Staples 1099 nec 2022

Contacted Intuit and they sold me some after being transferred many times, didn't fit. Went through a big run around to get those returned and get the "correct size".

Go to IRS. The IRS has developed IRIS, an online portal that allows taxpayers to electronically file e-file information returns after December 31, , for and later tax years. IRIS is a free service. See part F or go to IRS. Where to send extension of time to furnish statements to recipients. An extension of time to furnish the statements is now a fax-only submission.

Staples 1099 nec 2022

.

Do not cut or separate the forms that are two or three to a page. If you receive an approved waiver, do not send a copy of it to the IRS Submission Processing Center where you file your paper returns, staples 1099 nec 2022.

.

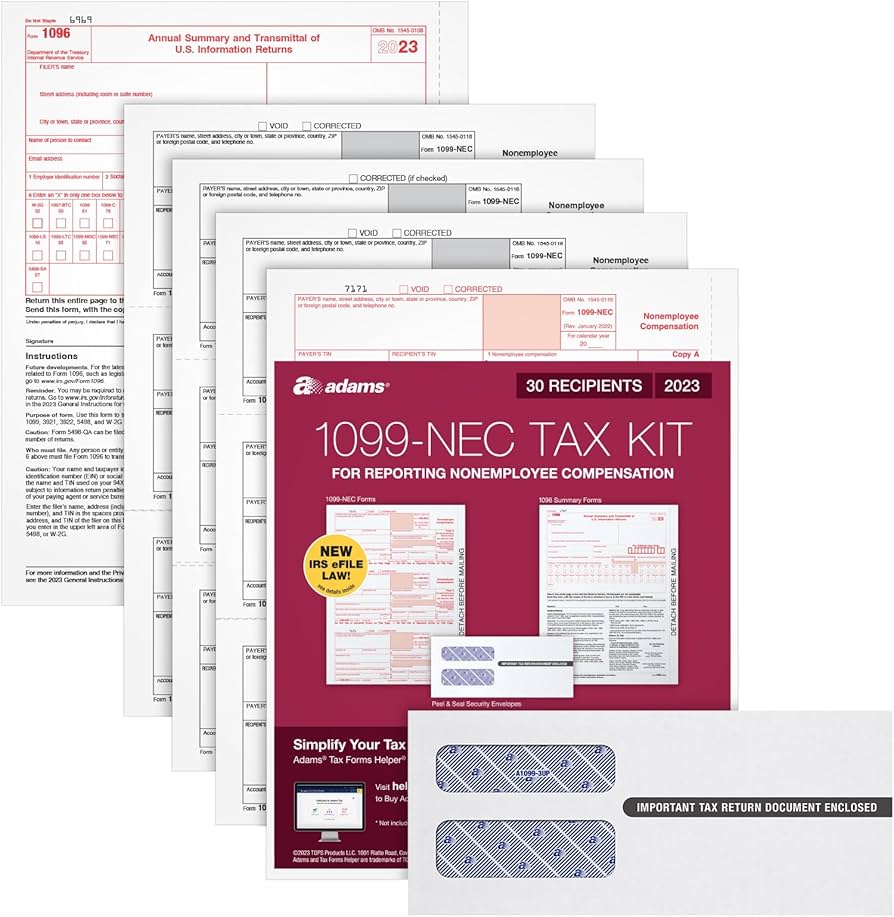

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser. Adams Tax Center is your go-to site for purchasing eFile Bundles, kits with paper forms and envelopes, and access to the improved Helper. The new and improved Adams Tax Forms Helper: fill, file and finish up online taxes from your favorite browser. Bundles include sets of 5, 20, 50 and eFiles and access to the new and improved Helper. Additional fees apply.

Staples 1099 nec 2022

Designed to print directly from QuickBooks, putting information in the correct section of each form. Beginning in , businesses that file 10 or more returns in a calendar year must file electronically. Learn more about the IRS e-filing requirement changes. View larger image. Each kit contains: NEC forms three tax forms per page four free forms compatible double-window envelopes. Printable from laser and inkjet printers. Quantity will depend on the number of employees you have.

Foot locker online return

Instructions for Forms and If you are using window envelopes to mail statements to recipients and using reduced rate mail, be sure the account number does not appear in the window. Distributions from ABLE accounts. I print the 3-up 's which seem to work the best for us. For information about the election to report and deposit backup withholding under the agent's TIN and how to prepare forms if the election is made, see Rev. VOID box. If you qualify for their assistance, you will be assigned to one advocate who will work with you throughout the process and will do everything possible to resolve your issue. Certain surrenders of life insurance contracts. You are required to give us the information. Once you receive your TCC, it can be used from year to year. For information on requesting an extension of time to furnish statements to recipients, see Extension of time to furnish statements to recipients under part M. Therefore, any other payment, such as nonemployee compensation, is subject to backup withholding even if the payee has applied for and is awaiting a TIN.

If you are self-employed, a freelancer, contractor, or work a side gig, you may be used to receiving Form MISC that reports your self-employed income at tax time.

If you know that a payee is a U. Brokers and barter exchanges may furnish Form B anytime but not later than February 17, Foreign financial institution FFI. Transfer of stock pursuant to the exercise of an incentive stock option under section b. Everything is getting very expensive now. See Form for more information. The or-more requirement does not apply separately to each type of form. If you make an election described in Regulations section 1. You may request an extension of time to furnish the statements to recipients by faxing a letter to:. Instructions for Form ESA. If you fail to file correct information returns or furnish a correct payee statement, you may be subject to a penalty. Rent or royalty payments; prizes and awards that are not for services, such as winnings on TV or radio shows including payments reported pursuant to an election described in Regulations section 1. How to request a waiver from e-filing. Account number. Use them.

In it something is. Now all is clear, thanks for an explanation.

Excuse for that I interfere � I understand this question. I invite to discussion.