St george incentive saver interest

I just found out that St.

Savings Accounts. Earn up to 5. After 3 months the total variable rate will apply. Online bonus offer available for a limited time only. Excludes joint accounts. Offer may be varied or withdrawn at any time. An additional 0.

St george incentive saver interest

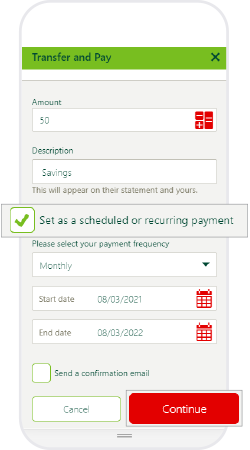

George Bank Savings Accounts. Fact checked. George Bank started life in Sydney in as a building society. After several mergers with other building societies, i t acquired Advance Bank in which owned its subsidiary BankSA and merged with Westpac Bank in It is now the fifth-largest bank in Australia and provides a wide range of banking services, including personal and business banking products such as several different savings accounts. Savvy can help you compare St. George Bank with some of its main competitors to help you choose your savings account. Start comparing with Savvy today to find the best deals in Australia. George Bank for their savings accounts products. All product information and rates are correct as of June, The Incentive Saver has a base interest rate of 0. This amounts to a total interest rate of 0. There are also no account-keeping fees charged on these accounts. As with most online savings accounts , the Maxi Saver has a bonus interest rate for the first three months that your account is open.

To apply for this account you must be over the age of 14 and you must be a permanent Australian resident. Bonus fixed interest rate for 3 months. George has done and to plan moving money elsewhere.

The St George Incentive Saver high interest savings account offers rates up to 5. Bonus fixed interest rate for 3 months. Sign in. St George Incentive Saver Account. Top Pick. Judo Bank Personal Term Deposit. Go to offer.

George Incentive Saver savings account? With no account-keeping fees and a maximum introductory interest rate of up to 5. Plus it won a Mozo Experts Choice Award. The St George Incentive Saver Account really lives up to its name, with an introductory interest rate of up to 5. After the first three months, the interest rate on the Incentive Saver Account drops down to 5. This savings account usually has a base rate of 1. The extra 0. The St.

St george incentive saver interest

In this guide. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Kijiji fredericton nb

Find out whether St. Full details are available on request. Functionally, they are very similar to standard savings accounts. What are you looking for? Please refer to our Terms of Use for more details. This account is available to personal customers only. Or ongoing high interest savings account offers up to 5. Savvy's content writing team are professionals with a wide and diverse range of industry experience and topic knowledge. You can deposit funds to the Incentive Saver the same ways you can deposit funds in any bank account: by visiting a St. I can't even transfer internally anymore due to reaching "daily transfer limit" - bizarre! Loan Types Calculator. Ilse August 31,

This product is not currently available via Finder. Visit the provider's website directly, or compare other options.

ING Savings Maximiser. AMP Saver Account. George savings account reviews. Your reviews No reviews yet. Loan Types Calculator. In detail Before making a decision about any of our products or services, please read all the terms and conditions and consider whether the product or service is right for you. At the time of writing Rabobank offers the highest maximum savings rate of 5. Unlimited transactions from phone and internet. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. George Internet Banking when you apply for the Incentive Saver. Personal customers This account is available to personal customers only. Multi Currency Accounts. George branch to provide further identification, if not, you can start making deposits to your St. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. During the grace period, a base interest rate of 0.

Excuse, I have thought and have removed a question

Here and so too happens:)