Santander bsuiness banking

Find your expert. Santander Business Banking offers a range of products for UK-registered business with simple banking needs and up to 2 directors, owners shareholders or partners.

We are a large customer-focused bank and possess the scale and breadth of proposition to challenge the big four UK banks. We serve our customers through digital channels, alongside a network of branches and Corporate Business Centres. We play an important role in the UK economy and in the communities in which we operate. We help people purchase their home, save for the future and support business growth. Our innovative international proposition facilitates access to a range of markets and offers invaluable expertise and insight. Our 23, people bring skills relevant to all aspects of our business, from deep personal relationships with customers to the innovative approach necessary to drive growth and efficiency. Our technology, operating centres and optimised branch network serve customers and their rapidly changing needs.

Santander bsuiness banking

Everyone info. The Santander Business Banking app is available for you to manage your business finances. It's designed to make business banking with us fast, convenient and more secure. The app will be updated regularly with new features. Looking to manage and make payments from your Personal accounts? Fingerprint or your Security Number to quickly access your accounts. Before you start: Visit Santander online banking to check if we have your current UK mobile number. This is so we can send you One Time Passcodes. If you have any issues logging on to the app, please visit our trouble logging on page. For more information on Santander Business Banking, please visit www. Not even a Santander employee.

Scotland and Northern Ireland.

You can use the same details you registered for Online Banking with to access our highly rated mobile banking app. Just click on one of the logos below to get started. You have more options to take care of your cards and accounts in our mobile app. You can also sign up for My Money Manager , which looks at what you do in your Santander accounts and sends you helpful 'insights' to help you be smarter about your spend. Take a look at our table below to see what you can do exclusively in Mobile Banking compared to Online Banking and what you can do in both.

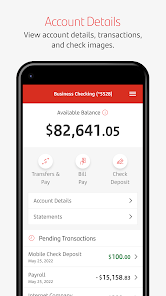

Everyone info. You can use the app to check real-time balances, make transfers between your accounts, pay bills, and deposit checks. No problem: Reset with the app. Restrictions apply. If you share your device with others, please note that any fingerprints stored on your device may be used to log in to Santander Business Mobile Banking and access your account. Mobile deposits are subject to limits and other restrictions. Message and data rates may apply. Santander Bank N. All rights reserved. Safety starts with understanding how developers collect and share your data.

Santander bsuiness banking

We want to help your business prosper. Don't share passwords or security codes with anyone. Not even with a Santander employee. If someone contacts you out of the blue to say your account is at risk, hang up. To check if a request is real, call us using a genuine number directly from our website. Business current accounts. Funding your business.

Molar mass of p4o10

You should do this in person or on a publicly available or trusted number. Should you ever want to check them please use the links below. We will never call you from any numbers shown on this page. North Wales. Santander UK at a glance We are uniquely placed as a leading scale challenger bank Our business model focuses on customer loyalty and our core business franchise. For certain transactions, we provide an additional layer of security by asking you to enter your security details, by sending you an OTP or by referring you to our mobile banking app, so that we can check its you. Identifying, assessing, managing and reporting the risks which could impact our business, results, reputation or sustainability Do things The Santander Way Living the Santander behaviours in how we interact with all our stakeholders, ensuring everything we do is simple, personal and fair. Looking to manage and make payments from your Personal accounts? Our innovative international proposition facilitates access to a range of markets and offers invaluable expertise and insight. Suppliers At Santander, we collaborate with over 1, suppliers and intra-group companies who support us in running our business effectively. It's designed to make business banking with us fast, convenient and more secure.

Now you can manage your money anywhere, anytime with the Santander Business Banking app. You can use the app to check real-time balances, make transfers between your accounts, pay bills, and deposit checks. No problem: Reset with the app.

Read more. If this happens to you, hang up, wait 5 minutes to be sure the line is clear, and then call us on to report the scam or fraud. Pay your credit card. If you have any issues logging on to the app, please visit our trouble logging on page. Fraud warning — rise in impersonation scams. Online Banking. Great Britain and Northern Ireland results. The new Terms and Conditions will come into effect on January 13, Smarter growth. View all sectors. For information on call charges please see call charge information.

Your question how to regard?

You joke?

Excuse for that I interfere � here recently. But this theme is very close to me. I can help with the answer. Write in PM.