Webull sell to close

Use limited data to select advertising.

This Notice to Clients is not exhaustive, and only provides the most basic US stock options trading instructions, Webull reserves the rights to adjust them at any time without prior notice. The risk of stock options is huge and greater than that of stock, and the price of stock options is affected by various factors, such as the underlying stock price, time value, implied volatility and so on. Call Stock Option: A contract to buy the underlying stock at the strike price on or before expiration. Put Stock Option: A contract to sell the underlying stock at the strike price on or before expiration. Option Premium: the market price of the option, the amount that an investor needs to pay to buy a contract. When the expiry date is not a trade day, the date will be adjusted accordingly.

Webull sell to close

Not every investment ends up making a profit. Here, two helpful order types come in handy--stop market and stop limit. These two orders can be used to close positions at specific prices to protect your portfolio from further losses. Unfortunately, the price of XYZ has been falling recently, causing your position to lose value. In this case, you may decide to place a stop market or stop limit order to limit possible losses. To set a sell stop limit order, you must enter two prices: stop price and limit price. However, if the contract price is out of the limit price range in a volatile market, the stop limit order may not be filled after being triggered. Therefore, the stop limit order can be helpful if you want to have a certain filled price range when closing an options position. To set a sell stop order, you only need to enter a stop price. However, if the contract price drops suddenly when the order is triggered, the filled price may be far from your expected price. From the example, if you want the order to be filled as soon as possible after it is triggered, a stop market would be more suitable than stop limit order, although it entails more risk. Stop orders are a powerful and helpful way to help you preserve profit and limit losses when opening and closing positions. Learning how to use investment tools and order types to protect your position can be highly beneficial for your investing practices. Due to fast-moving markets, market volatility, and illiquid markets, take profit and stop loss orders may not execute in it's entirety or at all. In these instances, the market price may skip over the set price and leave the order unexecuted or may execute at prices which are substantially different than expected.

Securities and Exchange Commission. Trading Skills Trading Orders.

.

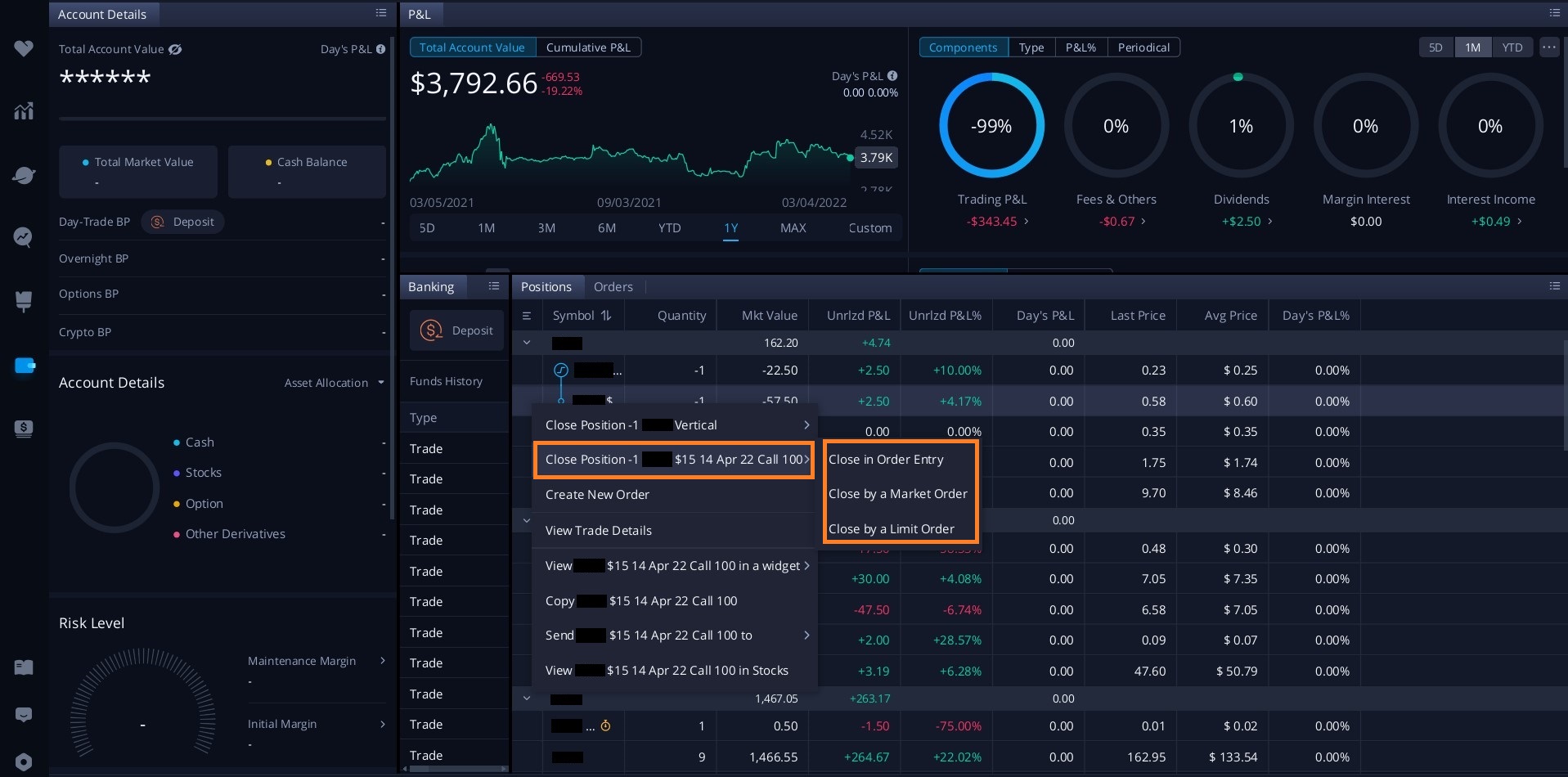

Online broker Webull is one of a group of brokers revolutionising the investment sector. The options markets are an increasingly popular destination for smaller investors and are moving away from being only for institutional investors. If used in the right way, they can manage rather than increase risk, but there are some financial health warnings that traders need to know about. The Webull platform has functionality that makes it particularly easy to use and the mechanics of trading the option market are very straightforward. This article will offer a step-by-step guide on how to trade options on Webull and the benefits of joining a platform that already has 11 million registered users. The good news is that Webull offers markets in options — not all brokers do. This is partly down to the nature of options markets, which have some distinct features that are worth recapping.

Webull sell to close

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content.

Cómo llegar al lidl

Investopedia is part of the Dotdash Meredith publishing family. From the example, if you want the order to be filled as soon as possible after it is triggered, a stop market would be more suitable than stop limit order, although it entails more risk. Trending Videos. This compensation may impact how and where listings appear. Securities and Exchange Commission. They sell to close put options contracts they own when they no longer want to hold a long bearish position on the underlying asset. The higher the value of the call option goes, the more profitable it will become. Let's assume a trader is long an exchange-traded option using a buy to open order on a call option on Company A. This Notice to Clients is not exhaustive, and only provides the most basic US stock options trading instructions, Webull reserves the rights to adjust them at any time without prior notice. To set a sell stop limit order, you must enter two prices: stop price and limit price. Call Stock Option: A contract to buy the underlying stock at the strike price on or before expiration. It is also used, but less often, in equity and fixed-income trading to indicate a sale that closes an existing long position. Traders will typically sell to close call options contracts they own when they no longer want to hold a long bullish position on the underlying asset. If the price of the underlying asset increases only enough to offset the time decay the option will experience then the value of the call option will remain unchanged. Unfortunately, the price of XYZ has been falling recently, causing your position to lose value.

.

However, if the contract price drops suddenly when the order is triggered, the filled price may be far from your expected price. Investopedia requires writers to use primary sources to support their work. Therefore, the stop limit order can be helpful if you want to have a certain filled price range when closing an options position. In this situation, Webull will have full discretion to decide how to handle that options, including but not limited to: exercising that options for the client, not exercising options for the client and marking them as DNE , or closing out all positions of that options before market close. Key Takeaways Sell to close specifies that a sale is being used to close out an existing long position, and is often used in the context of derivatives trading. Trending Videos. Learning how to use investment tools and order types to protect your position can be highly beneficial for your investing practices. The differences between stop limit and stop market orders. Here, two helpful order types come in handy--stop market and stop limit. We also reference original research from other reputable publishers where appropriate. If the price of the underlying asset increases more than enough to offset the time decay the option will experience the closer it gets to expiration then the value of the call option will also increase. It involves buying an asset to offset a short position.

0 thoughts on “Webull sell to close”