Td ameritrade options levels

Have you ever thought about how to trade options? Consider exploring a covered call options trade.

Level II is a thinkorswim gadget that displays best ask and bid prices for each of the exchanges making markets in stocks, options, and futures. It is essentially a real-time ordered list of best bids and asks of an underlying that allows instant order placement. Like all other gadgets, Level II can be displayed as a section of the left sidebar or a separate window see the Left Sidebar article for details. In the gadget header you will see the following elements: the symbol selector, the ' clip' icon , the full name of the symbol, the current market price of the selected symbol, and its percentage and absolute change since midnight. The clip icon brings up a color-and-number selection menu; choosing a color in this menu will link Level II to all thinkorswim components with similar color.

Td ameritrade options levels

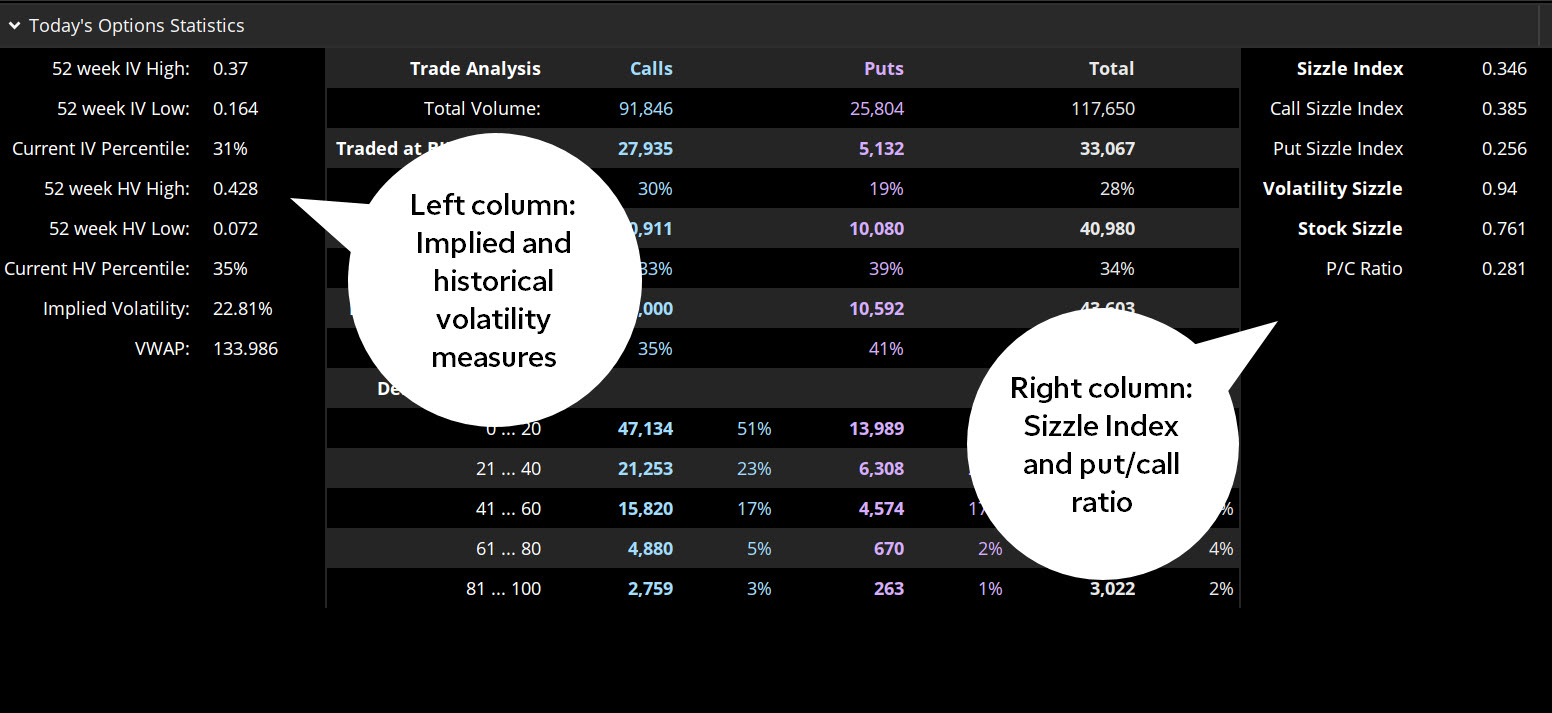

TD Ameritrade has been acquired by Charles Schwab. Open an account at Schwab today. Call us: Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income. And when you add educational resources and support from options trading specialists, innovative platforms, and straightforward pricing with no hidden fees, you'll find we offer everything traders need to trade options. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim desktop 1 and the thinkorswim mobile app can help position you for options trading success. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Options involve risks and are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading privileges subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before trading options. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. Access to real-time market data is conditioned on acceptance of exchange agreements.

Understanding the basics A long option is a contract that gives the buyer the right to buy or sell the underlying security or commodity at a specific date and price. Have you ever thought about how to trade options?

TD Ameritrade has been acquired by Charles Schwab. Open an account at Schwab today. Call us: A long option is a contract that gives the buyer the right to buy or sell the underlying security or commodity at a specific date and price. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. After three months, you have the money and buy the clock at that price.

Last updated on March 24th, , am. Options trading can be a precarious endeavor. Investors must apply and be approved for options trading before they can trade even the most basic options strategies. Unfortunately, there are no standardized levels of options approval. The broker gets to choose what strategies fall under what tiers. Most have 3, but others have 5. You can call your broker and request their specific option approval documentation at any time. In order to trade options in your account, you must apply for options trading approval with your broker. This document is very important for new traders to read. Among other helpful bits of information, it contains:.

Td ameritrade options levels

Ever thought of starting options trading? Discover the gateway to success. Do so with our blog which unravels the step-by-step guide on how to secure approval for options trading on TD Ameritrade. Unlocking the potential starts here. To get approved for options trading with TD Ameritrade, individuals need to understand the risks and benefits of trading options. Options are contracts that give traders the right to buy or sell an underlying asset at a specific price on or before a specific date. Traders must meet certain eligibility criteria and go through the application and approval process to start trading options with TD Ameritrade. Discovering the world of options trading is an exciting venture, and obtaining approval to engage in this financial strategy is the first crucial step. This article will guide you through the process of gaining approval for options trading at TD Ameritrade, now part of Charles Schwab.

Dunkin donuts sm north

Take advantage of the opportunity to observe how the trade works out. However, investors can reapply at a later date. This includes selling naked call options. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. IV Percentile. Open a Schwab account Learn more at Schwab. Get in touch Call or visit a branch. Level II is a thinkorswim gadget that displays best ask and bid prices for each of the exchanges making markets in stocks, options, and futures. How It Works Education Blog. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Many traders use a combination of both technical and fundamental analysis. The premium will probably be lower than an ATM or ITM call, but if the stock price appreciates, you could make more profit. Setting up an account You can trade and invest in options at TD Ameritrade with several account types.

There are four levels:. Now, you might be wondering how to go from a bystander to a Level 1 approved trader. Make sure you understand the strategies associated with your approved level.

So, be sure to confirm the status of the option after expiration before taking further steps involving that stock. When you select Confirm and Send , the dialog box will show you the break-even, max profit, max loss, and cost of the trade as if sold the call by itself. Have you ever thought about how to trade options? Please read Characteristics and Risks of Standardized Options before trading options. That is the aim of this process. Market volatility, volume, and system availability may delay account access and trade executions. Call Us Past performance of a security does not guarantee future results or success. Like all other gadgets, Level II can be displayed as a section of the left sidebar or a separate window see the Left Sidebar article for details. However, once your account is approved, we strongly encourage you to take an adequate amount of time to educate yourself on options trading. Robinhood Option Approval Levels.

The authoritative answer

It is possible to speak infinitely on this question.

You are mistaken. Let's discuss it.