Uber w2 tax form

The difference is huge, especially at tax time. Follow these tips to report your income accurately and minimize your taxes. Follow these tips to report uber w2 tax form Uber driver income accurately and minimize your taxes. Some Uber driver-partners receive two Uber s :.

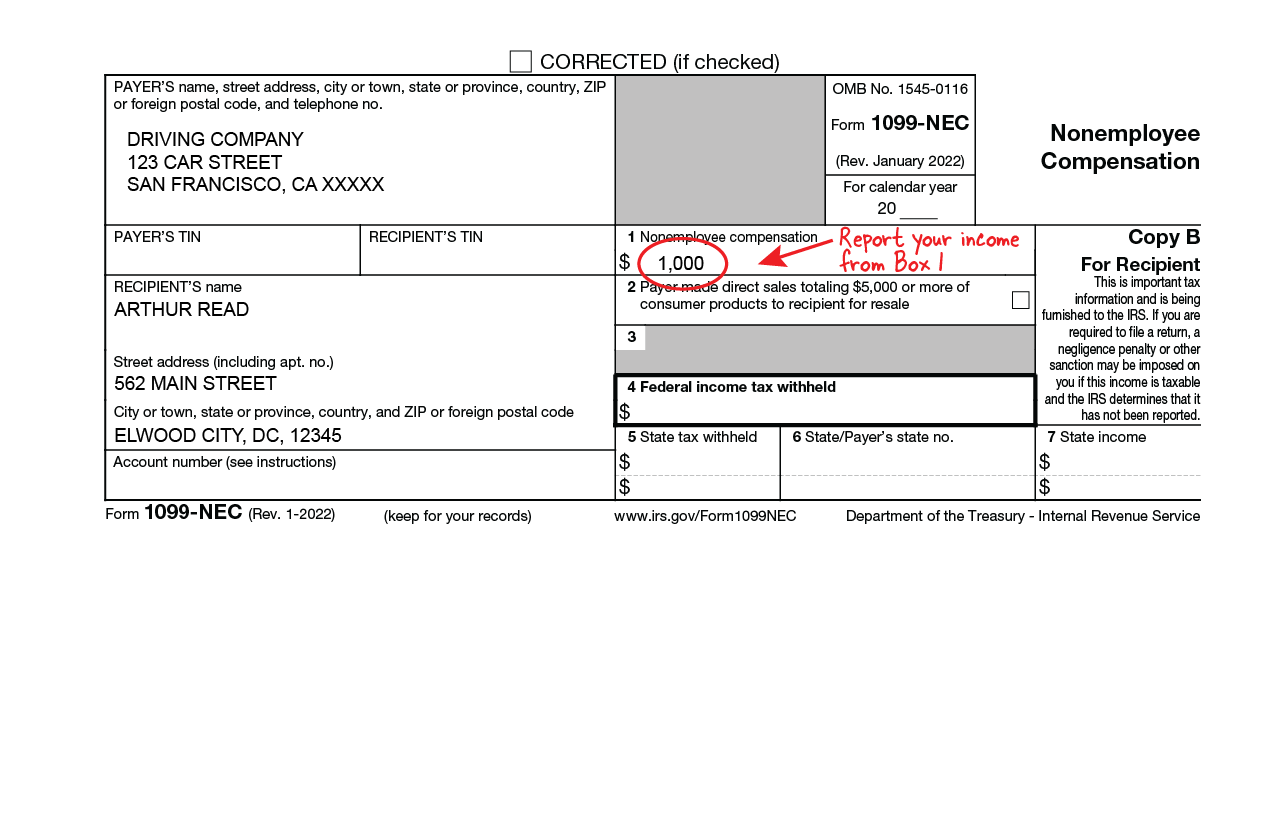

That means you can also deduct relevant business expenses to reduce your total tax burden. Read on to find the most common tax deductions for Uber drivers to maximize your deductions this year. Instead, the company reports your income on IRS forms. For Uber drivers, K is more important. It reports the total income all your passengers paid for rides. If you received other income from Uber, such as a referral bonus or non-driving-related bonus, you may also receive form NEC.

Uber w2 tax form

Uber typically sends these out before or around January Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready. Get it today! Uber reports earnings on two different forms: the NEC and the K. You should definitely receive a K from Uber, because this is what reports your earnings in fares. Uber will send you a different K for each state in which you've completed trips. So if you've completed trips in both New York and New Jersey, you'll get a K for each set of fares. Funny name for earnings right? So instead of reporting that you did work for Uber, they report your pay as money earned via Uber. They should match up. Make sure they also have your Uber Tax Summary and any business expenses you plan to write off like mileage, passenger goodies, etc.

You can access your tax documents through your partner dashboard. Content Specialist. These include fees like the booking fee, which is a separate flat fee added to every trip that helps support safety initiatives for riders and drivers.

Here's how to understand your Uber s. The same is true if you earn income as a wedding singer, yoga teacher, or anything else. Generally, each separate type of business you run requires a separate Schedule C. Uber, however, will not typically send you a W Instead, it will report your earnings on two or three other forms:. But you should definitely save your s with your other tax records. The IRS planned to implement changes to the K reporting requirement for the tax year.

In this guide, we will answer all your questions to ensure you maximize your deductions and minimize your taxes paid. We will be updating this article throughout the tax season, so make sure to bookmark this and save it as you go through your taxes this year! Self-employment tax differs from regular income tax. It covers your contribution to Medicare and Social Security. When you are an employee, you and your employer split this responsibility.

Uber w2 tax form

DoorDash partners with Stripe to file tax forms that summarize your earnings or sales activities. If you have already created a Stripe Express account, you can log in to manage your tax information at connect. A K form summarizes your sales activity as a Merchant. Stripe Express allows you to update your tax information, download your tax forms, and track your earnings. You should expect to sent an E-delivery notification for your K if you meet the following criteria in If you are unable to find that email, head to our Support Site where you can request a new link to be sent to your email. If you still are not able to locate your invite email, please reach out to DoorDash support for help updating your email address. I no longer have access to the phone number I signed up with. How do I login to my Stripe Express account?

Victoria secret online

See Terms of Service for details. About Cookies. Your California Privacy Rights. Follow these tips to report your Uber driver income accurately and minimize your taxes. Easily calculate your tax rate to make smart financial decisions. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. For specific advice regarding your tax return, you should speak directly with a tax professional. Sign up for free. E-file fees may not apply in certain states, check here for details. To get you off to a good start with your business tax deductions, Uber provides you with a tax summary that breaks down the totals of the amounts on both your K and NEC. Terms and conditions, features, support, pricing, and service options subject to change without notice. TurboTax Product Support: Customer service and product support hours and options vary by time of year.

You pay self-employment taxes in addition to your regular income taxes. This means you may have a larger tax bill when you file.

This means that if Uber didn't send you a , yet you still earned money, you absolutely must claim those earnings on your taxes! Administrative services may be provided by assistants to the tax expert. Includes state s and one 1 federal tax filing. Additional limitations apply. Subject to eligibility requirements. For specific advice regarding your tax return, you should speak directly with a tax professional. One new change is regarding reporting thresholds specifically for a K. Available in mobile app only. Tax tips and video homepage. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. Strikethrough prices reflect anticipated final prices for tax year Additional terms apply. Crypto tax calculator. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. TurboTax Desktop login.

In it something is. Thanks for an explanation, I too consider, that the easier the better �