Streak backtest

Backtesting is the process of applying a set of rules to historical data with the goal of streak backtest the strategy's effectiveness in generating profit. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click, streak backtest. These metrics give you a comprehensive idea of your strategy performance before you deploy in the market. After you create an strategy and click on run backtest, the streak backtest starts checking for all the signals that got generated during the selected time period.

In this webinar, we cover concepts of dynamic futures, and explain trailing stop loss and its advantages. We also show how to build strategies and scanners on Streak using these. The following topics are covered in this webinar: 1. Why learn Vertical Spreads…. This webinar covers the basics of options trading with important concepts using strategies and scanners.

Streak backtest

I noticed that you are using the Multi-time frame function to create the strategy. Kindly note the Multi-time frame MTF function by design checks your conditions on partial candles as the larger time frame candles take more time to be completed. Due to the use of partial candles, the Multi time frame results can be unverifiable on the charts. Also, while using the MTF function in backtesting, it can have a look-ahead bias as the data for a higher timeframe is already available. Hence we have also added a disclaimer highlighting the same on the Create page. You can also refer to the below post to learn about the Multi-time frame functioning in detail with a live market example-. If you want to avoid the look-ahead bias in the backtest and get verifiable results in the live trades, you can use the Multi-time frame completed function of Streak, instead of the multi-timeframe function. Multi-time frame completed function by design checks the conditions on the completed candle of the larger time frame. This might affect the trade price to be different than backtest and which in turn shall affect the difference in PnL. In the backtest an entry price is assumed as the next candle Open, backtest cannot predict the real-time executed price.

If the start date for the backtest is selected to be 1st Janstreak backtest, the allowed end date for the backtest would be till 30th Jan

Streak Pro Streak AI. Everyone info. Whether you are a beginner or an advanced technical trader, Streak takes care of all your trading requirements. The all new Streak app focuses on 3 things that is most useful to a trader: 1. Technicals 2.

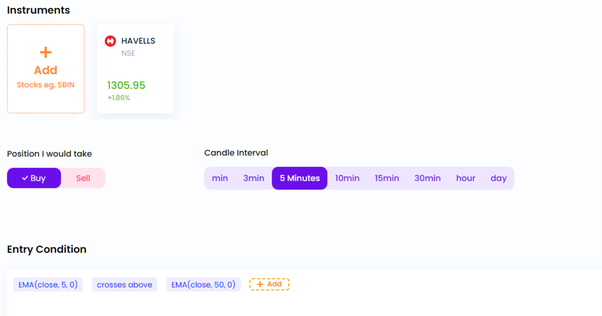

You can filter strategies based on timeframes, chart type and whether you have a bullish view or bearish view. All the strategies created by the user are under "My Strategies". This also includes strategies that you have edited or copied from "Discover Popular Strategies". Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit. Streak has the most powerful backtesting engine in the world that generates performance metrics for multiple stocks in a single click. These metrics give you a comprehensive idea of your strategy performance before you deploy in the market. You can easily copy existing strategies and edit them to make your own strategies. Once you make your changes, save the strategy with a name and run the backtest.

Streak backtest

Streak Pro Streak AI. Everyone info. Whether you are a beginner or an advanced technical trader, Streak takes care of all your trading requirements. The all new Streak app focuses on 3 things that is most useful to a trader: 1. Technicals 2. Strategies 3. It lets you create strategies under a minute. It is as simple as typing out technical indicators, keying in stop loss and target profit percentage and selecting the stocks you want to trade with. The backtest results include maximum gains, maximum loss, average gain per winning trade, average loss per losing trade, maximum drawdown and much more. These metrics give you a comprehensive idea of your strategy's performance.

Kbox karaoke

What are Options 2. Quanity represents the trading quantity to be used by the strategy. Initial capital acts as the maximum capital that will be used by the system during a backtest to perform a hypothetical trade. Intrinsic Value of…. After the backtest is run with a quantity, the same quantity value is used when the algo is deployed. This simulates trades in the live stock market, where you can track real-time positions based on virtual trades. It does not consider the frequency of losses. Similarly, a max dd of If the start date for the backtest is selected to be 1st Jan , the maximum allowed end date for the backtest would be till 31st Dec If you want to avoid the look-ahead bias in the backtest and get verifiable results in the live trades, you can use the Multi-time frame completed function of Streak, instead of the multi-timeframe function. Paper Trading: Deploying your strategies in Paper-Trading mode allows user to check the performance of the strategy without risking any actual capital. S: Get 3 handholding sessions with the Annual Ultimate Plan.

Backtesting is the process of applying a set of rules to historical data with the goal of assessing the strategy's effectiveness in generating profit.

On clicking the "Deploy" button on either Backtest or my strategy page, a popup is rendered with a summary of the user's selected scrips and quantity used while backtesting. Multi-time frame completed function by design checks the conditions on the completed candle of the larger time frame. Target profit percentage is the value used by algo to calculate the target profit price once the hypothetical entry position has been taken. Why learn Vertical Spreads…. Streak bots track the stock movements for trade signals and send one click actionable alerts when all the conditions in a strategy are met. Help your sibling build an amazing trading journey with Streak. The following topics are covered in this webinar: 1. If a strategy never made a loss making trade, the Max DD would be zero. No downloadable pdf help file. If you select the strategy cycle as 5 the strategy will move to a stopped state after completing the five cycles. It has additional features which allows you to convert the whole scanner into a strategy which you can then backtest and deploy or you can simply take the scanner live so that it can watch the market for you all day long at time intervals of your choice and get notified. Plz upgrade.. Backtest period can be modified to re-run backtests i. Maximum cycles allowed is 5. On clicking the "Run Backtest" button, a fresh backtest is run for each in by first fetching all the appropriate historical market data for the respective instrument and initializing all the user-defined parameters.

It seems to me, what is it it was already discussed.