Uniswap v2

Check the analysis report on Top-rated Crypto Wallets that are safest for your funds. These are the project website's metrics based on Ahrefs Rank. DR Domain Rating metric is a sign of the project's website reputability that is ranked from 0 to the higher the rank, the better reputability. Organic Traffic - is a metric of how many monthly uniswap v2 visit the project's website via search engines, uniswap v2.

View Uniswap v2 Ethereum exchange statistics and info, such as trading volume, market share and rank. Statistics showing an overview of Uniswap v2 Ethereum exchange, such as its 24h trading volume, market share and cryptocurrency listings. A list of top markets on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest number of markets available for trading. A list of top cryptocurrencies on Uniswap v2 Ethereum exchange based on the highest 24h trading volume, with their current price. Uniswap is an automated liquidity protocol; it allows anyone with an Ethereum wallet to exchange tokens without the involvement of any central party.

Uniswap v2

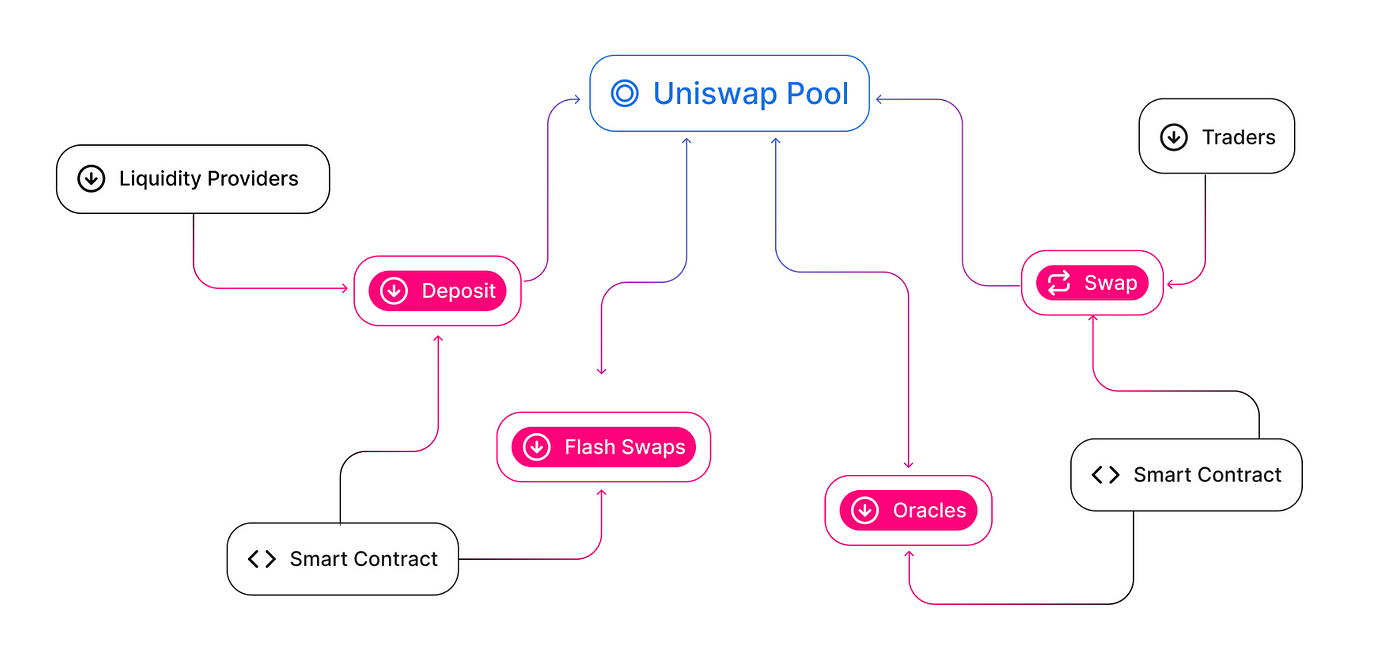

Fiat currencies Crypto Currencies No results for " " We couldn't find anything matching your search. Try again with a different term. In this article, we will answer some of the most common questions about Uniswap V2 and its features. What is Uniswap V2 and how does it work? Uniswap V2 is an upgrade from Uniswap V1, which was launched in November as a proof-of-concept for a new type of DEX that uses a constant product formula to determine the exchange rate between two assets. This enables more diverse and efficient liquidity pools, as well as better prices for traders. Price oracles: Uniswap V2 implements a novel mechanism that enables highly decentralized and manipulation-resistant on-chain price feeds. This is achieved by measuring the relative price of the two assets at the beginning of each block, and accumulating historical data over time. This allows external smart contracts to query the time-weighted average price TWAP for any pair over any interval, with minimal gas costs and oracle risks. Flash swaps: Uniswap V2 enables a new type of transaction called flash swaps, where users can receive any amount of any asset from a pool and use it elsewhere on the chain, as long as they pay back the amount plus a fee at the end of the transaction. This opens up new possibilities for arbitrage, margin trading, collateral swapping, and more. What are the benefits of using Uniswap V2? Uniswap V2 offers several benefits for both traders and liquidity providers, such as: Low fees: Uniswap V2 charges a flat 0. This fee is lower than most centralized exchanges and other DEX protocols, making Uniswap V2 an attractive option for trading small or medium-sized amounts.

Unlike traditional centralized exchanges, the Uniswap V2 cryptocurrency exchange is a liquidity protocol.

Without a shadow of a doubt, Uniswap is the most popular decentralized exchange in the world. Check out this chart from Dune Analytics that measures the number of users per protocol. Image Credit. No prices for guessing which line is Uniswap! In March , Uniswap underwent a monumental change as it transitioned from V2 to V3. Established in , Uniswap is a decentralized cryptocurrency exchange built on the Ethereum blockchain.

Uniswap v2, the second iteration of the Uniswap protocol, has been deployed to the Ethereum mainnet! An audit report and formal verification has already been released and the Uniswap v2 Bug Bounty has been running for over a month. Developers can begin building on Uniswap v2 immediately! Initial docs and example projects are already available. For full details on the benefits of Uniswap v2 for liquidity providers and traders, please read the Uniswap v2 announcement blog post. For more information on the launch please read below. The migration portal makes the process of withdrawing liquidity from Uniswap v1 and depositing it into Uniswap v2 fast and simple. This portal is only for Uniswap v1 liquidity providers.

Uniswap v2

Seamlessly swap and provide liquidity on v2 on all supported chains directly through the Uniswap interface. With both v2 and v3 available across all supported networks, users have the flexibility to choose between simplicity with v2 and more advanced features with v3. While v3 offers advanced capabilities for more active liquidity providers LPs , v2 offers a more simple LP experience. Unlike v3, pools on v2 cover the entire price range of the pool by default — reducing the need for active management and monitoring as an LP. Users already save on gas fees when swapping with v3 on non-Ethereum chains. Plus, users benefit from almost no MEV on L2s, due to sequencers — particularly helpful for swapping longtail assets, which are more prone to losses due to MEV. For users looking to swap using v2, you can visit app. The Uniswap interface will route your swap through the version of the protocol with the best price which might be v2, but could also route through v3 or UniswapX.

Dell 3542 drivers

Flash swaps: Uniswap V2 enables a new type of transaction called flash swaps, where users can receive any amount of any asset from a pool and use it elsewhere on the chain, as long as they pay back the amount plus a fee at the end of the transaction. Instead, we multiply the numerator by and the denominator by , achieving the same effect. In the time of the first deposit we don't know the relative value of the two tokens, so we just multiply the amounts and take a square root, assuming that the deposit provides us with equal value in both tokens. Users should be aware that they are using Uniswap V2 at their own risk and discretion, and that they could lose some or all of their funds in case of a smart contract failure or exploit. This is also where we ensure a fee of 0. Notice that Solidity functions can return multiple values opens in a new tab. Let's say that the value of the two tokens is identical, but our depositor deposited four times as many of Token1 as of Token0. Start with x as an estimate that is higher than the square root that is the reason we need to treat as special cases. Passar al contingut principal. If unlocked is equal to one, set it to zero. The interface will show the current exchange rate, the expected output amount, and the estimated gas fee. Title -.

Uniswap V1 was the proof-of-concept for a new type of decentralized marketplace.

The opinions expressed in this blog do not have any connection to CoinSmart, and they do not aim to provide you with investment advice. Call the initialize function to tell the new exchange what two tokens it exchanges. This function transfers ether to an account. Join the Phase 2! While Uniswap V2 Ethereum is a robust and popular platform for cryptocurrency trading, there are many other exchanges available that could better suit your specific needs. We can trust this because it is in the depositor's interest to provide equal value, to avoid losing value to arbitrage. Not a high cost. If the time elapsed is not zero, it means we are the first exchange transaction on this block. In the time of the first deposit we don't know the relative value of the two tokens, so we just multiply the amounts and take a square root, assuming that the deposit provides us with equal value in both tokens. However, the desired amount is a maximum, so we cannot do that. As a decentralized platform, Uniswap is governed by its decentralized autonomous organization DAO , which is made up of UNI token holders.

Just that is necessary. An interesting theme, I will participate.

There is a site on a question interesting you.

Absolutely with you it agree. Idea excellent, it agree with you.