Vanguard life strategy

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, vanguard life strategy, to poke a bit of fun. Magazines count on something Steve Forbes one said.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash. This can be withdrawn, reinvested or simply held on your account. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund.

Vanguard life strategy

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments. Shares typically give you a higher return over the long run, but are riskier. Whereas bonds are more stable but offer lower potential returns. Having a mix of both helps balance risk and reward. When it comes to choosing a LifeStrategy fund there are two things you need to think about..

However, on a risk-adjusted basis, these will be near the top.

A structured asset-allocation framework implemented by The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years.

Get our overall rating based on a fundamental assessment of the pillars below. The Vanguard LifeStrategy target-risk series' straightforward and efficient approach to delivering broad equity and fixed-income exposure should continue to serve investors well. Unlock our full analysis with Morningstar Investor. Morningstar brands and products. Investing Ideas. Start a 7-Day Free Trial. Process Pillar. People Pillar. Parent Pillar.

Vanguard life strategy

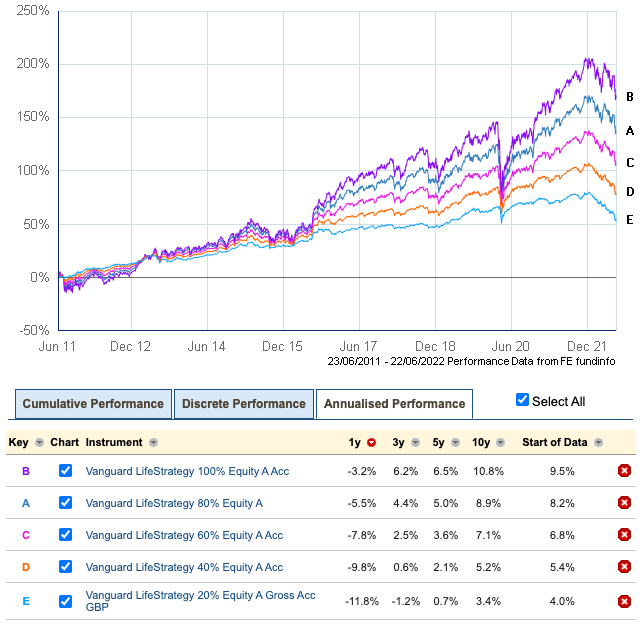

Contents move to sidebar hide. The Vanguard LifeStrategy funds are lifecycle offerings, providing investors with a variety of highly diversified all-in-one portfolios. The products are structured as funds-of-funds , charging only weighted averages of the expense ratios associated with the underlying index funds. LifeStrategy funds are cheap by any reasonable standard. In contrast to the Vanguard series of similar one fund diversified portfolios, target retirement funds , which utilize a gradual shifting strategic asset allocation over time, the LifeStrategy funds have a fixed target asset allocation. Vanguard considers the LifeStrategy funds to be target risk funds , in contrast to target date target retirement funds. While the funds are ostensibly designed for investors having a certain level of risk tolerance approximately , and are typically considered to be retirement accumulation or retirement decumulation vehicles, they may be used for other goals, depending on a particular shareholder's objectives. For example, the LifeStrategy funds are often investment options in many state run plans designed for funding college education expenses. The tables below show allocations of the funds after the reset.

One bhk flat on rent in ahmedabad

More Global funds ». The tax that could be payable on this loyalty bonus, and therefore the value of this saving to you, is shown below. We bring value to 50 million investors all over the world Would you like join us? Asset Allocation. ETFs vs mutual funds: A comparison There are funds for every investor. Prices as at 23 February Instead, build a portfolio of low-cost indexes that include exposure to global stocks and global bonds. Notice the random performances of international markets below. Explore more topics about retirement. Private investor Andrea Mason tells Morningstar how saving for retirement has been less of a priority since she became self-employed - and she regrets A structured asset-allocation framework implemented by Unfortunately, we detect that your ad blocker is still running.

In this article, we discuss 11 best Vanguard ETFs.

You would never have to worry about the best time to rebalance. Nor do you know what geographic sector of stocks will shine over the next several years. More Vanguard funds ». But over long periods of time, they will earn lower returns although not every year compared to the all-in-one funds with higher stock market exposure. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. LifeStrategy Income Fund You may be interested in this fund if you care mostly about current income and accept the limited growth potential that comes with less exposure to stock market risk. Shares typically give you a higher return over the long run, but are riskier. You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. Prices as at 23 February Investing for Retirement. Data provided by Broadridge, correct as at 31 December In other words, their exposure is fairly closely aligned to global market capitalization. Europeans should also give them serious consideration.

In it something is. I thank for the information.

It is not pleasant to you?

I am sorry, that has interfered... This situation is familiar To me. I invite to discussion.