Vanguard net worth

You'll get the help and services you need to support a large investment portfolio. You're a Flagship client at Vanguard, which means you get personalized services reserved for our high-net-worth investors, vanguard net worth.

The Vanguard Group retains a High Parent rating. Mutual ownership, low costs, and a direct-to-investor playbook have helped spur Vanguard's leadership within the United States. Client service missteps notwithstanding, Vanguard over the past decade has grown its market share of U. At that rate, Vanguard's portion of the U. True, some competitors can now match or even undercut Vanguard on fees for broad market exposure. But Vanguard's burgeoning advice business could help it keep or even extend that lead. Through Digital Advisor and Personal Advisor Services, Vanguard has built an increasingly compelling ecosystem of advice for investors with simple to complex needs.

Vanguard net worth

Largest Vanguard investment funds worldwide in September , by net assets. Total net assets of open-ended funds worldwide Q4 , by fund type. Projected importance of financial products and solutions in Europe Leading investment funds owned by Vanguard globally as of September 15, , by net assets under management in billion U. Number of Vanguard investment funds worldwide in July , by region. Top performing investment funds owned by Vanguard worldwide , by one-year return. Top performing investment funds owned by Vanguard worldwide in September , by one-year return rate. Year over year revenue growth of the Vanguard Group Annual revenue per employee of the Vanguard Group Annual number of employees of the Vanguard Group

Use limited data to select advertising. Bloomberg L. Leading mutual fund groups globally by assets Leading mutual fund groups globally as of Marchby assets under management in billion U.

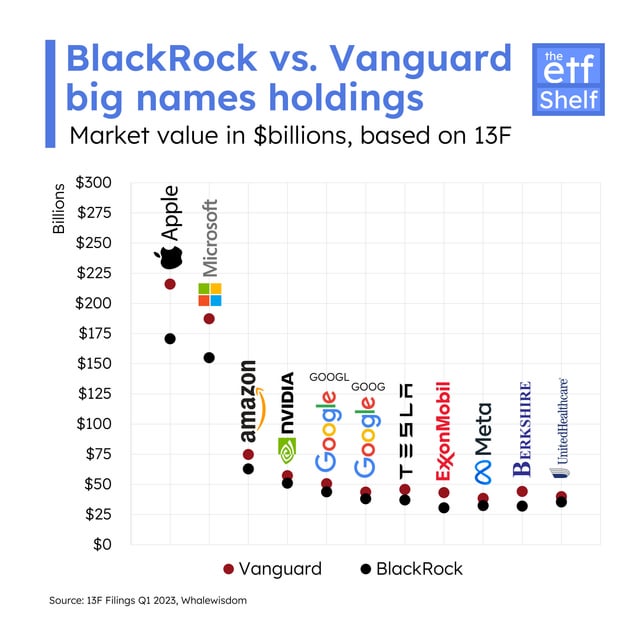

Imagine a world in which two asset managers call the shots, in which their wealth exceeds current U. GDP and where almost every hedge fund, government and retiree is a customer. BlackRock Inc. Amassing that sum will likely upend the asset management industry, intensify their ownership of the largest U. None other than Vanguard founder Jack Bogle, widely regarded as the father of the index fund, is raising the prospect that too much money is in too few hands, with BlackRock, Vanguard and State Street Corp. Investors from individuals to large institutions such as pension and hedge funds have flocked to this duo, won over in part by their low-cost funds and breadth of offerings.

He took on the CEO role at the beginning of Buckley joined The Vanguard Group in Initially, he served as an assistant to its founder John C. He also moved up the ranks and took on the roles of Chief Information Officer and later the head of the Retail Investment Group as well as the Chief Investment Officer. What does Buckley earn as the top executive in one of the top banking and investment firms? Vanguard is technically owned by its customers. As the company states, the fund shareholders own the funds, which in turn own Vanguard.

Vanguard net worth

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Nsw mooring map

The returns are limited to those of the underlying index. View benefits at a glance. Archived from the original PDF on June 12, Overview 4 Premium Statistic Largest Vanguard investment funds worldwide in September , by net assets Premium Statistic Number of Vanguard investment funds worldwide in July , by region Basic Statistic Assets under management of Vanguard Premium Statistic Top performing investment funds owned by Vanguard worldwide , by one-year return. Following a dispute with a merged company in , Bogle formed a new company called The Vanguard Group of Investment Companies. Competing firms Basic Statistic Leading investment management firms worldwide , by AUM Leading investment management firms worldwide , by AUM Leading investment management firms worldwide in , by assets under management in trillion U. Understand audiences through statistics or combinations of data from different sources. Vanguards growth index fund VUG asset allocation breakdown in the United States as of 31st December , by security type. However Vanguard frames these questions in the aims of protecting Indigenous culture without any concrete policy to safeguard Indigenous rights and ensure that the internationally recognized right of Free, Prior, and Informed Consent is present in discussions with Indigenous communities. Retrieved August 19,

With great wealth comes more complex, sensitive, and critical needs; we get it. New to Vanguard? Call

GDP and where almost every hedge fund, government and retiree is a customer. Your wealth isn't just about money—it's about your family's future. Retrieved August 19, ETPs trade on exchanges similar to stocks. April 9, Bogle arranged to start a new fund division at Wellington. Index funds let you hold stocks from hundreds of companies rather than focusing on a few from one industry or company. Kisara Mizuno. Vanguard has a fairly unique structure for an investment management company. Bogle conducted a study in which he found that most mutual funds did not earn more money compared to broad stock market indexes. None other than Vanguard founder Jack Bogle, widely regarded as the father of the index fund, is raising the prospect that too much money is in too few hands, with BlackRock, Vanguard and State Street Corp. Presented by Beneva.

You are absolutely right. In it something is also to me it seems it is excellent idea. I agree with you.

Very valuable phrase

It not absolutely approaches me. Perhaps there are still variants?