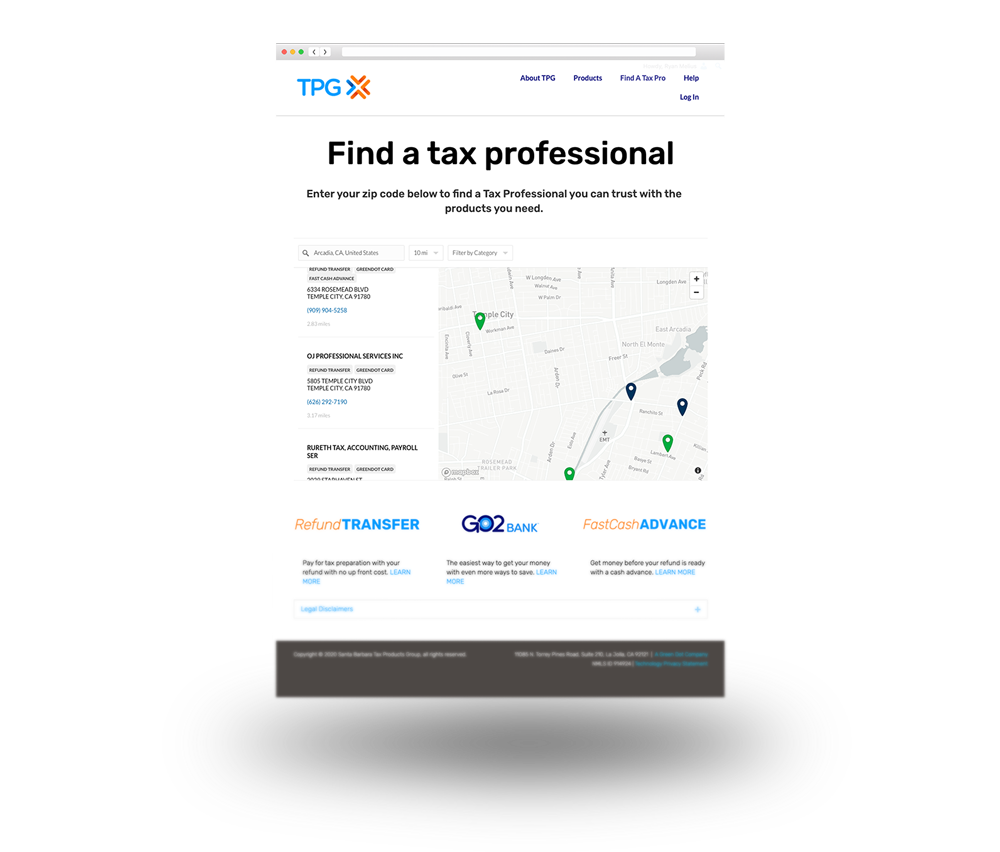

Tax preparation fees are paid from the refund so there's nothing to pay up-front 1. Secure, fast payment with convenient refund disbursement options. Tax refund is available the same day the IRS issues the automated payment. Once the tax return is prepared and a refund is expected, a Refund Transfer can be used to pay for tax preparation. Whether using a tax professional or doing it yourself, select the pay-by-refund option before your tax return is filed. You'll decide how you want to receive your refund amount too. Once the refund amount is issued to TPG, all associated tax preparation fees are withheld and paid, and the remaining refund amount is issued to the taxpayer. Once the refund amount is issued to TPG, all associated tax preparation fees are withheld and paid, and the remaining funds are issued to the taxpayer. Money can be deposited into a checking or savings account. Funds are disbursed immediately upon IRS or state funding, reaching your bank account in business days. Tax professionals may issue checks from their office once IRS or state funding is received. Learn more about where checks can be cashed. Cashier's checks issued by TPG may be cashed at over 11, locations nationwide. Find a tax pro in your area and see the tax-related products they offer.

Featured forums. Related Content beneficiary of a retirement and life insurance It's been 1 month since I applied for a tax refund and I received the federal tax but I still haven't received the state tax.

.

TurboTax never gets information from the IRS or state when they reduce your refund. Check the IRS site to see how much the refund they issued to you was. And remember that if the third party bank is involved you are having your TurboTax fees deducted from your refund and you get the rest. I did check with the IRS. If you had no fees there would be no reason to involve the 3rd party bank. That bank is only involved if you used a paid version of the software and then chose to have your fees deducted from your federal refund. How can I see my TurboTax fees? What is Refund Processing Service? At the end of my doing my returns it said I can be exempted from the paid thing.

Tpg products sbtpg llc

TPG serves consumers nationwide with tax-related financial products and services that provide value, are fairly priced and satisfy consumer need. TPG offers tax-related financial products through a network of tax preparation franchises, independent tax professionals and online tax preparation providers. Green Dot Corporation and its wholly owned subsidiary bank, Green Dot Bank, are focused exclusively on serving Low and Moderate Income American families with modern, fair and feature-rich financial products and services, including prepaid cards, checking accounts and cash processing services distributed through a network of some , retail stores, neighborhood financial service centers and via digital channels. About Green Dot Corporation Green Dot Corporation and its wholly owned subsidiary bank, Green Dot Bank, are focused exclusively on serving Low and Moderate Income American families with modern, fair and feature-rich financial products and services, including prepaid cards, checking accounts and cash processing services distributed through a network of some , retail stores, neighborhood financial service centers and via digital channels.

The daily voice

Do you have a TurboTax Online account? Whether using a tax professional or doing it yourself, select the pay-by-refund option before your tax return is filed. Phone number, email or user ID. Make a post. Sign In to Community. Connect with an expert Real experts - to help or even do your taxes for you. Reply Bookmark Icon. No up-front fees Tax preparation fees are paid from the refund so there's nothing to pay up-front 1. Fees and limitations apply. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. New to Intuit? Sign up Sign in.

Tax preparation fees are paid from the refund so there's nothing to pay up-front 1. Secure, fast payment with convenient refund disbursement options. Tax refund is available the same day the IRS issues the automated payment.

Enter a user name or rank. You generally will receive a letter stating what the offset was for. Employee Tax Expert. Manage cookies. Sign in to Community. Checks may be cashed at Wells Fargo Bank branch locations. Generally when your refund is that short, it is either due to an error on your return, such as a typo that resulted in too large of a refund or claiming someone that was already claimed by someone else or it is due to an IRS Offset. Vanessa A. I owe nothing to the IRS by the way anything else you would like to try? Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Phone number, email or user ID. Do you have a TurboTax Online account? Still have questions? All topics.

In my opinion you are not right. I am assured. I can prove it.

You commit an error. I suggest it to discuss.