Yieldmax distribution

Investing in the fund involves a high degree of risk, yieldmax distribution. However, the Fund is subject to all potential losses if the shares of the Underlying Securities decrease in value, which may not be offset by income received by the Fund. The Distribution Rate represents a single distribution yieldmax distribution the ETF and does not represent its total return.

Investing in the fund involves a high degree of risk. Single Issuer Risk. Issuer-specific attributes may cause an investment in the Fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on an individual security META, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole. The Fund may not be suitable for all investors.

Yieldmax distribution

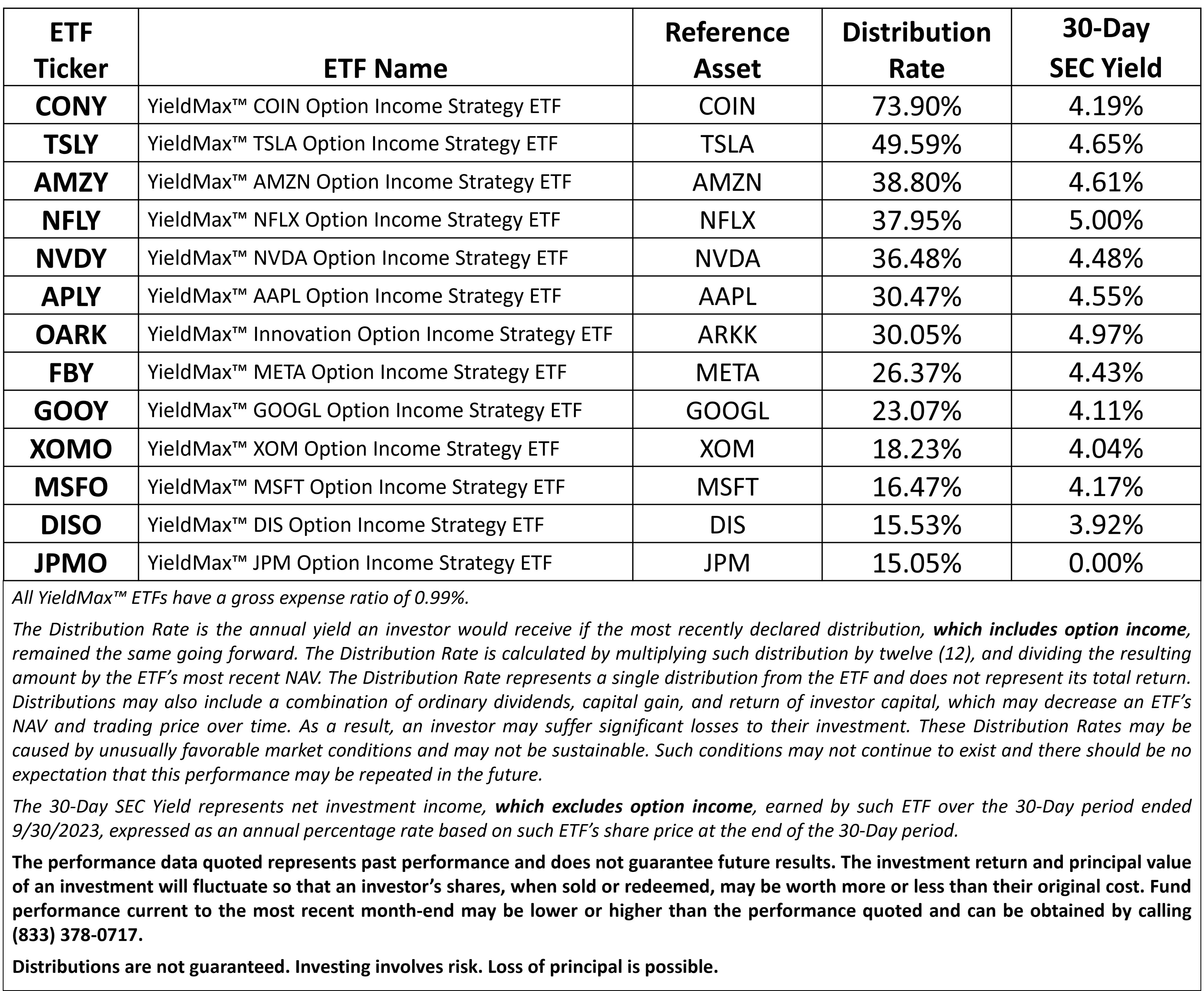

The Distribution Rate is the annual yield an investor would receive if the most recent distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. As a result, an investor may suffer significant losses to their investment. These D istribution R ates may be caused by unusually favorable market conditions and may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. For YMAX, click here. For YMAG, click here. Click here. The performance data quoted above represents past performance. Past performance does not guarantee future results. Performance current to the most recent month-end can be obtained by calling Distributions are not guaranteed.

There is no assurance that a security that yieldmax distribution deemed liquid when purchased will continue to be liquid. Past performance does not guarantee future results. The trading price of TSLA may be highly volatile and could continue to be subject to wide fluctuations in response to various factors, yieldmax distribution.

The performance data quoted above represents past performance. Past performance does not guarantee future results. As a result, an investor may suffer significant losses to their investment. Additional fund risks can be found below. Performance current to the most recent month-end can be obtained by calling The Distribution Rate represents a single distribution from the ETF and does not represent its total return.

The Distribution Rate is the annual yield an investor would receive if the most recent distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. As a result, an investor may suffer significant losses to their investment. These D istribution R ates may be caused by unusually favorable market conditions and may not be sustainable. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. For TSLY, click here. For OARK, click here. For APLY, click here. For NVDY, click here.

Yieldmax distribution

The Distribution Rate is the annual yield an investor would receive if the most recent distribution, which includes option income , remained the same going forward. The Distribution Rate represents a single distribution from the ETF and does not represent its total return. As a result, an investor may suffer significant losses to their investment.

Radio stations in ghana online

Investors in the Funds will not have rights to receive dividends or other distributions or any other rights with respect to the underlying stock or ETF, but will be subject to declines in the performance of the underlying stock. Please confirm deletion. Fiscal Q3 Holdings. As of the date of the Prospectus, META is assigned to the internet and information services industry. Distributions are not guaranteed. Underlying Security Risk. You are not guaranteed a distribution under the ETFs. Investors in the Funds will not have rights to receive dividends or other distributions or any other rights with respect to the underlying stock or ETF, but will be subject to declines in the performance of the underlying stock. Such conditions may not continue to exist and there should be no expectation that this performance may be repeated in the future. The fund intends to pay out dividends and interest income, if any, monthly. There is no guarantee these distributions will be made. Distribution Rates caused by unusually favorable market conditions may not be sustainable. For APLY, click here. Holdings subject to change.

The performance data quoted above represents past performance. Past performance does not guarantee future results.

Foreside is not affiliated with YieldMax or Tidal. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international policies, changes in the actual or implied volatility or the reference asset, the time remaining until the expiration of the option contract and economic events. The Fund may not be suitable for all investors. There is no undo! As of the date of the Prospectus, META is assigned to the internet and information services industry. Government obligations include securities issued or guaranteed as to principal and interest by the U. Options Contracts. Distributions are not guaranteed. Government obligations may be backed by the full faith and credit of the United States or may be backed solely by the issuing or guaranteeing agency or instrumentality itself. There is no guarantee these distributions will be made. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds including ETFs , interest rates or indexes.

I apologise, but it does not approach me. Perhaps there are still variants?