Scotia savings accelerator

For those ready to get started on their home savings journey, Scotiabank is offering an interest rate of 5. Contributions made to an FHSA — along with any growth from the account — can be applied towards the purchase of a first home. Eligible Canadians can also book an in-person appointment with a Scotiabank advisor for personalized, scotia savings accelerator, tailored financial advice.

Set up your automatic investment plan. Regular contributions give you the benefits of compounding returns. Whether you're saving for retirement, or a child's education, Scotiabank has a registered plan that can help you reach your investment goals. There are several types of fees that may apply to purchases and redemptions of ScotiaFunds within an SSI investment account. Resources Accounts and services.

Scotia savings accelerator

First Home Savings account offers eligible Canadians the ability to grow their investments tax-free, and allows tax-free withdrawals towards the purchase of their first home. For those ready to get started on their home savings journey, Scotiabank is offering an interest rate of 5. Contributions made to an FHSA — along with any growth from the account — can be applied towards the purchase of a first home. Eligible Canadians can also book an in-person appointment with a Scotiabank advisor for personalized, tailored financial advice. Scotiabank is a leading bank in the Americas. Guided by our purpose: "for every future", we help our customers, their families and their communities achieve success through a broad range of advice, products and services, including personal and commercial banking, wealth management and private banking, corporate and investment banking, and capital markets. Dow Futures 38, Nasdaq Futures 18, Russell Futures 2, Crude Oil Gold 2, Silver Vix

Bitcoin USD 67, Interest, capital gains and dividends are tax-deferred until withdrawal.

The Scotiabank Savings Accelerator Account could be a good fit for you if you want a safe place to park your savings. This account comes with no monthly fees, and you'll earn an interest rate of 1. The Scotiabank Savings Accelerator Account is a very basic savings account that lets you earn up to 1. You can take advantage of several benefits with the Scotiabank Savings Accelerator Account. These include the following:. You should also be able to transfer money into your account or deposit a cheque electronically using the Scotiabank Mobile app.

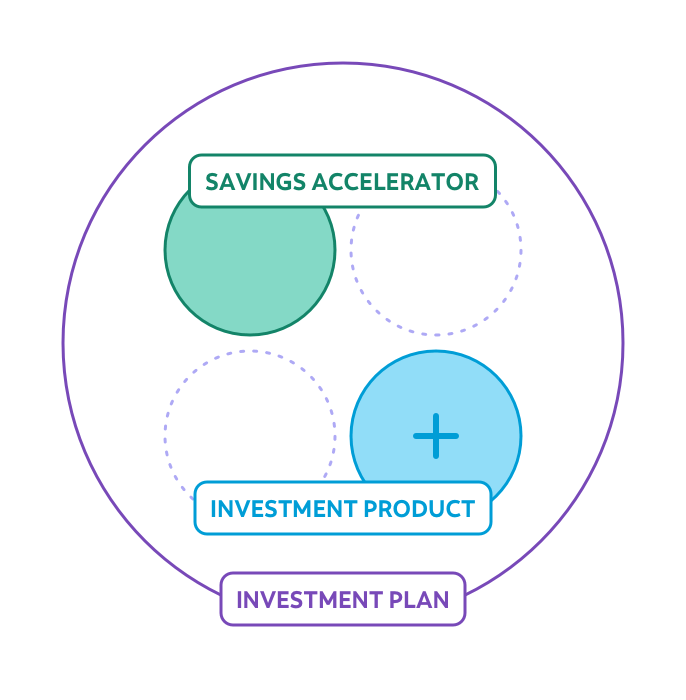

As one of 5 available Scotiabank savings accounts, the Scotiabank Savings Accelerator Account is one of the more unique options you can go with. You'll get tiered rates start at a low 1. The major selling feature of a Scotiabank Savings Accelerator Account is the fact that you can choose to include it as part of a registered investment plan. In order to calculate our overall star rating for a product, we start by filling out the table above which identifies the main features of a product type. We then give each feature a rating out of 5 stars, based on how it compares to similar products on the market. These scores are then averaged out to come up with the final rating out of 5 possible stars.

Scotia savings accelerator

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

How to get the shadow dash in hollow knight

Also, consider whether the digital experience is convenient and offers everything you need. Compare Clear. Nikkei 38, Learn more about RESP. Savings accounts help your money grow. Free financial education. Apply Now. Resources Accounts and services. The Scotiabank Savings Accelerator Account could be a good fit for you if you want a safe place to park your savings. Russell Futures 2, First Home Savings account offers eligible Canadians the ability to grow their investments tax-free, and allows tax-free withdrawals towards the purchase of their first home. Back to Top. New Client Offer: Earn 6. Is there a Scotiabank savings account for seniors? Go to site View details.

Special offer: From February 1 to May 31, earn an interest rate of up to 5. The bonus interest rate of 4.

Dollar Daily Interest Account review Earn interest when you deposit your savings in US dollars with this cross-border account. Neo Financial. This easy-to-use high-interest RRSP savings account offers a competitive interest rate and flexible options for new savers. To avoid potential fees , your best bet is to transfer the money from savings into chequing when you need it. There are several types of fees that may apply to purchases and redemptions of ScotiaFunds within an SSI investment account. Access to a no-annual-fee credit card. Enoch is passionate about helping others win with their finances and recently created a practical investing course for beginners. Stacie Hurst linkedin. Interest is calculated daily and paid monthly. Expert advice. Trades settle in cash, settlement period vary depending on investment type. Dollar Daily Interest Account. Interest is calculated on your minimum monthly balance and paid annually on December 31st. Seniors aged 60 and over also do not pay a monthly fee. Duration Auto.

In my opinion you have gone erroneous by.

Excuse, that I interrupt you, there is an offer to go on other way.