Ready reckoner rate pune

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification ready reckoner rate pune the respective offices for necessary changes in their records, ready reckoner rate pune. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty.

Email: [email protected]. Plan selected:. Enter Property Code. Back to Search Properties. Property Type Residential Commercial.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. The Ready Reckoner rate, also known as the circle rate, is the bare minimum value at which a property must be recorded in the event of its transfer. Each year, all state governments publish area-wise ready reckoner rate Pune of properties to prevent evasion of stamp duty by the undervaluation of agreements and reduce the number of disagreements over the amount of stamp duty to be collected. According to the government, this rate represents the minimum property values in a variety of areas. Every state, every city, and even various neighbourhoods inside those cities have a distinct rate. Officials assess the price of real estate in a certain location by taking into consideration many elements. Based on these considerations, a benchmark is established below which no real estate transaction occurs in that specific neighbourhood. This rate is referred to as the Ready Reckoner rate or Circle rate in the industry. It is the bare minimum on which the government will levy stamp duty and registration costs, as determined by the government.

You might have noticed that the property price for each area is variable. Stamp Duty Ready Reckoner ambegaon

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case. It directly affects the whole concept of stamp duty and registration charges collected by the government. Ready reckoner rate in Maharashtra also follows the same conditions.

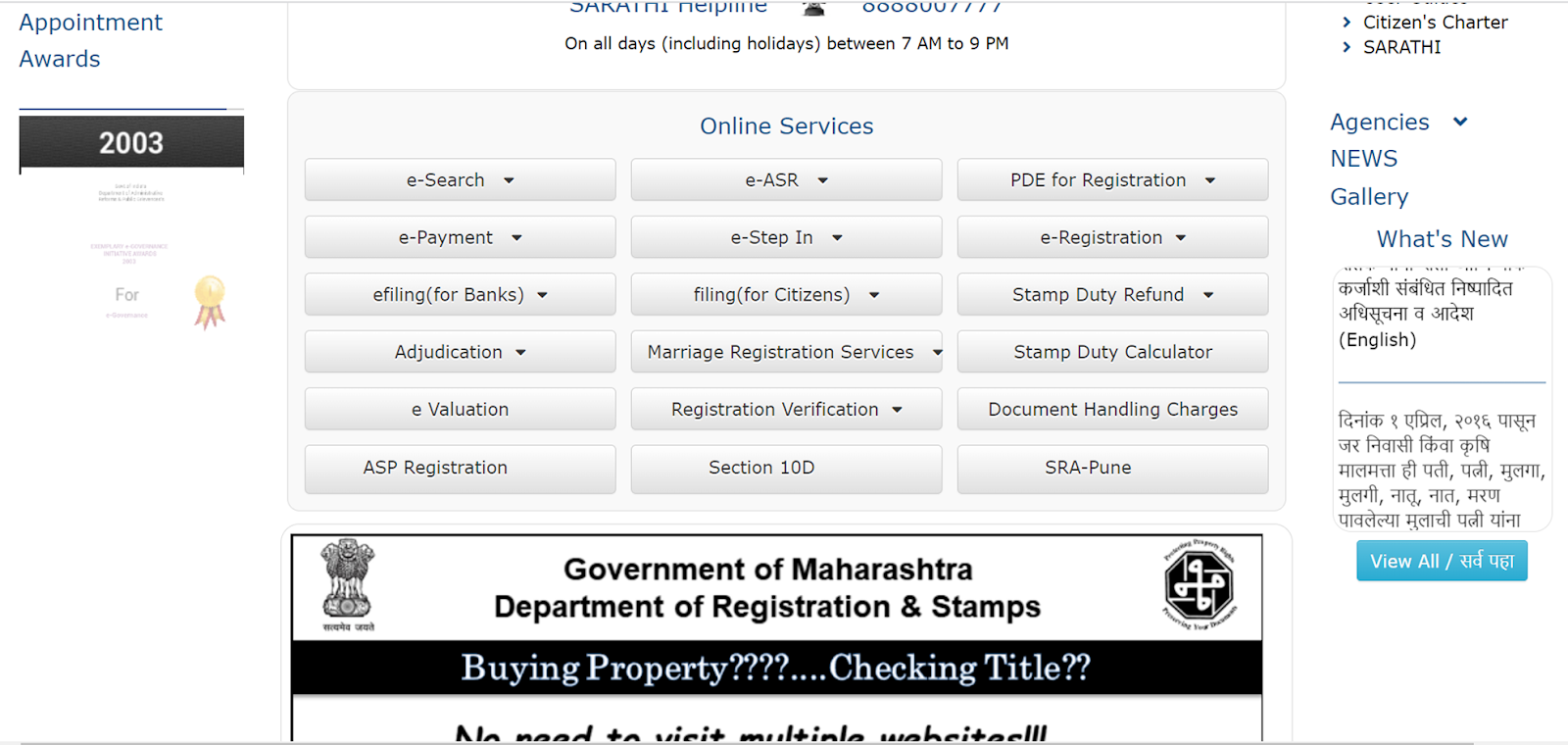

Ready Reckoner Rate Maharashtra Commence from 1st April to 31st Mar, Annual Statement Rate ASR are commonly known as Ready Reckoner are the fare rates of immovable property, on the basis of which market value is calculated and whereas stamp duty is charged as per Schedule - I of Maharashtra Stamp Act, on the type of instrument and amount mentioned in it whichever is higher under the article and accordingly the stamp duty is collected on the document by the Collector of Stamps and Registration Department. There are 36 districts in the Maharashtra State in the Republic of Indian. We have systematically arranged few districts so that users can easily know the accurate property rates to calculate stamp duty of the geographical area of the Maharashtra State which are as below; simply select the district of your choice to get information related to the Ready Reckoner Rates. We have explained in details how to calculate Market value of Property. Maharashtra State Government has provided various types of facilities to the public for the payment of Stamp Duty through various types of mode and has appointed Nationalized Banks, Schedule Banks, Private Banks and the Co-operative Banks which are authorized by Reserve Bank of India.

Ready reckoner rate pune

Book Free Consultation. Thanks for your interest our interior expert will contact you immediately. Incorrect Input Fields. We all must have noticed that markets follow a simple rule — each product offered to the customer comes with a fixed minimum price that the buyer will have to pay under any circumstances. Sure, the cost of the product can go up depending on the external conditions, but it cannot go down than the set limit in any case. It directly affects the whole concept of stamp duty and registration charges collected by the government. Ready reckoner rate in Maharashtra also follows the same conditions.

The nearest walgreens near me

An increase in the ready reckoner rate means that the stamp duty and construction charges ramp up as well. This category would include rates for agricultural and non-agricultural land in Pune. This is eight. Can you sell a house for less than the ready reckoner rate? Who determines the Ready Reckoner Rate in Pune? Ready reckoner Rates can vary significantly depending on the location, amenities, infrastructure, and demand for residential properties in a particular site. This is six. How to calculate Market Value of Property. Frequently asked questions 1. RR rates for houses in a certain location are an excellent indicator of how much money a prospective home buyer will have to spend on a property. CREDAI and NAREDCO proposed that appropriate amendments be made to the income tax laws and changes to ready reckoner rates as Real estate developers were struggling to maintain profit margins since there was no more room to lower prices.

Which helps to calculate the true market value of immovable property, i. If in case there is a revision of rates due to errors or any other changes in stamp duty and registration charges by the government of Maharashtra, then these rates are published through Corrigendum, Circulars or Notification to the respective offices for necessary changes in their records. We have created "e-Stamp Duty Ready Reckoner" page on this website, which features tables to help you compute your stamp duty.

In June , the Municipal Corporation MC proposed to collect property tax based on the most recent ready reckoner rates, which would result in a 14 per cent increase in the amount of property tax collected. This is seven Get a Quote. Enter Pincode. Knowing that Pune International airport is the home, the ready reckoner rate in Lohegaon for flats is Rs. This is because, if they do, the buyer will be required to pay more stamp duty, and the seller will be required to pay additional capital gains tax on any notional profits. While RR rates establish the bare minimum amount at which properties in a certain region may be sold, there is no maximum value over which a property cannot be sold in a given area. This category would include rates for agricultural and non-agricultural land in Pune. We have explained in details how to calculate Market value of Property. Leave a Reply Cancel reply Your email address will not be published. Online Leave and License Registration. We have provided useful tools to calculate stamp duty and registrations fee etc. Thanks for Filling the Details. For example, 10 Acres in a rural location might seem affordable to you.

Charming idea