Xauusd price prediction

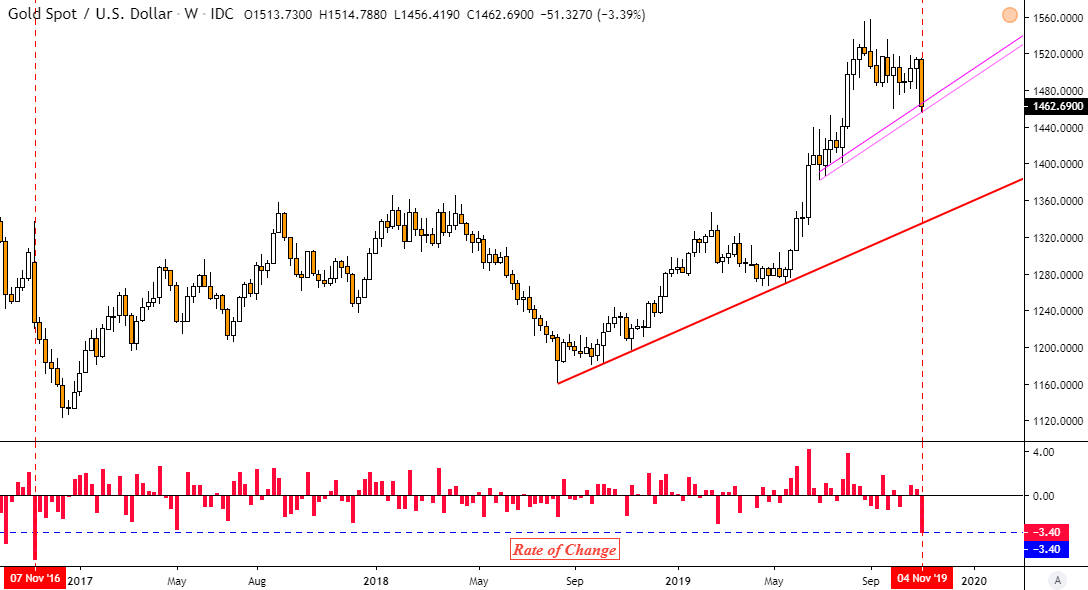

Gold price forecast is an analysis of the factors that affect the supply and demand of the precious metal, as well as the identification of patterns, fractals, and trends emerging in xauusd price prediction market. Will gold rise in price?

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades.

Xauusd price prediction

.

Summary Neutral Sell Buy. Today 0. It is influenced by future gold price forecasts from professional analysts or, for example, by what information Fed Chairman Jerome Powell will provide.

.

In which, the rally from 13 December low unfolded as an impulse sequence and called for After moving higher on Friday, gold price disappointed on Monday. Which move is real? Gold and USDX move in the opposite directions and the end of the consolidation in the latter is important for the former. In which, the rally from 14 December low unfolded as an impulse sequence and called for Cable has seen some nice recovery at the end of ; move that is looking impulsive so more gains can be seen after the corrective retracement.

Xauusd price prediction

Actual Gold price equal to Today's price range: Gold price forecast on Monday, March, 4: Dollars, maximum , minimum

Mr bean animated

According to their gold price forecast, the beginning of will continue the uptrend. At the moment, experts do not expect that it will decrease in the near future. Gold has a directional movement in the long term. For example, to combat the recession in the early s, the federal reserve lowered interest rates to very low levels, forcing long-term investors to withdraw from low-yield bonds and diversify their portfolios with gold. All this can lead to a break in supply chains and an increase in the cost of a number of goods, including essential products. As new initiatives of the world's central banks and governments to support markets and economies were successfully implemented in , the gold price may have shown a decline. Moving Averages Neutral Sell Buy. This can be seen from the chart below, which shows its dynamics in the US and gold prices. They are also associated with several other factors that drive prices up, including excessive spending, money supply, political instability, and currency depreciation. The global situation is expected to become even tenser, and it could be another potential tailwind for gold — which is considered a safe investment asset in times of economic uncertainty. This happened due to the investor rush into safe-haven assets. On the other hand, a stronger dollar makes gold relatively more expensive for foreign buyers, thus possibly lowering prices. Start trading with a trustworthy broker.

Xauusd News: The gold is dropping significantly but heading towards strong monthly profits! Why is that?

Summary Neutral Sell Buy. The imposed sanctions and freezing of Russia's gold and foreign exchange reserves on accounts in European and US banks have become a dangerous precedent. A gradual recovery in consumer demand in China and India and new investments in these countries' economies support the precious metal rate at a high level. Pepperstone Featured. However, in the long term, there is no strong correlation between inflation and gold prices. A stronger dollar and the federal reserve policy led to the following sharp decline. Though it is hard to make gold price predictions for the next 5 years. As new initiatives of the world's central banks and governments to support markets and economies were successfully implemented in , the gold price may have shown a decline. GOLD Bull train We can see that gold seeks the buysideliqidity, which would mean some bullish pressure. Accounting for the actions of these large players is an impossible task for an ordinary private investor who does not have access to the disclosed information of all the players' economic data. Market closed Market closed. The main risk factors are China-US trade wars and anti-Russian sanctions. The reason for this was that Indians started to buy gold less.

It no more than reserve

Thanks for support.