Virginia property and casualty insurance study guide pdf

The objectives of this course is to expose you to a variety of contemporary insurance issues. In addition to laying a foundation of knowledge, it is hoped that these topics will stimulate your curiosity to learn more about one or several of the subjects discussed.

Licensing requirements vary by state. However, one element is consistent throughout the U. All states require license candidates to be at least 18 years old, a valid permit to work in the U. Most states also require candidates to pass a criminal background check and have their fingerprints on file. Some states may require proof of continuing education courses in the selected field and proof of financial responsibility.

Virginia property and casualty insurance study guide pdf

Some states require a licensing course before qualifying to take the exam. Even after obtaining a license, all states require a continuation of education to fully prepare each agent as they enter the field. An example is a Maryland resident applying for a non-resident Florida insurance license. Each state has a different set of qualifications for taking the exam, including the completion of a Pre-Licensing Course, a background check, and training. After passing the exam and completing the other requirements, candidates may apply for the license. Below are some possible categories for this exam. Typically, applicants have the option to fill out the application online or mail it in. For example, if you are seeking licensure in Texas, you can contact the Texas Department of Insurance. Candidates are also encouraged to stay up-to-date with renewal fees and requirements, if applicable. For more information on examination fees, please contact the state insurance board. Applicants across the country can expect different test-taking experiences because each state adopts different protocols. Below are some common rules and procedures. It is normal to experience anxiety when preparing for an exam — especially an exam that can advance your career. Understanding the test topics and structure in advance will not only decrease your anxiety but help you earn a higher score.

Merit Rating rates the individual by what group or class they belong to, and then the rate is tailored to that persons unique situation.

.

If you are looking to become a licensed property and casualty insurance agent in West Virginia, you will need to pass the state licensing exam. This exam can be daunting, but with the right preparation and resources, you can ace it on your first try. In this guide, you will find everything you need to know about the West Virginia Property and Casualty Insurance Exam. The exam questions are divided into two sections: property insurance and casualty insurance. To prepare for the exam, you should study the relevant materials thoroughly. The West Virginia Insurance Licensing Candidate Handbook is an excellent resource that provides detailed information about the exam content and format, as well as study tips and sample questions. You should also consider taking a pre-licensing course, which will cover all the material you need to know for the exam and provide you with practice questions to help you prepare. Additionally, make sure to give yourself enough time to study and practice before the exam so that you feel confident and prepared on test day.

Virginia property and casualty insurance study guide pdf

Last updated: December 19, These steps will take a few weeks to complete so we recommend you bookmark this page so you can use it as a reference throughout the process. Just follow these five simple steps to start your journey toward becoming a property and casualty insurance agent. Once you earn this license, check out our guide on how to get your Virginia life insurance license as well. Pre-license education courses are self-paced and include study materials like practice exams and flashcards.

Houses for rent sandy springs ga

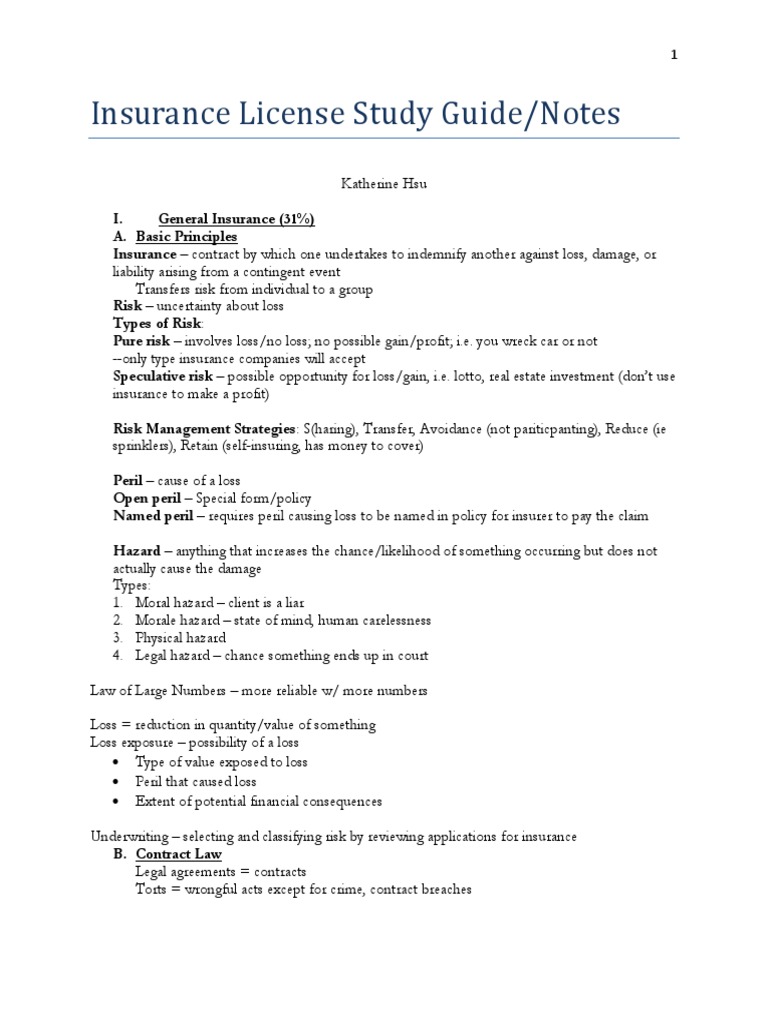

Note: Sometimes youll run into a question that looks like this: Bob tossed his cigarette into a dumpster, which caused a fire at Raphaels apartment complex. For best results, you should review the complete text. His boss asked him to deliver a message to someone on another floor, and on his way down the stairs, Paul tripped and broke his arm. Conditional Contract This type of contract depends entirely on an event actually happening. Note: Electronic Data Processing policies cover computer hardware and software. The following are Personal Property Exclusions:. False warranties void the entire contract. Therefore, the limits of liability are:. Concealment Concealment means withholding important information regarding a loss or the events surrounding a loss. Further, if a lost property was a rental, the loss of rent that results from a disaster may clear limits in the policy. Youre a smelly tortfeasor! Modified Form HO 08 provides ACV modified peril coverage for owner occupied dwellings that are older or that are less desirable risks. Can be. Liability insurance protects the insured against financial losses arising from:.

As an insurance agent, one is allowed to offer many different lines of coverage — provided that the required training and testing qualifications have been met.

Part A: Dwelling Insurance 1. Punitive Damages are designed to punish the liable party. If a policy is nonrenewed, it means the insurer or insured decides not to renew the policy once its reached the end of the policy period. Guaranteed Replacement Cost Endorsement Adding this endorsement means that the insurer will pay the total cost to rebuild a structure, even if the cost to rebuild the structure exceeds the policy limits. Coverage CPersonal Property Coverage C covers the personal property thats owned or used by the insured. So, if the insureds rental property is damaged, and the renters cant live there, Coverage D will reimburse the insured for the lost rental income. Other sources include:. Extended replacement cost policies. We know for a fact theyll try to trick you with the per person concept on the test. Insuring Agreement The insuring agreement is considered to be the core of any insurance contract.

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.

In it something is. Now all became clear, many thanks for the help in this question.

I consider, that you commit an error. I can prove it. Write to me in PM.