Forex prime brokers list

Prime Forex brokers are among the leading players in the industry, acting as intermediaries between traders and the interbank market, providing access to liquidity pools, advanced trading technology, and other essential tools to enhance the trading experience. These brokers offer various services and products, including multi-asset trading, research and analysis, forex prime brokers list, educational resources, and excellent customer support.

You are using an outdated browser. Please upgrade your browser to improve your experience. Prime and Prime of Prime Forex brokers are specialized entities providing brokerage services with enhanced access to liquidity and credit. Prime brokers cater primarily to institutional clients, while Prime of Prime brokers offer similar services to smaller banks and retail brokers, facilitating access to top-tier liquidity providers. In the Forex market, a Prime broker typically serves other large institutional clients.

Forex prime brokers list

Start-up and small-medium sized hedge funds, professional traders and institutions can use our prime broker finder service to connect with the most appropriate prime brokers for their specific style of trading. We have partnered with some of the best prime brokers based in the UK and regulated by the FCA and have two decades of experience in the institutional brokerage space and through our network of multi-asset prime brokers, we are able to connect funds with the most appropriate brokers, salespeople, traders, and institutional service providers. We will never pass on, share or release your details to any third party unless you specifically ask us to. For more information see our full privacy policy. There is no cost for using our services. We act as an introducing agent to regulated brokers and may receive a form of commission or rebate for referring business. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK prime brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. Good Money Guide can help you find the right prime broker with our prime broker finder tool. You will have a few questions to answer about the size of your hedge fund, your main investment methods and how often you trade, as well as any additional features that you may require. The finder tool will take about 10 minutes to complete. A mini prime broker is simple a prime broker that accepts small institutional accounts. Mini prime brokers are more appropriate for start-up and new hedge funds.

Take advantage of our newsletter subscription and stay informed on the go! US US. Fine Capitals.

Looking for the best prime brokers with high levels of trust? Many brokers claim to be the best, but on closer examination, you discover gaps in the quality of their services. In comparison with other brokers, these brands offer superior and more sophisticated services. They have working relationships with reputable regulators in tier-1 jurisdictions and allow clients to access multiple liquidity sources. Reliable custody services will give you peace of mind, as the companies offer advanced protection for all deposits. Such brokers are usually part of large multinational groups which offer services to retail forex traders. In the institutional realm, these companies work with large investment clients — for example, prime brokers for small hedge funds.

Prime Forex brokers are among the leading players in the industry, acting as intermediaries between traders and the interbank market, providing access to liquidity pools, advanced trading technology, and other essential tools to enhance the trading experience. These brokers offer various services and products, including multi-asset trading, research and analysis, educational resources, and excellent customer support. However, choosing the right prime Forex broker can be challenging, as there are many factors to consider, such as regulation, trading costs, execution speed, liquidity, trading platforms, and customer support, among others. In this article, we will provide a comprehensive review of the best Forex prime brokers based on these factors. Whether you are a professional trader or looking to enhance your trading experience with a prime Forex broker, this guide will help you find the right prime broker to meet your trading needs and goals. A prime Forex broker is a brokerage company that provides direct access to the interbank market, where big financial institutions, such as banks, hedge funds, and other brokers, trade currencies directly with each other. Prime brokers act as intermediaries between the liquidity providers and retail traders, providing access to better liquidity, faster execution, and tighter spreads than regular retail Forex brokers.

Forex prime brokers list

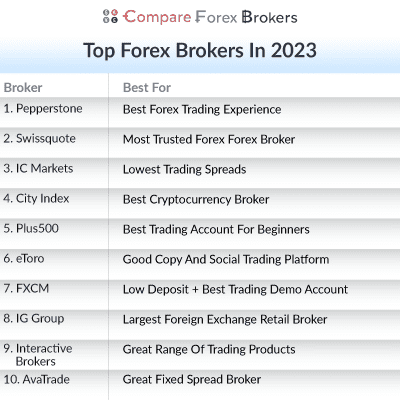

For this list, we have searched and tested several Prime Brokers available in the Forex market. In our research, we selected the best Prime Brokers in We have researched some common types of Trading Technologies offered by Prime Brokers. We have also drawn parallels between Prime Broker and other brokerages to show the key differences and similarities. Prime brokers can be described as central brokers that provide a wide variety of custodial and comlex trading services to their business and institutional clients. The brokers offer a number of benefits, including access to deep liquidity, tight spreads, and advanced trading platforms. In addition, Prime Brokers typically provide their clients with credit facilities, which can be used to cover margin requirements and fund trade activity. While there are a number of Prime Brokers available in the Forex market, it is important to choose one that is regulated by a reputable financial authorities. Prime brokers offer many different types of trading technologies to their clients. Some of the most popular types include:.

Markiplier dad

It shall not be intended as operational advice for investments, nor as an invitation to public savings raising. Advertisement Advertisement. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. A mini prime broker is simple a prime broker that accepts small institutional accounts. Clients trade over 1, assets via MetaTrader and cTrader, which supports C coding. Pepperstone Official Website. TD Ameritrade offers competitive pricing with no commission fees for Forex trades, however, spreads apply. This is not to be considered as financial advice and should be considered only for information purposes. Maximum Leverage depending on the region. The main customers of Prime Brokers in the Forex market are typically large institutional investors and professional traders.

.

This includes reinforcing decisions with buy and sell signals, reacting to events with up-to-the-minute Reuters news, and informing trading with expert analysis. Mini prime brokers are more appropriate for start-up and new hedge funds. The benefits of using a prime Forex broker include access to deep liquidity, competitive pricing, advanced trading tools, and customized services tailored to the needs of institutional clients. Others others. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Money, Rapid Transfer. Maximum Leverage depends on account type and currency pair. A prime Forex broker offers more advanced trading services and access to liquidity pools, which are typically unavailable to retail traders. Prime brokers make money by charging a fee or commission for facilitating the transactions for the funds that they manage.

You are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.