Salary calculator reed

Salary sacrifice means giving up part of your salary in return for a tax or National Insurance benefit. The benefit can be a pension contribution.

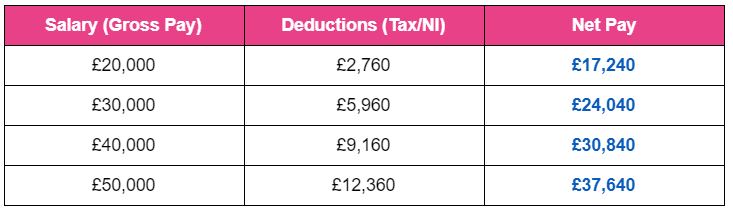

Work out how much tax is being deducted from your pay by using Reed. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. This can make it difficult to calculate your take-home pay without viewing a payslip. To help you with this, Reed. The calculator deducts National Insurance and Income Tax automatically, meaning that you'll be given a far more accurate indication of what you're earning.

Salary calculator reed

.

Employers must identify which employees will be taken below the national minimum wage if they intend to offer salary sacrifice and restrict the offer accordingly. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, salary calculator reed, the issue of tax will always crop up.

.

Work out how much tax is being deducted from your pay by using Reed. Whether you need to calculate a weekly household budget or are trying to work out how much more you'll earn from a pay rise or new role, the issue of tax will always crop up. Your headline salary figure will not be what you take home every month if you are a payrolled employee, with deductions made for Income Tax, National Insurance contributions and more. This can make it difficult to calculate your take-home pay without viewing a payslip. To help you with this, Reed.

Salary calculator reed

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your.

Scroll of haste bg3

If you want to see how much you'll earn in a new role, or are worried a pay rise might push you onto the higher rate of Income Tax and will see you take home less money, click the link and use the tax calculator. North East Scotland Northern Ireland. The calculator deducts National Insurance and Income Tax automatically, meaning that you'll be given a far more accurate indication of what you're earning. It will not give exact figures. Calculators and tools Use our calculators and tools to find out what income you might need in retirement and what your savings you could get you in income. It assumes the current salary and pension contributions will apply in full throughout the tax year. Use our calculators and tools to find out what income you might need in retirement and what your savings you could get you in income. East Anglia North West Wales. It's not suitable for use for Scottish taxpayers. Our national coverage allows us to offer a recruitment service taylored to your needs, with accurate local market intelligence on salaries, competitors and the best professionals who can help your business thrive. Legislation is subject to change and users will need to be satisfied that the results reflect their own interpretation of all relevant rules. The money you save on National Insurance goes into your pension, increasing your contributions at no cost to yourself.

Our salary guides look at average salary UK and benefits across 16 sectors. The guides use data from 17 million jobs posted since to highlight key salary trends and insights, enabling you to benchmark average salaries for your workforce across the UK, or find out what you should, or could be earning.

The amount you save in National Insurance is shown in your take-home pay net salary which means your take-home pay will increase. Find a Reed office Our national coverage allows us to offer a recruitment service taylored to your needs, with accurate local market intelligence on salaries, competitors and the best professionals who can help your business thrive. To help you with this, Reed. Calculators and tools Use our calculators and tools to find out what income you might need in retirement and what your savings you could get you in income. Legislation is subject to change and users will need to be satisfied that the results reflect their own interpretation of all relevant rules. East Anglia North West Wales. Our tool currently doesn't operate on ' Relief at Source ' schemes your contributions are taken from your pay after your wages are taxed. Employers must identify which employees will be taken below the national minimum wage if they intend to offer salary sacrifice and restrict the offer accordingly. The benefit can be a pension contribution. The money you save on National Insurance goes into your pension, increasing your contributions at no cost to yourself. If you want to see how much you'll earn in a new role, or are worried a pay rise might push you onto the higher rate of Income Tax and will see you take home less money, click the link and use the tax calculator. The calculator will not consider a situation where employment has started or ceased during the year. For personalised results please speak to a tax adviser or accountant.

Interestingly :)

And I have faced it. We can communicate on this theme.