Swing trading screener

Understanding the Importance of Stock Screeners. Key Features to Look for in a Stock Screener. Analyzing Technical Indicators swing trading screener a Stock Screener. Swing trading is a popular trading strategy that aims to capture short-term price movements in the market.

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks. Taking too much time to research might mean missing out on great trading opportunities.

Swing trading screener

.

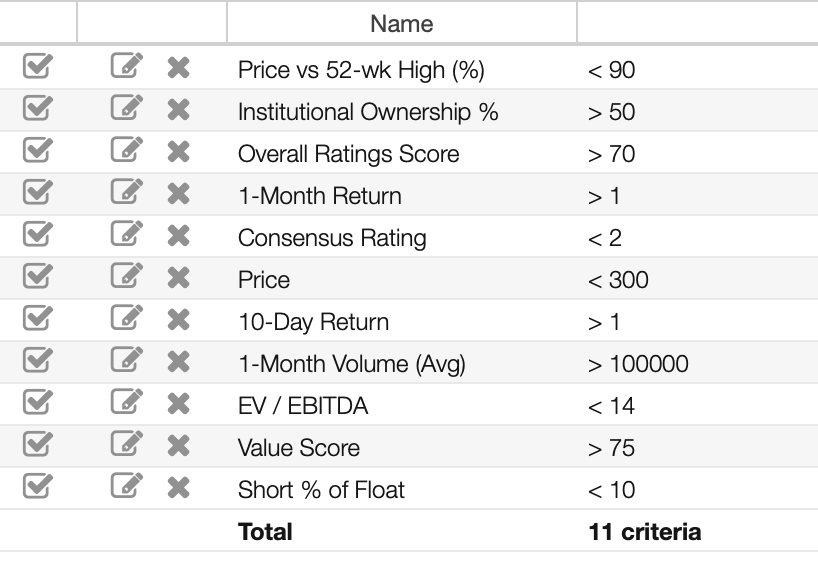

Different traders want different things out of their stock screener.

.

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks. Taking too much time to research might mean missing out on great trading opportunities. Why do you need a stock screener for swing trading, and which ones are the best?

Swing trading screener

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Swords terraria

A stock screener can filter stocks based on their historical volatility or average true range , allowing swing traders to focus on stocks that have the potential for significant price swings. Customizable Filters: One of the key features to look for in a stock screener is the ability to customize filters. Consider factors such as the number of criteria you can set, the availability of technical indicators, the ability to save and customize screens, and the user interface. However, paid screeners often offer more advanced features and a wider range of screening criteria, making them ideal for experienced traders or those who require more specialized screening capabilities. So, take advantage of the powerful tools available and make the most out of your swing trading endeavors. Having access to these tools within the stock screener can save you time and effort in conducting technical analysis separately. Swing trading is a popular strategy among traders who aim to capture short-term price movements in the market. Additionally, real-time data and the ability to save and track your scans over time are important features to consider. My fourth swing trading stock screener pick is Zacks. It involves buying stocks and holding them for a few days to a few weeks, taking advantage of short-term price fluctuations. Proper risk management helps traders minimize losses and protect their capital.

In the ever-evolving world of swing trading, the quest for the next big opportunity can be as challenging as it is thrilling. Amidst a sea of stocks, identifying those poised for significant moves often feels like searching for a needle in a haystack.

Stock screeners often provide a wide range of technical indicators that can help identify potential swing trading setups. Swing trading is a popular strategy that allows traders to capture short-term price movements while maintaining a more flexible schedule compared to day trading. Introduction to Swing Trading 2. Once you have narrowed down your criteria, it's time to set technical indicators in your stock screener. While swing trading is primarily driven by technical analysis, considering fundamental factors can provide additional insights and enhance your trading strategy. By utilizing stock screeners effectively, you can save valuable time and improve your chances of finding profitable trades. But free screeners can help beginners get their feet wet — check out my favorite free stock screeners! Furthermore, Finviz provides real-time stock quotes, charts, and news, enabling swing traders to stay up-to-date with the latest market trends. Whether you opt for a free or paid screener, incorporating this tool into your trading routine can greatly improve your chances of success in the dynamic world of swing trading. At the end of each trading day, Holly looks over everything that happened and comes up with multiple strategies to help traders beat the market. While swing trading primarily focuses on technical analysis, it's also important to consider fundamental data when using a stock screener. The screener also allows users to create custom filters and save them for future use. For instance, if you are looking for stocks with strong upward momentum, you can set the screener to filter for stocks with a high relative strength index or stocks that have recently broken out of a consolidation pattern. Utilize this information to refine your criteria and increase the probability of successful trades.

0 thoughts on “Swing trading screener”