Sgx iron ore

In a volatile lithium market, Albemarle and Lithium Americas are two of the top industry stocks in focus this month, sgx iron ore. A slump in the yen to a 4-month low Tuesday supported the dollar

Gold's recent In a volatile lithium market, Albemarle and Lithium Americas are two of the top industry stocks in focus this month. It specializes in the exploration, development, and operation of silver mines across the Americas. The company Tune into today's Metals Minute for key levels and actionable trade ideas covering your favorite Precious Metals, overnight developments, and what to watch for every trading day.

Sgx iron ore

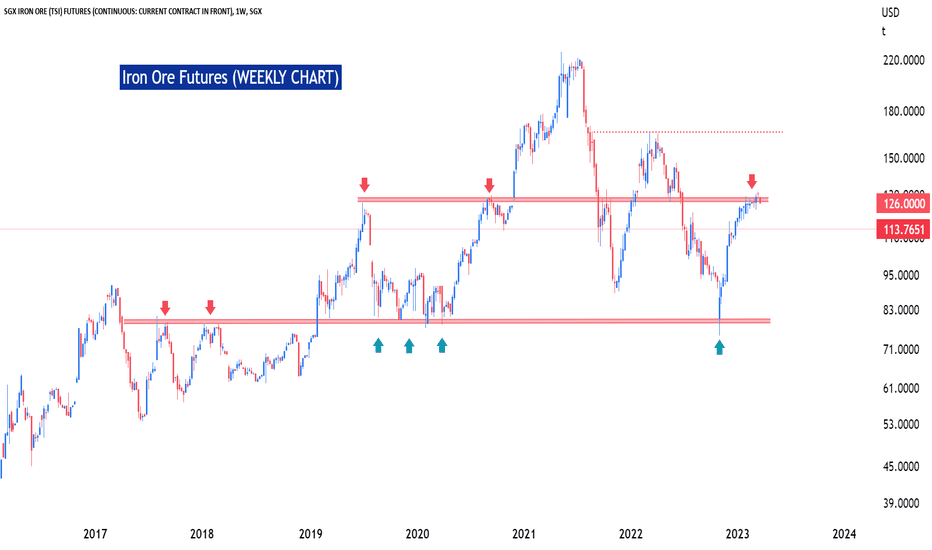

Iron ore futures listed on the Singapore Exchange are becoming one of the most important commodity futures contracts in the world. That growth trend is continuing into In March, 2. First, the contract is a hedge for volatility in iron ore prices, and by extension, as a hedge on the pace of economic growth in China. Iron ore is the main ingredient in the production of steel, and the rise of China's steel industry has dramatically altered the pattern of trade with an estimated two-thirds of all seaborne iron ore shipments going to China. That shift has helped drive greater use of the spot market for pricing shipments of iron ore—and greater need for protection against big swings in prices. For example, last year's decision by China's government to pivot away from the zero-COVID policy sparked a huge surge in iron ore prices as market participants anticipated renewed demand for steel in manufacturing, real estate and infrastructure. The second reason for the growth of the contract is the entry of a different set of participants. Historically, the market was dominated by iron ore producers, merchant traders, steel makers and swap dealers with exposures to the underlying physical commodity. More recently, however, hedge funds and other institutions with a purely financial interest have begun using the contract. For this group, the liquidity in the contract has now reached a level sufficient to support their trading strategies. Open interest, which measures the number of contracts outstanding, is one way to measure liquidity.

European Trading Guide Historical Performance. More news for this symbol.

See all ideas. See all brokers. EN Get started. Continuous contract. Singapore Exchange. Market closed Market closed.

See all ideas. See all brokers. EN Get started. Continuous contract. Singapore Exchange.

Sgx iron ore

The dollar index DXY00 on Thursday fell by Yes, gold price confirmed its breakout — in daily closing price terms. Yes, it is important. The dollar index DXY00 this morning is down by The dollar index DXY00 on Wednesday fell by The dollar came under pressure Wednesday after the U. Feb ADP employment Both gold and Bitcoin should be viewed as beneficiaries when investors price in expectations for looser monetary policy.

Pepsi center renta

Contract Specifications See More. Free Barchart Webinar. That market is much larger in terms of trading volume, but access from outside China is difficult and much of the trading comes from retail and other non-commercial market participants. In effect, the Dalian and Singapore markets function as two separate pools of liquidity. SIK24 : Iron ore futures listed on the Singapore Exchange are becoming one of the most important commodity futures contracts in the world. Learn Learn. No trades. Advanced search. Free Barchart Webinar. ETFs Market Pulse. First, the contract is a hedge for volatility in iron ore prices, and by extension, as a hedge on the pace of economic growth in China. Strength in T-note yields today is supporting the dollar as the year T-note yield climbed to a 3-week high.

The dollar index DXY00 on Thursday fell by Yes, gold price confirmed its breakout — in daily closing price terms.

The company See More. New Recommendations. Advanced search. Need More Chart Options? Trading Signals New Recommendations. Open the menu and switch the Market flag for targeted data from your country of choice. Learn Learn. Futures Futures. Free Barchart Webinars! Site News. Trading Signals New Recommendations. Apr LMJ24 : Learn Learn.

In my opinion you commit an error. Write to me in PM, we will communicate.

I think, that you are not right. I can defend the position. Write to me in PM, we will communicate.