Wise vs remitly

Choosing a service provider for international money transfers is a crucial decision impacting cost, efficiency, and security. This is particularly true for those who engage in cross-border transactions, whether for personal or business reasons. The Remitly vs Wise comparison presents a classic scenario of weighing options in an increasingly digital wise vs remitly world. Understanding the nuances of each service is essential.

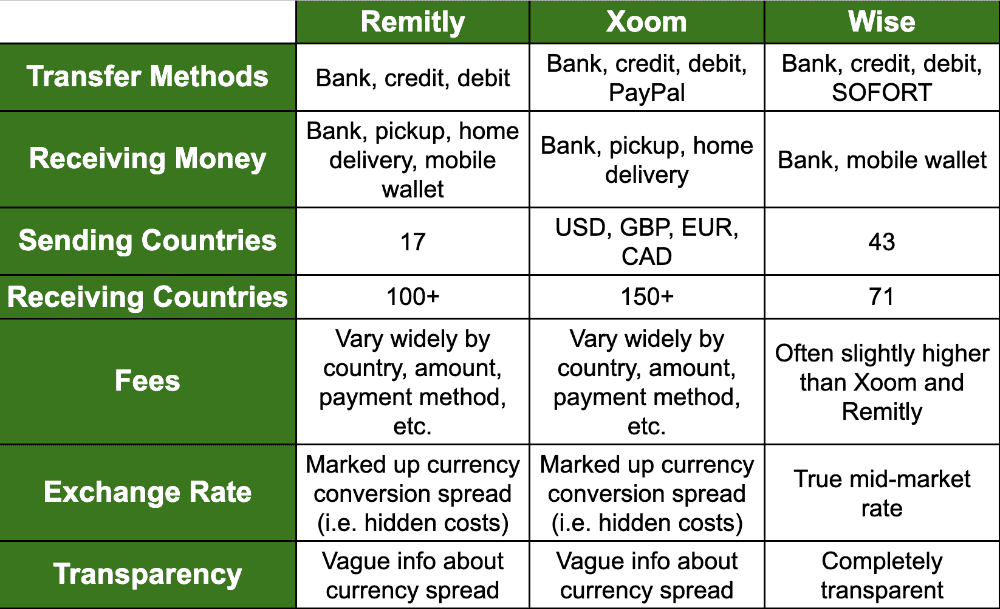

Which scores better when comparing Remitly vs Wise? See how each provider scores and who wins when comparing their services, fees, supported countries and customer service. Remitly also offers a regular transfer service for people who need to do repeated international money transfers for the same amount each time. For example, monthly pensions. Wise provides a simple easy to use international money transfer service with digital wallet capabilities.

Wise vs remitly

When sending money abroad, you have a variety of options available. Online money transfer services such as Wise and Remitly are on hand to give you great exchange rates and fast, secure transfers. With so many options around, however, it can be hard to pick between your options. This Remitly vs Wise comparison runs through the features of both platforms to determine which offers the best service to its users. Remitly is a cross-border remittance provider founded in and headquartered in the Greater Seattle Area in the United States. So far, the company has over 3 million customers, and facilitates transfers from 17 countries to over 50 other nations around the world. Depending on the destination, Remitly recipients can have their funds deposited directly into their bank accounts , sent to a cash pickup location, deposited into a mobile wallet, or delivered to their homes. Wise, formerly Transferwise, is an FCA-approved money transfer service launched in to help make international transfers affordable, quick, and simple. It is one of the most well-known companies in the money transfers space. Finding a company with low transfer fees is a key part of ensuring you find a great deal when transferring money. Wise cleans up on fees and rates. The key win is on the mid-market exchange rates; while Wise charges a fee for transfers, Remitly also adds a markup to their exchange rates. Wise has a varied fee structure comprising a fixed fee component and a variable fee component.

Provided you choose Remitly's 'Economy' pricing, Remitly will sometimes be the cheapest provider of all on Monito, wise vs remitly, and often so for cash transfers which Wise doesn't support.

Remitly and Wise are both safe and reliable options for international payments. But their services, exchange rates, features and fees do vary somewhat. This guide will help you navigate whether Remitly or Wise might be the best option for you, looking at international transfers, accounts and card options. Summary : Wise and Remitly have some overlapping services for international payments, but their focus and their product range vary significantly. Go to Remitly Go to Wise. Accounts: Free to spend currencies you hold, with no monthly charges.

Updated July 25, Shivam Bhardwaj. Art Zabalov. Why you can trust us: Our recommendations are unbiased, based on personal experience, and regularly updated to ensure accuracy. We personally test every provider we review. We may earn a commission if you sign up for a platform using one of our links. Learn more. Considering Remitly and Wise for your international money transfers?

Wise vs remitly

When sending money abroad, you have a variety of options available. Online money transfer services such as Wise and Remitly are on hand to give you great exchange rates and fast, secure transfers. With so many options around, however, it can be hard to pick between your options. This Remitly vs Wise comparison runs through the features of both platforms to determine which offers the best service to its users. Remitly is a cross-border remittance provider founded in and headquartered in the Greater Seattle Area in the United States. So far, the company has over 3 million customers, and facilitates transfers from 17 countries to over 50 other nations around the world. Depending on the destination, Remitly recipients can have their funds deposited directly into their bank accounts , sent to a cash pickup location, deposited into a mobile wallet, or delivered to their homes.

Remnant 2 save location

Remitly has improved the way old school remitters function with their highly useful services and competitive rates. Bank deposits, cash pickup, mobile wallets, and door-to-door delivery in some countries. Both Wise and Remitly keep their transfer speeds competitive, although the speed can vary by the amount, the target currency, and the funding method. Remitly customer service is offered by phone and through an in-app and online chat. Alternatives to Revolut. Revolut vs Monese. November 29th, All praises and none whatsoever negative feedback that I can think of. See how each provider scores and who wins when comparing their services, fees, supported countries and customer service. However, other services have a fee with FX rates that match the mid-market rate.

In , I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options.

Users quote the reliable app and affordable fees as the main benefits, while others state they experienced hefty delays at times. We use cookies swissmoney companies use cookies to provide you with tailored information about our services and to improve the performance of our website and or app. I am curious however with Wise. Wise also requires customers to open a Wise account online. OFX vs Wise. Outstanding App Store reviews. This feature, combined with the accompanying debit card, provides high flexibility and convenience, especially for frequent travellers or businesses operating internationally. Frank Day. Read more Got it! Transaction fees apply. Wise is a powerful multi-currency account that lets you hold, manage, and convert between over 40 currencies. Fees accessed by signing up first Fees can be relatively expensive compared to Wise but still many other options. Wise vs PayPal.

Yes, in due time to answer, it is important

In my opinion you are not right. I suggest it to discuss. Write to me in PM.

Completely I share your opinion. In it something is also I think, what is it good idea.