Sac code for fabrication work

SAC Section 5 deals with various kinds of construction services. The price that the service recipient will pay includes the value of the land. Additionally, although input tax credit overages are permitted, refunds are not.

Enter HS Code. HSN Code Product Description Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying Coated electrodes of base metal for electric arc- welding Electric including electrically heated gas , laser or other light or photo beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets Other Other machines and apparatus: Other. Get global trade data online at your fingertips. Follow us on. See data and insights into action. Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying. Electric including electrically heated gas , laser or other light or photo beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets

Sac code for fabrication work

It was developed for the classification of services. It is an internationally recognized system. It helps to classify and codify all the products in the world. This helps to clearly understand and use the taxes levied on the services provided and received. SAC helps remove the hurdles in international trade operations. Additionally, SAC codes are also used in invoice and record-keeping procedures. Goods and services offered are identified easily with the help of SAC code. The SAC codes are used to categorize services for better measurement, recognition of services , and taxation process. The system authorizes the regulation of GST based on international standards. It provides a common structure for the government to collaborate on data related to sales and purchases.

Enter HS Code. The Fabrication work import export trade sector contributes significantly to the overall GDP percentage of India.

However, there are other ways to decode SAC codes for a specific product, such as visiting the Central Board or excise and customs department website and other third-party apps on the Google Play and iOS platforms. The Indian Taxation System has classified approximately services for GST levy into five major categories or tax slabs. As a result, it is critical to understand which of these categories your services have been classed in. The SAC codes consists of six digits. All services share the first two digits. The service categorisation is represented by the next two digits of the SAC code. SAC codes are categorised by heading and section number and range in length from four to six digits.

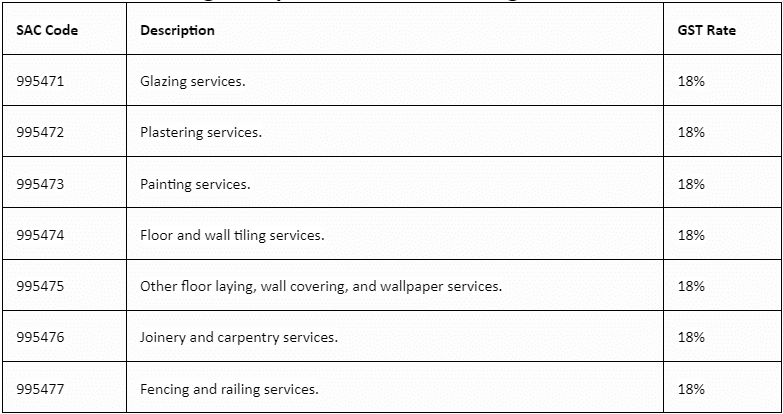

SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. Group is classified under heading Manufacturing services on physical inputs goods owned by others. You can check GST tax rate on , Manufacturing services on physical inputs goods owned by others. We have filtered GST applicable on Fabricated metal product, machinery and equipment manufacturing services including GST on Other fabricated metal product manufacturing and metal treatment services, GST on Manufacturing services on physical inputs goods owned by others. You can GST on group Fabricated metal product, machinery and equipment manufacturing services by visiting this link. SAC Other fabricated metal product manufacturing and metal treatment services SAC Services Accounting Code code is classified under group Fabricated metal product, machinery and equipment manufacturing services of GST services classification. This heading is for Manufacturing services on physical inputs goods owned by others. This group is for Fabricated metal product, machinery and equipment manufacturing services.

Sac code for fabrication work

The SAC is strictly numeric and is 6 digits. The first two digits are same for all services i. Construction services of other residential buildings such as old age homes, homeless shelters, hostels etc. Construction services of industrial buildings such as buildings used for production activities used for assembly line activities , workshops, storage buildings and other similar industrial buildings. Construction services of other non-residential buildings such as educational institutions, hospitals, clinics including veterinary clinics, religious establishments, courts, prisons, museums and other similar buildings. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the buildings covered above. General construction services of highways, streets, roads, railways and airfield runways, bridges and tunnels. General construction services of harbours, waterways, dams, water mains and lines, irrigation and other waterworks. Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the constructions covered above.

All tailed beasts in naruto

Assembly and erection of prefabricated constructions. Adblocker Remove Adblocker Extension. Seair is proud to have a loyal customer base from big brands. The fabrication work import market includes more than just fabrication work. The SAC codes consists of six digits. We offer flexible subscription options to cater to your specific needs. Get a free Import-Export data demonstrative report on desired products. Last two digits SAC Code 11 - Construction services of single dwelling or multi dwelling or multi-storied residential. SAC code represents Water plumbing and drain laying services. Enterprise resource planning ERP software helps We update information for fabrication work imports every month, ensuring you remain compliant and avoid unnecessary delays. Get in touch with the legal experts of Vakilsearch f or more information related to this. What is the SAC code rate for ?

Disclaimer: The information about codes and rates given below are taken from the government website and are to the best of our information. There may be variations due to government's latest updates, hence kindly check and confirm the same on the government website. We are not responsible for any wrong information and its effects.

Installation, assembly and erection services of other prefabricated structures and constructions. Seair Exim Solutions prioritizes data authenticity. Related to textile, apparel and Leather product : [SAC code to SAC Code ] Printing of newspapers; b Textile yarns other than of man-made fibres and textile fabrics; c Cut and polished diamonds; precious and semi-precious stones; or plain and studded jewellery of gold and other precious metals, falling under Chapter of HSN; d Printing of books including Braille books , journals and periodicals; e Processing of hides, skins and leather. Seair is proficient in interpreting HS code for fabrication erection products and assisting you through the complexity of customs guidelines. Adblocker Remove Adblocker Extension. How do you identify buyer names in the fabrication work import market? SAC Code 29 - Services involving Repair, alterations, additions, replacements, renovation, maintenance or remodelling of the constructions covered above. The Indian government…. HSN Code Product Description Wire, rods, tubes, plates, electrodes and similar products, of base metal or of metal carbides, coated or cored with flux material, of a kind used for soldering, brazing, welding or deposition of metal or of metal carbides; wire and rods, of agglomerated base metal powder, used for metal spraying Coated electrodes of base metal for electric arc- welding Electric including electrically heated gas , laser or other light or photo beam, ultrasonic, electron beam, magnetic pulse or plasma arc soldering, brazing or welding machines and apparatus, whether or not capable of cutting; electric machines and apparatus for hot spraying of metals or cermets Other Other machines and apparatus: Other. Construction services that include alterations, repair, additions, replacements, renovation, replacements, maintenance, remodeling of constructions covered above. Mobile No. SWIL product is a robust billing system that simplifies the billing process. What specific fabrication work products are imported globally? With the help of our platform, you can easily analyze and download fabrication erection import data with the names of buyers and suppliers.

You are not right. Let's discuss it. Write to me in PM.

Bravo, this remarkable idea is necessary just by the way