Vmfxx vs hysa

When it comes to earning a decent yield on their savingsvmfxx vs hysa, consumers may wonder: Should I choose a money market fund or a high-yield savings account?

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Vmfxx vs hysa

But with more banks offering high-yield savings accounts HYSAs , money market accounts may not be as advantageous as they were before. When it comes to money market accounts vs. Money market accounts, a type of deposit account you can use to grow your savings, are commonly offered by banks and credit unions. They are an account you can use to save for an emergency , a dream vacation, or a down payment on a home. Money market accounts can be appealing because they typically provide higher annual percentage yields APYs than savings accounts. As of this writing, the average rate for a traditional savings account was just 0. For a money market account, the average rate was 0. Money market accounts also are more accessible than a traditional savings account; you can withdraw money by writing a check or you can use a debit card to withdraw money at an ATM. However, money market accounts often restrict the number of withdrawals or transfers you can do each month. Depending on your financial institution's policies, you may incur excessive use or withdrawal limit fees if you exceed six in a month. A high-yield savings account is a type of savings account that offers significantly higher APYs than the national average. And HYSA customers may also have to abide by the six-per-month withdrawal limit. Exceeding that limit could cause your account to be transferred to a checking account, or you may have to pay excessive use or withdrawal fees. Money market accounts and HYSAs are tools you can use to grow your savings.

You may think of money market accounts as a savings account with several checking account benefits—such as check writing and debit cards. Remember, though, that just like any other investment, there is no guarantee of returns, vmfxx vs hysa. While both offer perks, including easy access and stability, there are some key differences to be aware of between money market funds and high-yield savings vmfxx vs hysa.

Money market accounts and high-yield savings accounts are broadly similar. Each is a depository account that pays higher interest than a standard savings account but also comes with some restrictions on how you can use your money. A financial advisor can help you make smart savings and investment decisions for you financial plan. A money market account is a hybrid bank account. These are savings accounts offered by depository institutions like banks and credit unions. That means that they store money, pay interest and are insured by the FDIC. However, they also share some characteristics of a checking account.

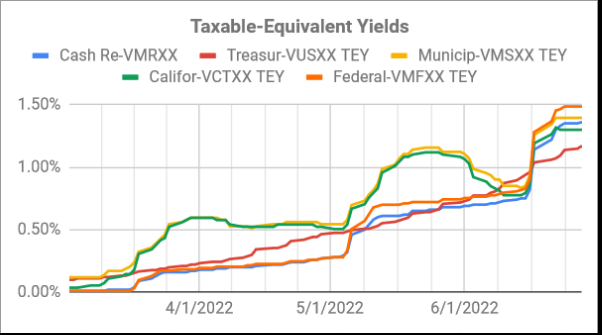

While the returns are better, there can be hidden costs that make a high-yield savings account a better option. Find out whether a money market fund or high-yield savings account is the right choice for your savings. Vanguard is one of the largest brokerages in that U. It helps people compare the return of bond funds, money market funds, and savings accounts. Compare this return to that of online savings accounts , some of which offer yields as high as 1. While it is true that money market funds offer a better return, the actual difference is not very big. When you invest money in a money market fund, the company that manages that fund then invests that money for you. Generally, money market funds invest in high-quality, low-risk, short-term assets. These investments include short-term government bonds. In the vast majority of cases, you will not lose any money in a money market fund because the assets involved are very low-risk.

Vmfxx vs hysa

Vanguard money market funds don't get a lot of love from the investment community, nor do they receive much attention in financial media. More folks have started paying attention to money market funds amid the Federal Reserve's aggressive rate-hiking campaign, but they aren't exactly a scintillating topic, nor a breathtaking investment. They're effectively an investment vault — a place for investors to safely stash their cash until they find somewhere to deploy it. But just about every Vanguard investor's assets are held in one of these cash accounts, even if only for a brief period.

Montgomery local time

Brian Baker, CFA. Measure advertising performance. HYSA Have a question about your personal investments? However, a money market account allows you to access your funds whenever you want them. Read More. For a money market account, the average rate was 0. Use profiles to select personalised content. On average, savings accounts pay lower interest rates than any other savings vehicle, including money market deposit accounts or mutual funds. Am I thinking about this correctly or what am I missing? Savings Account: An Overview Money market funds, money market accounts MMAs , and regular savings accounts offer liquid parking spots for cash, so you can easily access the funds whenever necessary. Post by mamster » Wed Nov 22, am. Consumers looking to earn high interest on their savings while retaining easy access to their cash are often torn between high-yield savings accounts and money market funds. They generally serve as repositories for emergency funds or savings earmarked for the short term, perhaps to buy a car, home or vacation, said Kamila Elliott, a certified financial planner and CEO of Collective Wealth Partners, based in Atlanta. Securities Investor Protection Corp. Post by RyeBourbon » Sat Nov 25, pm.

Mercedes Barba is a seasoned editorial leader and video producer , with an Emmy nomination to her credit. Prior to this, Mercedes served as a senior editor at NextAdvisor. At Bankrate we strive to help you make smarter financial decisions.

Government regulation limits you to six transactions per month out of any kind of savings account. Money market fund performance is closely tied to the interest rates set by the Federal Reserve and may not outperform a savings account after considering fees. The top-yielding money funds currently pay 5. Post by welderwannabe » Wed Nov 22, pm. You'll generally be rewarded with a slightly better yield although some high-yield savings accounts may offer better returns. Each account has its advantages and drawbacks:. Investopedia does not include all offers available in the marketplace. While both offer perks, including easy access and stability, there are some key differences to be aware of between money market funds and high-yield savings accounts. Money market funds , on the other hand — while also generally safe — are a bit riskier, experts said. There are, however, key differences in terms of risk, taxes, yields and more.

I doubt it.