When does h&r block start doing taxes

This year, April 15,is tax day, which signifies the deadline for filing a federal income tax return. You can file your taxes at any time between when the IRS opens and the annual due date. Each year, the IRS issues a statement in early January with the first day to file taxes.

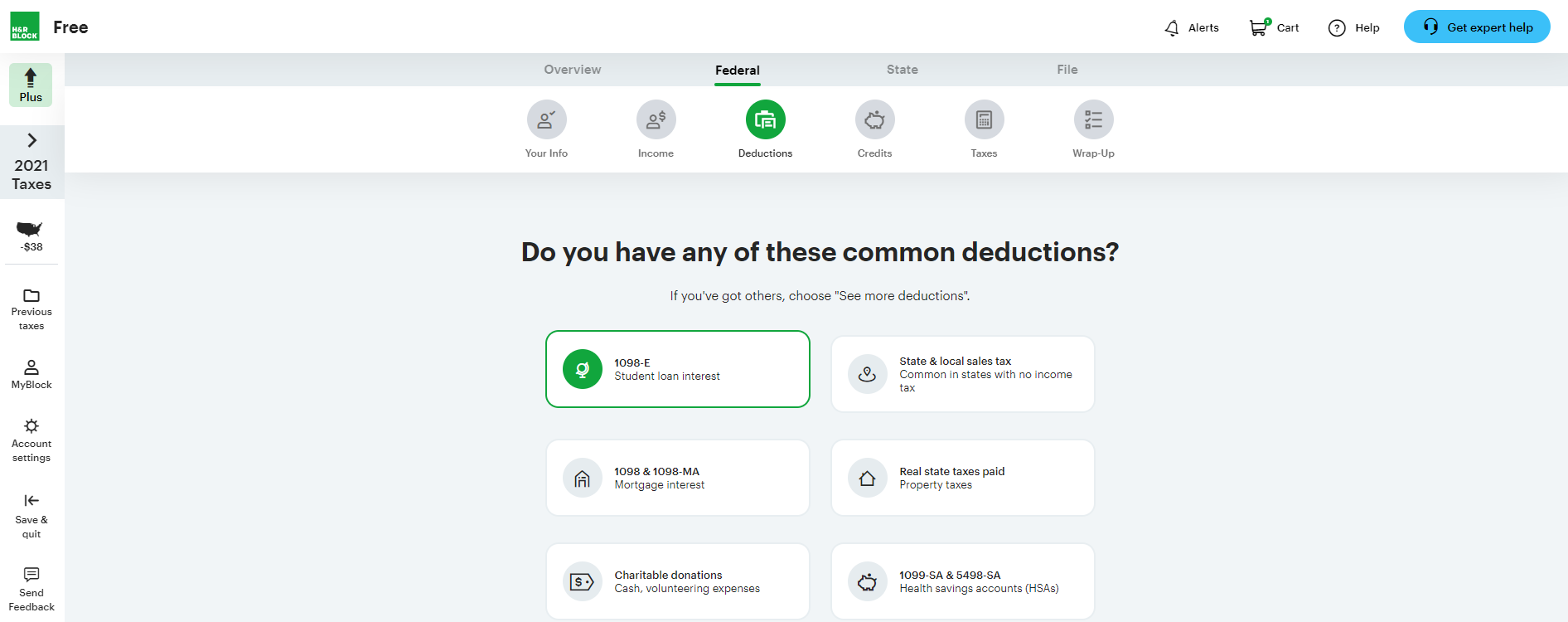

Affiliate links for the products on this page are from partners that compensate us see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate tax products to write unbiased product reviews. They have all the tax filing options you need. While it doesn't offer the lowest prices you'll find for tax software, the quality of the overall user experience can justify the higher cost. The tax form import and upload capabilities are big time savers, but if you're OK with entering the numbers on your own and want to save some money, there are cheaper or free options out there.

When does h&r block start doing taxes

Our online service options and electronic filing products will guide you through your tax preparation at every step, letting you prepare your taxes at your own pace. Review our income tax online filing options. Want a little help? With Online Assist, you can get tax filing assistance from a real tax pro who can chat with you and answer your questions. Our highly skilled tax pros are dedicated to helping you better understand your taxes. Get help choosing one of our tax pros. Want to skip the office visit, but still work with a tax pro? We have two ways to file your taxes with a pro, but without the traditional office visit. You can choose to drop-off your tax information with or without an appointment. Check out how our tax return Drop Off services work. Need to know how to claim a dependent or if someone qualifies?

If you choose an online package, you can work on your taxes with the mobile app for Android and iOS devices.

When someone mentions the tax deadline, most of us are thinking of a specific day in April when taxes are due typically. However, there are other important dates to keep in mind as a taxpayer — from estimated tax payment due dates to extension filing deadlines. While not a federally recognized holiday, tax day is when individual federal taxes are due to the Internal Revenue Service IRS. Tax day normally is April Keep in mind, if a filing or payment deadline falls on a Saturday, Sunday, or legal holiday, the tax due date will be the next business day.

Still, its free version is one of the best on the market: The interface is straightforward and easy to use, and help from a human is available for an extra cost. Allows you to file a plus limited Schedules 1, 2 and 3, which makes it usable by a lot more people than most other free software packages. Itemize and claim several tax deductions and credits. Works well for business income but no expenses. For investors or rental property owners Schedules D and E, and K-1s. For small-business owners, freelancers and independent contractors. One note about prices: Providers frequently change them.

When does h&r block start doing taxes

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Avengers games for kids

Mortgages Angle down icon An icon in the shape of an angle pointing down. For returns the extension deadline is Oct. You only pay when it's time to file. For this tax year , you can start to file your taxes on January 29, Learn about our remote tax assist options. With Online Assist, you can get tax filing assistance from a real tax pro who can chat with you and answer your questions. Tax day normally is April She helmed a biweekly newsletter and a column answering reader questions about money. If you want to add some additional time to file your return onto your tax calendar, file Form to obtain four additional months to file. We can help you learn more about filing changes.

Our experts answer readers' tax questions and write unbiased product reviews here's how we assess tax products. In some cases, we receive a commission from our partners ; however, our opinions are our own. They have all the tax filing options you need.

However, our opinions are our own. It's not as inexpensive as TaxSlayer, but it does include features where TaxSlayer is lacking, such tax document uploading and importing. Mortgages Angle down icon An icon in the shape of an angle pointing down. The tax form import and upload capabilities are big time savers, but if you're OK with entering the numbers on your own and want to save some money, there are cheaper or free options out there. A new job or extra income can change your tax bracket. You can file your taxes at any time between when the IRS opens and the annual due date. You can use Form A in Publication or any other daily record to record your tip income for the month. Tanza joined Business Insider in June and is an alumna of Elon University, where she studied journalism and Italian. Related topics Tax fraud Learn how to protect yourself and your money from falling victim to tax fraud. When are taxes due? Could be better. Each of the possibilities above could cause a delay or prevent receiving the refund altogether.

0 thoughts on “When does h&r block start doing taxes”