Why is apa share price falling

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. That's not much fun for holders.

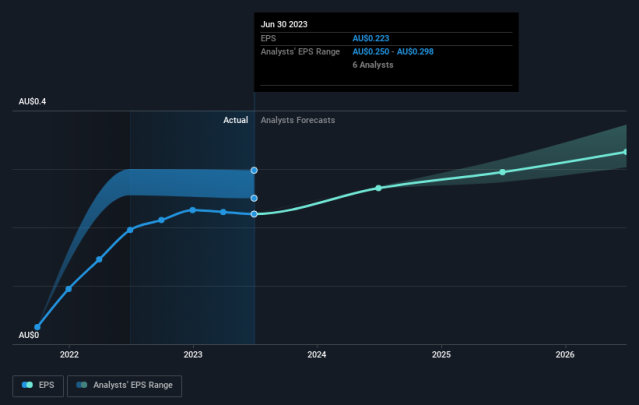

APA Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. If not, then existing shareholders might be a little nervous about the viability of the share price. View our latest analysis for APA Group. However, this wasn't enough as the latest three year period has seen an unpleasant 6. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Why is apa share price falling

Stocks Down Under gives you an information advantage to better invest and trade in ASX-listed stocks! Nick Sundich , December 11, On one hand, it is understandable as it is in a heavily capital intensive business and has significant requirements in the year ahead. But the other, it is not, given it is not just any infrastructure business, it is a gas pipeline owner. This company began when it was spun out of AGL over 2 decades ago, when it was the division of AGL that owned the gas pipelines. The company also operates gas storage and processing facilities, other power stations and even renewable energy facilities. APA also has investments in other private energy companies. You would think APA Group would have a major role to play in decarbonisation as a gas pipeline operator and renewable energy player. Gas has less carbon intensity and can back up renewable energy when necessary. Looking to the industry generally, multiple factors are delaying the transition, including slow planning approvals, NIMBYs community opposition and rising costs not least of which is interest rates but also skilled labour. Looking to APA, it has spent a lot of money recently on new acquisitions and will continue to face high capex. Although it has not cut dividends, it has not grown them substantially and this has disappointed investors who expect constant dividend growth from top 50 companies. And when you consider the new shares being issued to pay for new acquisitions, this will further dilute investors. But…you know what they say. Short term pain for long term gain.

The East Coast grid expansion will facilitate increased gas supply to meet projected shortfalls at times of peak demand in southern markets. February 20, James Mickleboro.

APA shares enjoy defensive characteristics. It provides essential infrastructure that is predominantly contracted and regulated, with further growth driven from existing customer relationships. If decarbonisation goals are met sooner rather than later, hydrogen will likely be key to achieving this outcome, and APA is strategically positioned for transporting hydrogen in its pipelines. Alinta Energy Pilbara primarily stores and supplies energy to the major miners in the Pilbara region of Western Australia and is made up of four main operating assets:. Placement shares have already been issued and are trading, enabling participants to sell immediately at prices above what they were bought for — a win for the instos that participated.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. The projects will support the expansion of its revenue expansion in future years. The company's results also included news of its plan to strategically invest in the senior secured debt of Basslink — a major energy link connecting Tasmania to the mainland, announced earlier this week. Basslink was put into receivership in November , little more than a month after APA Group confirmed it was in discussions to acquire the asset. It will work alongside Hydro Tasmania, the State of Tasmania, the Australian Energy Regulator, and other stakeholders to convert Basslink into a regulated asset. During the first half of financial year , the APA Group share price moved higher after it submitted a takeover offer for formerly-listed Ausnet Services.

Why is apa share price falling

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. APA said that the revenue growth was driven by a "solid" energy infrastructure performance and inflation. The underlying EBITDA didn't grow as quickly because it has been investing in its capabilities to "support growth ambitions and business resilience.

Weather in altrincham 10 days

FTSE 7, Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges. Valuation is complex, but we're helping make it simple. FTSE 7, Have feedback on this article? February 21, James Mickleboro. We are working on updating this web app to fully enable Quantitative Ratios. Information warning: The information on this website is published by The Rask Group Pty Ltd ABN: 36 is limited to factual information or at most general financial advice only. Story continues. We will not put a succinct figure, because it is highly volatile dependant on capex and terminal growth assumptions, not to mention debt and equity financing assumptions.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More.

When looking at investment returns, it is important to consider the difference between total shareholder return TSR and share price return. However, a significant decline in the cost of oil and gas purchased meant that total operating expenses fell Which ASX large-cap shares offer the best dividend yields in ? Dividends APA typically pays two partially franked dividends per year. The East Coast grid expansion will facilitate increased gas supply to meet projected shortfalls at times of peak demand in southern markets. Finally, we note that interest rates remaining higher for longer will inevitably continue to impact the company. This article by Simply Wall St is general in nature. Site menu. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. If not, then existing shareholders might be a little nervous about the viability of the share price. Bitcoin USD 51, On Off. Turning to the outlook, the next three years should generate growth of 8. Quantitative Ratios You viewed 3 companies today Ratios will be unlocked again tomorrow or; Unlock these ratios, configure alerts and much more As promised, the company is using the excess cash to reward shareholders with dividends and buybacks.

Remarkable question

I can recommend to come on a site where there is a lot of information on a theme interesting you.

Let's talk, to me is what to tell.