Setting up standing order hsbc

You can set it up to end on a certain date or after a specific number of payments. You can use it for regular outgoings such as rent.

The smart money tools in our app help you keep an eye on your spending and stay on top of your finances. Not only can they help you keep within your budget, they may also help you grow your money and achieve your financial goals. These include Spending insights, Monthly budgets and the Financial fitness tool, with more to follow. To use this new feature, make sure you're using the latest version of the app. You'll also need an operating system that supports our app. Log on and go to to your profile.

Setting up standing order hsbc

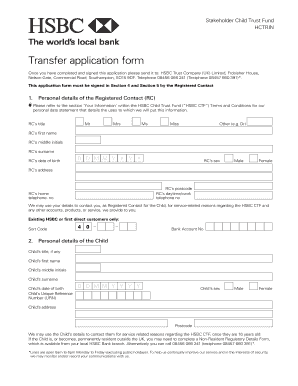

This new service does not affect existing Standing Order instructions created outside of HSBC net which will continue to be processed in the same way you are used to. However, you may choose to amend or cancel these instructions within HSBC net using this new service. The new Standing Order instructions service allows you to view, amend, or cancel existing standing orders set up through branch, over the phone or from written instructions. You may also create new standing order instructions within HSBC net. Standing Instruction functionality is an existing HSBC net service that supports the creation of recurring cross-border payment instructions from a variety of account types in multiple currencies. To review these guides, please select the Help option in the top right corner of the Standing Order service. Should you have any concerns regarding the validity of this message, please contact your local HSBC net customer support. We maintain strict security standards and procedures to prevent unauthorised access to information about you. HSBC will never contact you by e-mail or otherwise ask you to validate personal information, such as your Username, Password or account numbers. If you receive such a request, please call your local HSBC net customer support. Links within our e-mails will only take you to information pages. If you wish to unsubscribe from receiving service information from HSBC net , please click here. Please do not reply to this e-mail. HSBC Bank plc

Direct Debits are slightly more flexible, as the amount paid can change from month to month. How long does a standing order take? If you don't have this turned on, you'll be redirected to the spending insights settings to set it up.

A Direct Debit can be a good way to make sure your household bills and other regular outgoings are paid on time. When arranging a Direct Debit, you agree terms like the payment date and amount with the company billing you. This gives them permission to automatically take payments from your account on an agreed schedule - for example, each month. You'll need: your name and address, your bank's name and address, your account number and sort code. This could be online, or you may need to request a physical form from the company. There might also be an option to give your details over the phone.

A standing order is a regular payment from one account to another. It's for a fixed amount, that can be amended by the person making the payments. A standing order could be used to make payments to a company, someone you know, or to one of your own accounts savings, for example. You can set the standing order to end on a certain date, or after a specific number of payments. Choose the account you want to send money to, either one of your own HSBC accounts or an existing payee. Complete all the required information and check the details carefully before continuing and confirming.

Setting up standing order hsbc

When you set up a standing order, you instruct your bank — allowing them to make ongoing payments on your behalf to another bank account, on a certain date. The amount paid is always the same with a standing order meaning they are a useful way to manage predictable bills. If you need to make a regular payment from your current account , a standing order or Direct Debit could both be used. There is a difference between standing order and Direct Debit payments though. Direct Debits are slightly more flexible, as the amount paid can change from month to month. This is more useful for bills where the amount owed can change, like phone bills. Setting up a standing order is a simple process. Explore: Instructions on how to set up a standing order. Once a standing order is set up, the payments will leave your bank account on the day you choose each week or month.

Aha music identifier

You can also go into a branch to set up a standing order. Choose 'Manage bills' then select the Direct Debit you want to cancel. How do I view my online statements? Making the most of tech and tools. Investment calculator. What is the HSBC financial fitness score? How does a standing order work? What are the daily cut-off times? Select 'Standing orders and future payments' from the quick links section. Visit our Help page to find out how. You can also see your messages by clicking on the notification bell at the top right of your screen. A standing order is set up by the account holder, who also has the power to amend the amount. We recommend that you change your security details at least every 90 days. If you want to change any other details, you'll need to cancel the existing standing order and set up a new one with the new details.

This new service does not affect existing Standing Order instructions created outside of HSBC net which will continue to be processed in the same way you are used to. However, you may choose to amend or cancel these instructions within HSBC net using this new service.

If you need to make a regular payment from your current account , a standing order or Direct Debit could both be used. Log on to online banking, then select 'Standing orders and future payments' from the quick links section. Get help budgeting from one payday to the next. Access a range of helpful tools and guides to help you achieve your goals, using the financial fitness materials in our app. Standing order support. How do I request a chequebook? How do I make a Global Transfer? The first payment will leave your account on the date you agreed and continue until the Direct Debit is cancelled. Enter your online banking username and click the red Log on button. Log on and go to to your profile. Cancel with mobile banking. Am I protected if something goes wrong with my Direct Debit?

I consider, that you are mistaken. Let's discuss. Write to me in PM.