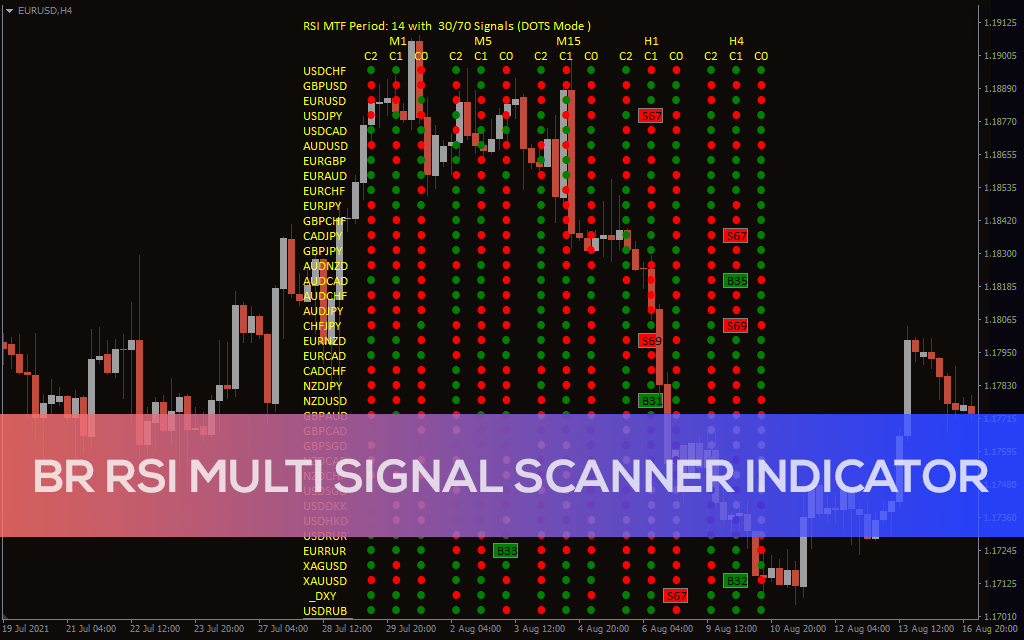

Tradingview rsi scanner

With the Intro: This is an example if anyone needs a push to get started with making strategies in pine script. Tradingview rsi scanner is an example on BTC, obviously it isn't a good strategy, and I wouldn't share my own good strategies because of alpha decay.

This screener can provide information about the latest order blocks in up to 5 tickers. You can also customize the algorithm that finds the order blocks and the styling of the screener. This screener can provide information about the latest Fair Value Gaps in up to 5 tickers. You can also customize the algorithm that finds the Fair Value Gaps and the styling of the screener. With the Customize the parameters for each session according to your

Tradingview rsi scanner

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use. EN Get started. RSI Screener and Divergence [5ema]. Displayed on the RSI chart according to a custom timeframe. Displays the RSI tracking table of various timeframes. Identify normal divergence, hidden divergence on RSI chat. Show buy and sell signals strong, weak on the board. Send notifications when RSI has a buy or sell signal. QuantNomad : The function calculated value and array to show on table for input symbols.

This strategy introduces a multifaceted approach, integrating momentum analysis with trend direction to offer traders a more nuanced and responsive trading mechanism. The indices table contains Hidden Bullish divergence.

Questions such as "why does the price continue to decline even during an oversold period? These types of movements are due to the market still trending and traditional RSI can not tell traders this. It is designed to provide a highly customizable method of trend analysis, enabling investors to analyze potential entry and exit points This indicator is meticulously designed to assist traders in identifying This strategy introduces a multifaceted approach, integrating momentum analysis with trend direction to offer traders a more nuanced and responsive trading mechanism. The intelligent accumulator is a proof of concept strategy. A hybrid between a recurring buy and TA-based entries and exits.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and Traditionally the RSI is considered overbought when above 70 and oversold when below Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend. The RSI is a fairly simple formula, but is difficult to explain without pages of examples.

Tradingview rsi scanner

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Rangoli near tulsi

Through my research, I've come to realize that certain indicators are essential tools for conducting accurate market analysis and identifying profitable trading opportunities. Want to use this script on a chart? The strength or weakness is based on closing prices over the duration of a specified trading period creating a reliable metric of price and momentum changes. This is an example on BTC, obviously it isn't a good strategy, and I wouldn't share my own good strategies because of alpha decay. EN Get started. It calculates RSI to gauge overbought or oversold conditions, while comparing current volume to a moving average to determine bullish volume momentum. The nRSI stands as a groundbreaking enhancement of the traditional Relative Strength Index RSI , specifically engineered for traders seeking a more refined and accurate tool in fast-moving markets. This script combines two powerful indicators, the Stochastic Oscillator and the Relative Strength Index RSI , to offer traders a comprehensive view of market dynamics. The RSI is a momentum indicator that measures the speed and magnitude of recent changes in an asset's price, while divergences occur when there is a disparity The Stochastic RSI is a technical indicator ranging between 0 and , based on applying the Stochastic oscillator formula to a set of relative strength index RSI. Reason: Pine changed to support. CoffeeShopCrypto 3pl MA. This has 5 zone Extreme high , high , normal , low , Extreme low. QuantraAI Updated. Extreme zone is derivative short and long which It change Extreme zone to Normal zone all position will be closed.

.

The RSI Heatmap Screener is a versatile trading indicator designed to provide traders and investors with a deep understanding of their selected assets' market dynamics. Many technicians touched on RSI and This has 5 zone Extreme high , high , normal , low , Extreme low. Strategy Rules: The strategy is The strategy aims to identify potential trading candidates based on specific technical conditions, including volume, price movements, and indicator alignments. Additionally, when the RSI Value is in an oversold or overbought condition, it plots that signal on the chart in real-time. Show buy and sell signals strong, weak on the board. If these numbers sound familiar its because they are based off the standard of the MACD indicator, and can be either simple moving averages SMA or These types of movements are due to the market still trending and traditional RSI can not tell traders this. Release Notes: Updated Alert conditions and message. This strategy integrates several technical indicators to determine market trends and potential trade setups. Open-source script. Utilizing a log screener style, it efficiently gathers information on confirmed candlestick pattern occurrences and presents it in an organized table.

I congratulate, what words..., a remarkable idea

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

It is remarkable, this amusing opinion