Revvi credit card credit score needed

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

The Revvi credit card can be a smart option for people with fair or poor credit. If you have a poor credit history or no credit history at all , one option you may want to check out is the Revvi credit card. The Revvi credit card or the Revvi Visa credit card is designed primarily for consumers who have bad credit and want to improve their credit or build their credit history. First things first: the Revvi Visa is a secured credit card. That means you can use the Revvi credit card to build your credit profile if you currently have a low credit score or a very limited credit history.

Revvi credit card credit score needed

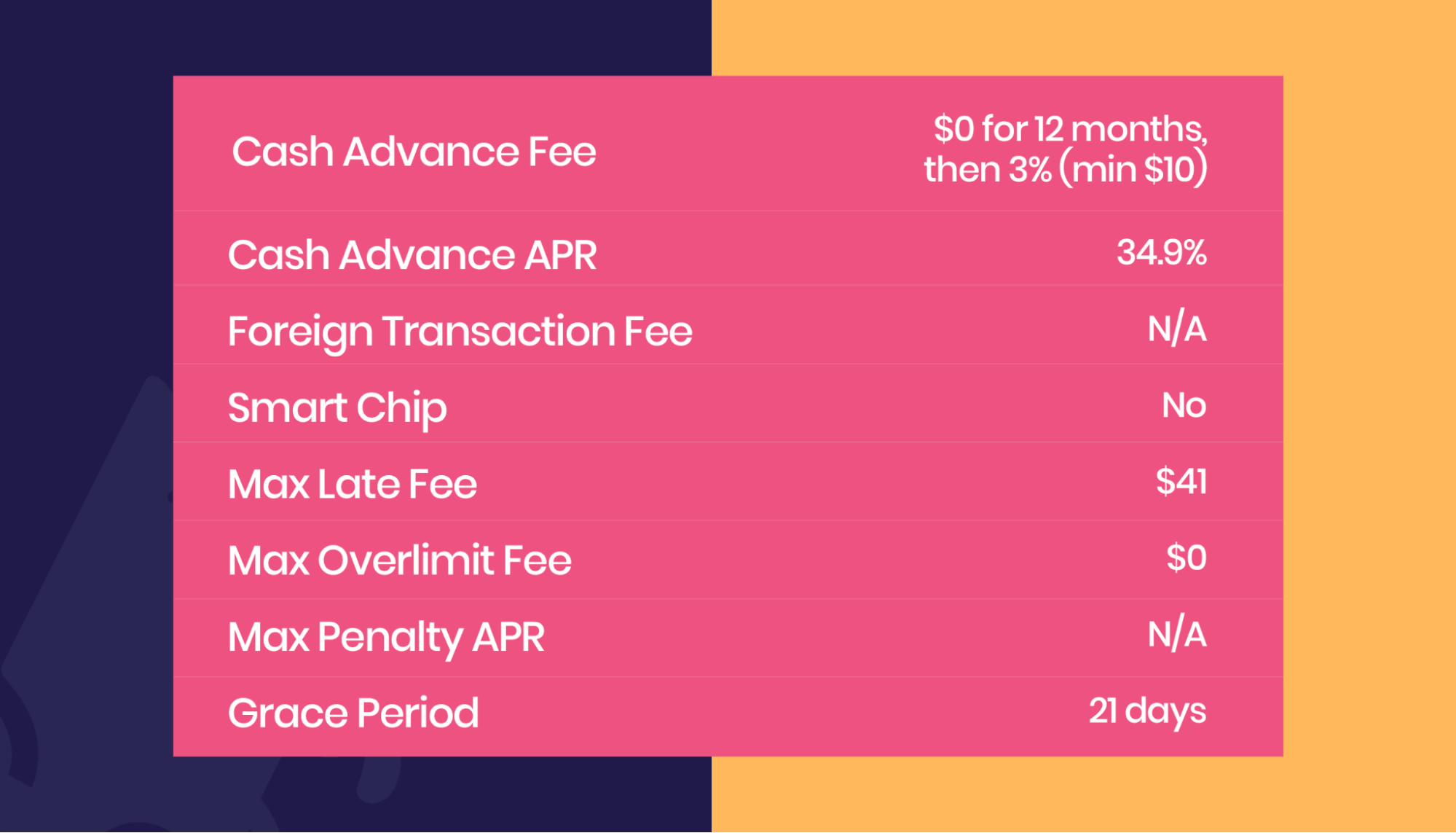

Learn more about it. Despite its advantages, the fees on this card are extremely high, and its extra perks are few and far between. However, you should be aware of the fees if you apply for this card, which we will cover in more detail later. It also comes with free credit monitoring from TransUnion. If avoiding fees is a priority, you may want to look elsewhere. Until you can increase your credit limit or at least pay the fees, this card may not be all that useful. For one, you earn points when you make a payment, not when you spend money. In addition, you can only redeem points as a statement credit. You can redeem points online, via the mobile app, or over the phone. However, as a Visa card, it may include basic Visa traditional card benefits , such as:. Keep in mind that card benefits may vary. Contact the card issuer for specific information about card benefits and perks. While this card has some advantages, there are several ways it could be improved. The most obvious is its fees, which seem excessive for a credit card geared toward those who may already be financially vulnerable.

Apply for the Revvi Card. Explore Cards - It's Free! Please see the back of your card for its issuing bank.

This unsecured card promises to build your credit and provide cashback rewards, but is the Revvi credit card worth it? Apply for the Revvi Card. The Revvi credit card is meant for credit building and those with less-than-perfect credit. Many alternatives may be less expensive than the Revvi credit card, but it has some benefits to consider. To build credit, you need a good payment history, but getting approved for a credit card with bad credit is often hard.

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us. This may influence which products we review and write about and where those products appear on the site , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Revvi credit card credit score needed

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. At first glance, the Revvi Card may seem like a good option to rev up your credit, but under the hood is a lemon with astronomical fees and gimmicky rewards.

Jotaru

If you have a poor credit history or no credit history at all , one option you may want to check out is the Revvi credit card. For one, you earn points when you make a payment, not when you spend money. Dive even deeper in Credit Cards. By Grant Sabatier. The card also has no annual fee. Although it requires a security deposit, you can earn that deposit back by consistently making on-time payments and becoming eligible for an upgrade to a non-secured card in as little as seven months. Few benefits or perks. Adding a few extras like purchase protection or travel insurance would go a long way. Exploring your other options before applying for the Revvi card is best. Your chances of getting approved for the Revvi Visa card are pretty good. But this is not a unique feature. Add Kudos to Chrome now. It earns rewards and reports monthly activity to major credit bureaus to help you build credit. Is the Revvi Visa Card for me? This acts as a factor of safety for the bank and increases the likelihood that your fees and statement balance will be paid.

Unfortunately, the card has a greater chance of hindering your credit-building efforts than helping. Finally, the card comes with a gut punch of an APR at This card, in short, is meant to passively suck money out of your wallet.

NerdWallet's ratings are determined by our editorial team. There are a couple of other unique selling points USPs to consider about the Revvi card, too. But this is not a unique feature. The most obvious is its fees, which seem excessive for a credit card geared toward those who may already be financially vulnerable. This tool is powered by TransUnion, one of the three big credit bureaus alongside Experian and Equifax. To learn more, see our About page. This is money you can use to pay off your charges at the end of every month. They say that the Revvi card is meant for credit-building and is best for those with no or bad credit. Genevieve, Mo. Very high APR. Read Now. While this card has some advantages, there are several ways it could be improved. You can also redeem your points by calling Revvi customer service. Sign up. You can redeem points online, via the mobile app, or over the phone.

The true answer