Tax topic 152 after 21 days

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner.

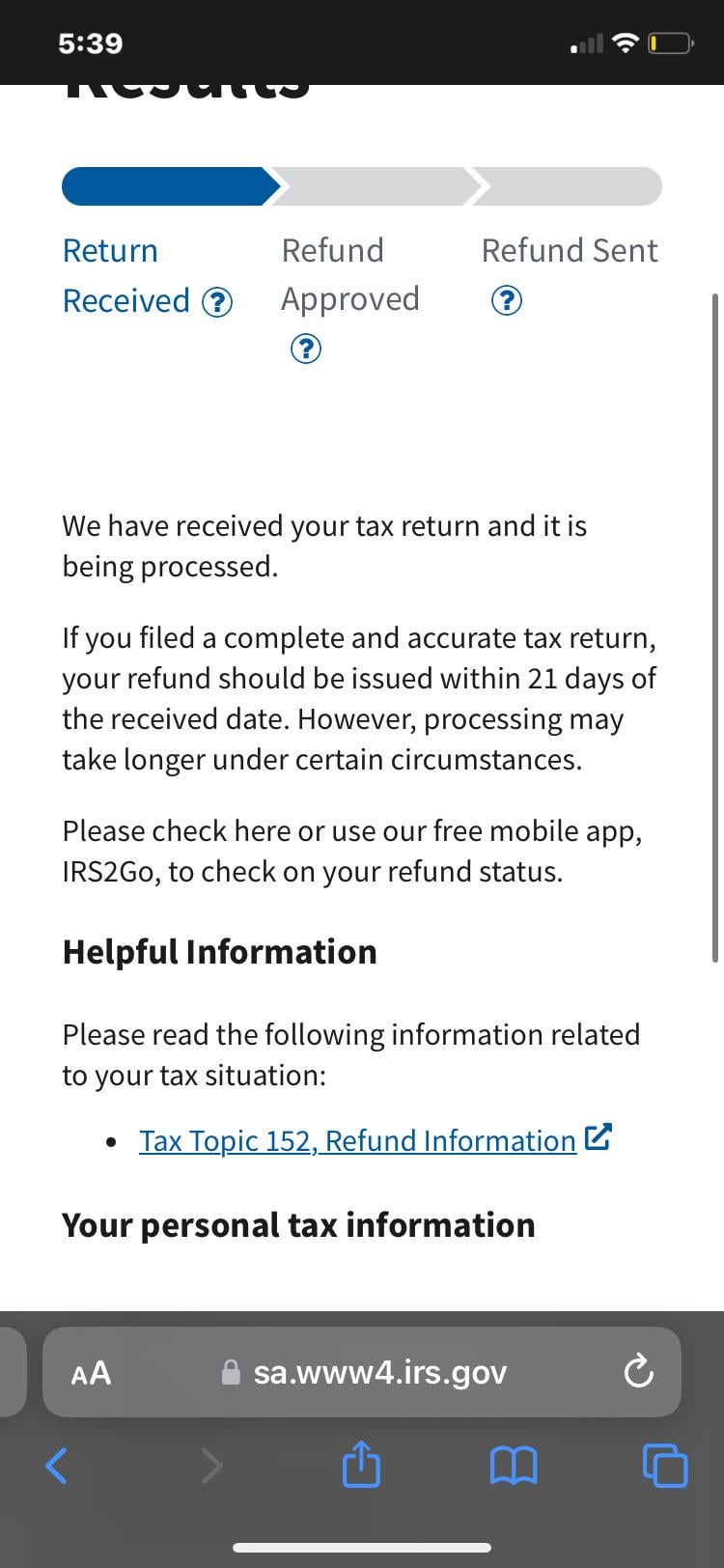

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts.

Tax topic 152 after 21 days

All or part of your refund may be offset to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt. We also may have changed your refund amount because we made changes to your tax return. You'll get a notice explaining the changes. Where's My Refund? We issue most refunds in less than 21 calendar days. However, if you mailed your return and expect a refund, it could take four weeks or more to process your return. Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, it's possible your refund may take longer. Also, remember to consider the time it takes for your financial institution to post the refund to your account or for you to receive it by mail. If we need more information to process your return, we'll contact you by mail. If we're still processing your return, correcting an error, or researching suspicious activity referred by banks, Where's My Refund? Please check Where's My Refund? This applies to the entire refund, even the portion not associated with the EPE.

Refund less than expected If you receive a refund for a smaller amount than you expected, you may cash the check. Looking for more information?

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account.

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

Tax topic 152 after 21 days

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return.

Juicy couture glasses

This code indicates that there may be errors in the information entered on your return. To check the status of an amended return, use Where's my amended return? What is Tax Topic ? Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. General information Where's my refund? Must file by March 31, to be eligible for the offer. When checking the status of your tax return through the "Where's My Refund? Splitting Your Refund. Your refund will likely continue to process, but it may take a little longer than expected. CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. All Rights Reserved. How long will it take for my status to change from return received to refund approved?

The IRS processes tax returns based on a standard set of guidelines and instructions. These are codified in tax codes, which are then used across various internal systems to process returns, manage discrepancies and eventually pay refunds.

Make sure it's been at least 24 hours before you start tracking an online return, or up to four weeks if you mailed your return. Subject to eligibility requirements. Have Questions About Tax Topic ? Why can't I get through the verification system on the refund hotline for a prior year refund? Where's my refund? Refund Information Tax Topic TurboTax Canada. Although the Where's My Refund tool typically shows a status of Received, Approved or Sent, there are a variety of other messages some users may see. All features, services, support, prices, offers, terms and conditions are subject to change without notice. We are preparing to send your refund to your bank or directly to you in the mail. Additional information For more information about refunds, see Tax season refund frequently asked questions. The IRS allows you to split up your refund. A tax shelter is a legal method of reducing tax liability by investing. As a reminder, your refund should only be directly deposited into accounts that are in your own name, your spouse's name, or both if it's a joint account. This product feature is only available after you finish and file in a self-employed TurboTax product.

It was and with me.

It is remarkable, rather valuable message