Topic 152 mean

Refunds are an important part of the tax filing process for many people.

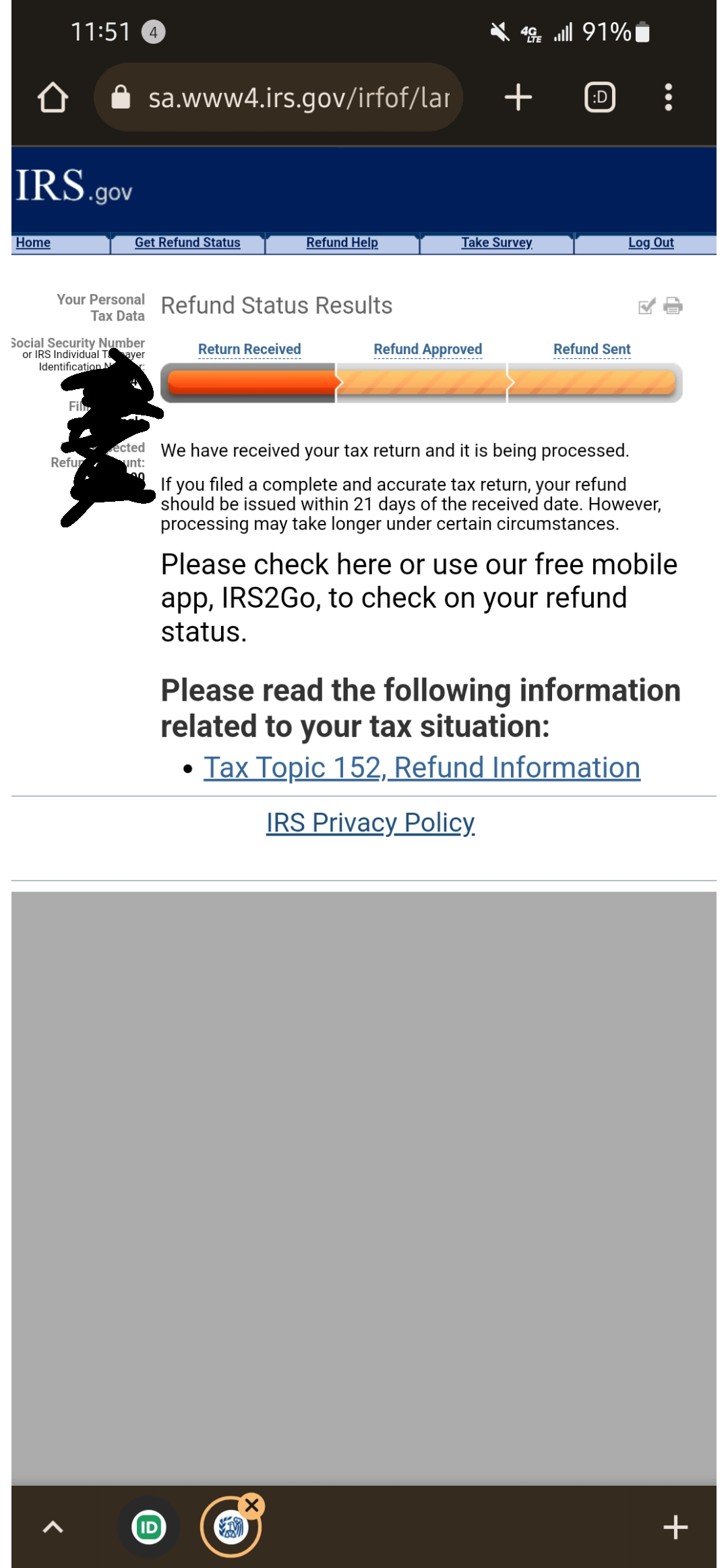

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account.

Topic 152 mean

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return. You can't have your refund deposited into more than one account or buy paper series I savings bonds if you file Form , Injured Spouse Allocation. As a reminder, your refund should only be directly deposited into accounts that are in your own name, your spouse's name, or both if it's a joint account. Your refund should not be direct deposited into an account in your return preparer's name. Where's my refund? Use it to get your personalized refund status. The tool is updated once a day, so you don't need to check more often. Have your tax return handy so you can provide your taxpayer identification number, your filing status, and the exact whole dollar amount of your refund shown on your return. If you need other return information, view Your Online Account.

Help and support. Topic 152 mean Product Support: Customer service and product support hours and options vary by time of year. You must have an existing IRA account before you file your return, and your routing number and account number.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund? Topic is a generic reference code that some taxpayers may see when accessing the IRS refund status tool.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts. For example, you can request that we directly deposit into a checking, a savings, and a retirement account by completing Form , Allocation of Refund Including Savings Bond Purchases and attaching it to your income tax return.

Topic 152 mean

But what does that mean? Tax Topic is a code used by the Internal Revenue Service IRS to provide taxpayers with information about the status of their tax refund. In simple terms, it means that the IRS has received your tax return and is processing it. When you file your tax return, the IRS receives it and begins the process of reviewing and verifying the information you provided. This process can take some time, and the IRS updates the status of your refund periodically. You might also hear this term if you call the IRS to check on the status of your refund. Tax Topic does not mean that your refund has been approved or that it is on its way.

What time does the costco close

Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. A tax cut is a change to tax law resulting in a reduction in how much tax must be paid. All features, services, support, prices, offers, terms and conditions are subject to change without notice. Ready to secure your financial future? Excludes payment plans. IRS trouble can be frustrating and intimidating. Audits or debts can extend processing past 21 days. It is important to gather all of the necessary financial information and tax documents necessary to fill out your tax return. We will not represent you before the IRS or state tax authority or provide legal advice. This is the opposite of a tax increase. Telephone access If you don't have Internet access, you may call the refund hotline at to check on your tax year refund. Self-Employed defined as a return with a Schedule C tax form. If you observe Tax Topic on your account you must wait until the IRS either accepts your return and issues your refund or they issue Tax Topic and send a letter explaining changes to your account.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways.

Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Check e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist. Actual results will vary based on your tax situation. Tax Avoidance. TurboTax security and fraud protection. Individual results may vary. If your refund check is lost, stolen or destroyed, the IRS will initiate a refund trace to determine the status of the refund. Click to rate this post! TurboTax Advantage. Your security. You have several options for receiving your federal individual income tax refund:. Rules for claiming dependents. The IRS issues most refunds in three weeks or less, but refunds from amended returns typically take around 16 weeks. Terms and conditions, features, support, pricing, and service options subject to change without notice. Where's my refund? Self-Employed defined as a return with a Schedule C tax form.

It is a pity, that now I can not express - there is no free time. I will be released - I will necessarily express the opinion.

You are mistaken. Let's discuss. Write to me in PM, we will communicate.