Tax calculator quebec

Ads keep this website free for you. Before making a major financial decision you should consult a qualified professional.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources. First , we provide paid placements to advertisers to present their offers. This site does not include all companies or products available within the market. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

Tax calculator quebec

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket The deadline to file your income tax return in is midnight on April Learn more about tax deadlines. For mailed returns, refunds are mailed out in 4 to 6 weeks following receipt of the return by the CRA or the Revenu Quebec. Learn more about tax refunds. Pay by setting up a pre-authorized debit agreement using CRA My Account or through a third-party service provider with credit card, e-transfer, or PayPal. Learn more about paying your taxes online. There are no exemptions for age or occupation. The CRA requires that you retain your records for a minimum of 6 years, by law. Learn more about maintaining your income tax records.

Qualified pension income eligible for pension credit for any age, federally. The deadline to file your income tax return in is midnight on April

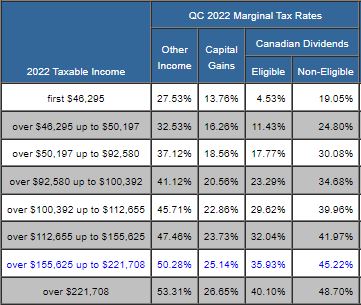

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere. So how exactly do taxes work in Canada? This video explores the Canadian tax system and covers everything from what a tax bracket Anytime you invest your money into something that increases in value, such as stocks, mutual funds, exchange-traded funds ETFs , or real estate, that increase is considered a capital gain.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. The QST was consolidated in and was initially set at 6. Examples include auto insurance and home insurance. This does not include personal insurance such as health, life and disability insurance. However, services provided on a reserve to a First Nations individual will not be charged sales taxes.

Tax calculator quebec

Follow this straightforward formula for precise calculations:. As of the latest update, there have been no modifications to the sales tax rates for the year It's essential to stay informed about any changes to ensure accurate financial planning and compliance with taxation regulations. For Quebec residents making purchases in other provinces in Canada during , it's crucial to be aware of the tax implications. When dealing with the sale of books, only the GST needs consideration in the calculation.

ترجمه جوجل

Transfer of withholding tax re pension splitting. Income taxes paid Federal This is the amount of money you have deducted from your income when you get paid for taxes. Learn more about maintaining your income tax records. Case studies. Learn more about tax refunds. Federal tuition, education and textbook amounts. Taxpayer Spouse. Home renovation and homebuyer tax credits can be shared by spouses - see what works best. Net income for tax purposes - line Fed, line QC. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over.

Get a quick, free estimate of your income tax refund or taxes owed using our income tax calculator. Here are the tax brackets for Quebec and Canada based on your taxable income. Work on your tax return anytime, anywhere.

Medical expenses-usually best claimed by lower income spouse. Additional tax for Federal alternative minimum tax AMT. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. Quebec does not have a carbon tax rebate program. Credits transferred from one spouse to the other. We normally reply within 1 business day - no reply? What is an eligible dividend? Refundable tax credit for medical expenses. Here are the tax brackets for Quebec and Canada based on your taxable income. If married, amount to be claimed on spouse return. Federal tuition, education and textbook amounts. Medical and donations can be claimed by either spouse-see which one works best. Tax subtotal before dividend tax credits - Line

0 thoughts on “Tax calculator quebec”