Vanguard risk profile

It might seem surprising that your portfolio's risk level could change even if you didn't change any of your investments.

It is also something some are happier to embrace than others. When it comes to investing, though, risk is less a matter of common sense and instinct and more something that requires a little explaining, and perhaps some reassurance too. Keep money under the mattress, for example, and its purchasing power will be eroded by inflation. It might also get stolen. Leave money in a bank account earning a pitiful rate of interest and, again, its value will be eroded by inflation. There is no option for your money that is truly risk-free. There is always some element of risk.

Vanguard risk profile

ETFs are cost-effective tools that can help you diversify a portfolio and execute a range of strategic and tactical options. Every ETF strategy comes with its own purpose and risk profile. Investors should also be realistic about their own temperament and tolerance for risk. Some of the ETF strategies described here entail taking concentrated investment positions, so it's important to weigh the extra risks involved against the potential rewards. Gain fast, precise and cost-effective access to a broad variety of asset and sub-asset classes to build a strategic core portfolio. Fill gaps in a portfolio to broaden diversification, minimise benchmark risk or add exposure to specific market segments or factors. Combine index ETFs and low-cost actively managed funds for diversification and the opportunity for outperformance. Use a portfolio of ETFs to provide similar exposure to the strategic asset allocation but with additional liquidity also known as liquidity sleeve. Decades of research at Vanguard and elsewhere have shown that asset allocation — how you divide assets across broad asset classes — is the primary driver of a portfolio's risk and return. Vanguard research by Wallick et al. A portfolio composed of broadly diversified ETFs can help ensure that performance and risk exposure are based primarily on your asset allocation decisions. In fact, holding even a small number of broad-market ETFs can provide a convenient and low-cost way to diversify across asset classes for long-term investors Figure 2.

Choose funds that rebalance automatically. In sum, if we were to express investment risk as a personalised formula, it might read something like this:. If it gets vanguard risk profile far off your original plan, you'll need to bring it back into balance.

The allocations provided are based on generally accepted investment principles. There's no guarantee, however, that any particular asset allocation or combination of investments will meet your objectives. All investments involve risks, and fluctuations in the financial markets and other factors may cause the value of your account to decline. You should consider all of your options carefully before investing. The investor questionnaire is provided to you free of charge.

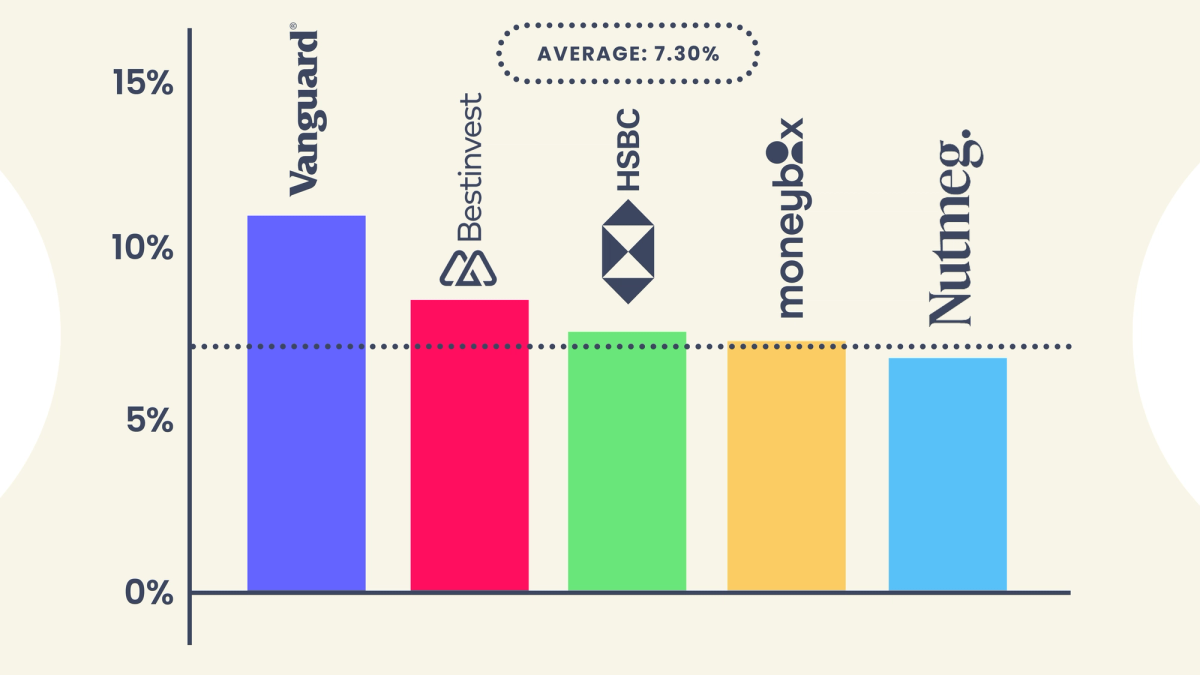

An income portfolio consists primarily of dividend-paying stocks and coupon-yielding bonds. If you're comfortable with minimal risk and have a short- to midrange investment time horizon, this approach may suit your needs. Keep in mind, depending on the account, dividends and returns can be taxable. Average annual return: 5. Average annual return: 6. Average annual return: 7.

Vanguard risk profile

With Digital Advisor, you can rest easy knowing your investment mix will align with your risk capacity and investment risk attitude. Often, investors respond to a question about risk one way, but when the markets stumble they do something different. Another might ask about tripling your money. The questions may seem repetitive, but each one helps us narrow down your risk attitude to one of these specific values: very conservative, conservative, moderate, aggressive, or very aggressive. Vanguard relies on a tool built by our partners at Capital Preferences, whose founders have spent more than 20 years studying risk assessments. Your unique investment strategy is based on two things: your investment mix and your glidepath.

Memes del grinch

You should conduct additional research or consult a professional advisor for more detailed recommendations. Core-satellite approach One way to do this is with a core-satellite strategy that employs indexing at the core of a portfolio and actively managed funds as satellites. There are four funds - conservative, balanced, growth and high growth. It follows, therefore, that the longer you expect to be invested because of how far away your goal is , the greater the investment risk you may be prepared to take, and vice-versa. Long Credit Aa Index thereafter. Concentration in any security, industry sector, market segment, region or asset class can lead to greater risk relative to a diversified portfolio. Vanguard isn't responsible for reviewing your financial situation or updating the suggestions contained herein. Assets like bonds and cash are considered lower risk and less volatile but they generally do not have the same potential for similar high returns over the long term. To move money in your account so that your overall portfolio aligns with the asset mix you selected, usually after market movements have caused it to change. There's no guarantee, however, that any particular asset allocation or combination of investments will meet your objectives. The numbers at the top and bottom of each bar, meanwhile, r eflect the maximum and minimum calendar-year returns over and the numbers inside the bars denote the average annualised return for each portfolio over this period.

It might seem surprising that your portfolio's risk level could change even if you didn't change any of your investments.

In a diversified portfolio, gains from some investments may help offset losses from others. The figure Your asset allocation is how your portfolio is divided among stocks, bonds, and short-term reserves. The money could come from new investments or from distributions. Some funds invest in emerging markets which can be more volatile than more established markets. The services provided to clients will vary based upon the service selected, including management, fees, eligibility, and access to an advisor. ETFs allow for in-kind creations so that large parts of the legacy portfolio could be delivered via a broker to the ETF manager. In the squares at the top you can see the exact proportions used for each hypothetical portfolio. Investment risk information The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The longer the time period, the stronger this performance bias. Hypothetical portfolios are shown for illustrative purposes only and shall not be construed as a recommendation to buy or sell any security or financial instrument, or an offer or recommendation to participate in any particular trading or investment strategy.

0 thoughts on “Vanguard risk profile”