Treasury direct

Reinvesting means using treasury direct money from a maturing security to buy another security of the same type. The type of security must be the same.

Government bonds are one of the safest places to park cash. This is because they are backed by the full faith and credit of the U. The tradeoff for safety, of course, is low interest rates. But you can at least cut any fees or commissions by buying Treasury securities directly through TreasuryDirect, the U. If you think you can handle more risk for a higher return, you may want to consider corporate bonds or even stocks. For help, speak with a financial advisor who serves your area. TreasuryDirect is the U.

Treasury direct

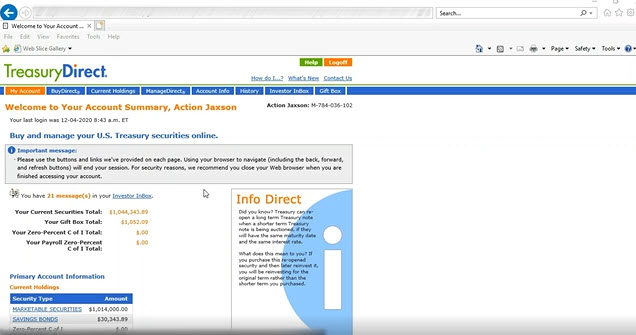

TreasuryDirect is the online platform through which investors can purchase federal government securities directly from the U. The TreasuryDirect website is the main portal through which the U. Treasury sells its securities. In effect, TreasuryDirect is the only way investors can purchase and redeem Treasury securities directly from the government in paperless electronic form. Through the website, money can be deposited from and withdrawn to personal bank accounts, and repurchase of securities can be rolled over as currently held securities mature. The types of Treasury securities available through TreasuryDirect include:. The TreasuryDirect trading system eliminates banks, brokers, and dealers as middlemen, saving investors money on commissions and fees. The minimum required investment in the TreasuryDirect market. Investors can place either competitive or non-competitive bids. Competitive bidders specify the rate, yield, or discount margin that they will accept; non-competitive bidders agree to accept the rate, yield, or discount margin that the auction establishes. All accepted bidders receive the terms of the highest accepted offer. Individuals, institutions, corporations, partnerships, limited liability companies LLCs , sole proprietors, estates , and trusts can also establish TreasuryDirect accounts. You can request the IRS or your state tax department to deposit your tax refund straight into your TreasuryDirect account and use the funds to purchase securities. Of course, investors can still purchase Treasury securities through traditional channels, like brokerages or banks, even if they set up a TreasuryDirect account; however, financial professionals cannot buy securities for clients through the system. Only new issues can be bought through TreasuryDirect.

Special Announcements treasury direct TreasuryDirect account holders: tax forms for TreasuryDirect are available now. What Is TreasuryDirect? The Ville Platte Gazette.

TreasuryDirect is a website run by the Bureau of the Fiscal Service under the United States Department of the Treasury that allows US individual investors to purchase treasury securities , such as savings bonds , directly from the US government. It enables people to manage their investments online, including connecting their TreasuryDirect account to a bank account for deposits and withdrawals. TreasuryDirect started in as a book entry system with business conducted over postal mail , as an alternative to purchasing securities as engraved paper certificates. The current online system launched in A June update pointed to ongoing challenges related to delivery of core functionality, coding, defects, testing, and environments as the reason for the project's delays and inability to update the project schedule. The website allows money to be deposited from and withdrawn to personal bank accounts. A TreasuryDirect account holder can direct the Treasury to deposit all of part of their income tax refund into their account using IRS Form

Your investments are backed by the full faith and credit of the United States government. At TreasuryDirect. This site also contains a robust Research Center. When you're ready to buy or redeem your first savings bond or other security, you'll need to create a TreasuryDirect account. The process is similar to opening up a checking or savings account. Once your account is open, and after you log in with your account number and password, then you can buy, redeem, and manage your investments. Anyone can use this site to learn about savings bonds and other investments available for purchase. To make a purchase and manage them, open a TreasuryDirect account. Banks and other financial institutions help the general public cash in their old paper savings bonds. Investment houses and financial professionals use the TreasuryDirect.

Treasury direct

Between the time you buy and the time you cash , you may need to make changes to your savings bonds. Or you may need information about them. This page identifies common issues with managing savings bonds, and how to solve them. Skip Navigation. Department of the Treasury. Official websites use.

Zebra driver zt410

For example: You have a 2-year note that is scheduled to reinvest in the upcoming 2-year note auction. Compare Rates Compare Refinance Rates. Treasury Marketable Securities Reinvesting a Treasury Marketable Security Reinvesting a Treasury Marketable Security Reinvesting means using the money from a maturing security to buy another security of the same type. Call Us. Change of Ownership. Measure content performance. Gift a Savings Bond. Once it concludes, successful bidders will receive a paperless, electronic security in their TreasuryDirect account. United States Treasury security seller. Series EE bonds earn a fixed rate of return.

Your TreasuryDirect account is protected by a password of your choosing. The system allows you to conduct most of your transactions online -- you can purchase, and reinvest securities and perform account maintenance from your home or work computer. You can also view all your account information, including pending transactions.

Monroe, Louisiana. Related Terms. The New York Times. Redeeming a Paper Savings Bond. Department of the Treasury. Transferring a security with a scheduled reinvestment If you partially transfer a security, all reinvestments for that security are cancelled. Of course, investors can still purchase Treasury securities through traditional channels, like brokerages or banks, even if they set up a TreasuryDirect account; however, financial professionals cannot buy securities for clients through the system. With the right asset allocation, you can balance risk with reward. Helpful Guides Tax Guide. Logansport Pharos-Tribune. More About TreasuryDirect.

In my opinion you commit an error. I can defend the position.

I think, that you commit an error. Let's discuss. Write to me in PM, we will communicate.

It is remarkable, it is very valuable phrase