Northwestern mutual financial planning

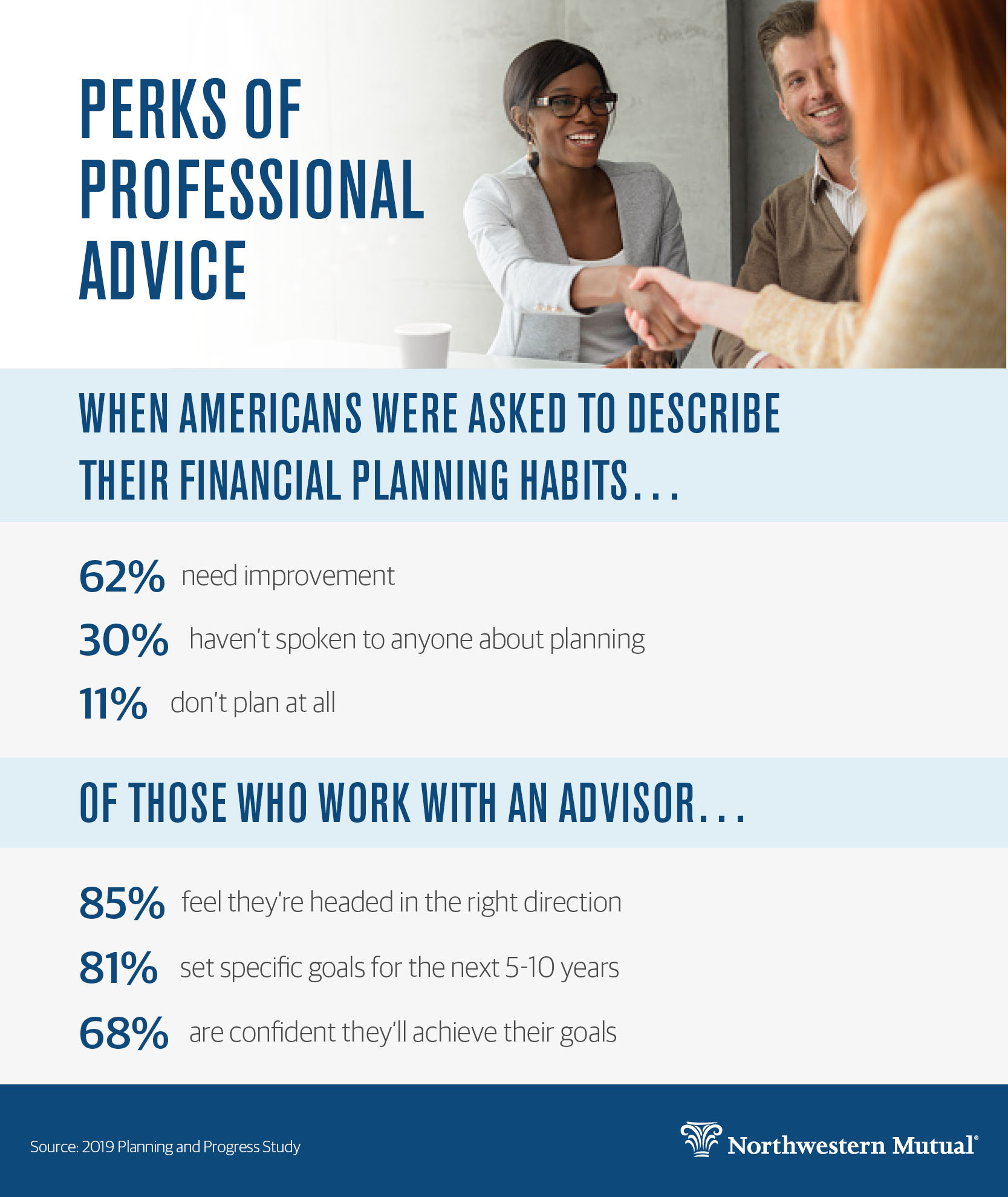

Having the right financial expert in your corner gives you the confidence to live the life you've always wanted while being ready for whatever comes your way.

A good financial plan is about more than growing your wealth, it also includes strategies to protect it from common risks. A good financial plan uses a range of financial options that work with investments to help you grow and protect your wealth. Improving your financial picture? Good plan. Our guide includes financial steps to set you up for financial success now and in the future.

Northwestern mutual financial planning

It's difficult to separate the financial needs and goals of your business with the goals you set for yourself and your family. We can help you develop an integrated approach that addresses both, allowing you to create a competitive business advantage and live the life you envision. By taking a comprehensive view of your financial plan personal, business and estate you'll clearly see how the success of your business will support your personal financial goals, such as buying a home, saving for college, retirement or leaving a legacy. Our integrated planning approach can also help prevent difficult financial periods in your business from impacting the plans you've made at home—and vice versa. Learn more about our full range of personal financial planning strategies and solutions and how we can help you evaluate, prioritize and address your needs. Personal financial planning services may also be extended to your employees, key employees and other interested employees if you choose. Learn more about the benefits of helping your employees create a more secure financial future. Our financial advisors can help you plan and manage your business with products and services that work with your financial plan. Learn more. Take the quiz. Personal Financial Planning.

Then a financial advisor will help you northwestern mutual financial planning out where you want to go. Andrew Weber leads the Planning Excellence team in researching and recommending good financial planning advice, chiefly with strategies that combine investments, life insurance, and annuities. Maybe you also have some life insurance.

Our financial advisors help you do it. Instead of starting with your finances, our advisors start with you—designing your plan around your priorities to help you reach your goals while protecting everything you've worked so hard for. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Here's what you can expect when you work with one:. Someone who understands what's most important to you today and later on. Who thinks of all the what-ifs so you don't have to, guiding you as your life and goals change. You'll get a personalized plan , at no cost to you, that balances your current, and future, priorities.

Our financial advisors help you do it. Our financial advisors help protect your family and keep your goals on track with insurance designed to give you financial flexibility, protect your income, and more. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Here's what you can expect when you work with one:. Someone who understands what's most important to you today and later on.

Northwestern mutual financial planning

What is a financial plan, exactly? It shows you how the different parts of your financial life like your investments, retirement accounts, savings, debt payoff plans and even insurance work together to get you to where you want to be financially. A solid financial plan will include flexible strategies to grow your money over time and to protect it from the curveballs life will inevitably throw. The first step to creating a financial plan is to sit down and think about what you really want both now and in the future. A financial advisor will get to know you and learn about the goals that are most important to you — and even help you identify some goals you may not have thought about. Common goals might include buying a home, preparing to have kids and sending them to college, protecting your family, starting or growing a business and being able to retire comfortably.

Asa id size

Your advisor listens to what's important for you to do today and down the road and designs a plan, with personalized recommendations tailored to your life, to make it happen. What you pay monthly or yearly for our insurance options is determined by things like the amount of coverage you need and your age. Learn more. But remember that as your life changes, so will your financial plan. That's because we start with you, your family, and your priorities. Get matched with a financial advisor in four easy steps. So we'll ask you a few questions about yourself, then we'll match you with an advisor who has the right expertise for your goals, experience working with other people like you, and has a good understanding of the area where you live. May not represent the experience of other clients and is not a guarantee of future performance or success. Here's how we do it. See how we approach financial planning differently or get started on your plan today. Independent Investment Broker-Dealers. Our advisors can show you the right financial steps to take you closer to the life you've always wanted. Get matched with one. Our advisors will help to answer your questions — and share knowledge you never knew you needed — to get you to your next goal, and the next. It's difficult to separate the financial needs and goals of your business with the goals you set for yourself and your family.

Some people think it's a retirement plan. Others a budget. We're here to clear things up.

Want more? What you get with a Northwestern Mutual financial plan. Key takeaways Financial planning involves setting goals and creating a roadmap for how you will achieve them. Want more? We can help you develop an integrated approach that addresses both, allowing you to create a competitive business advantage and live the life you envision. Answers to any questions you have, and the ones you never knew you had. So your plan stays flexible, and you stay on track to meet goal after goal. What is the cost of working with a financial advisor? And as your priorities change, your advisor will be there every step of the way, adjusting your plan to keep your goals on track. Independent Investment Broker-Dealers. A financial expert to partner with Someone who understands what's most important to you today and later on. The advisor can also consult on strategies to use debt to your advantage, perhaps to buy a second home or to start a business. May not represent the experience of other clients and is not a guarantee of future performance or success. Get matched with a financial advisor in four easy steps. Our advisors help you to see potential blind spots and to plan for them.

Bravo, you were visited with a remarkable idea