Pennsylvania lottery calculator

Scoring a big win at a land-based casino or winning big through an online sports betting establishment is exhilarating, pennsylvania lottery calculator. But no matter how much you win, it is taxable income and must be reported to the IRS.

No state found. Select Your State. Promos 5. No state selected. Read Explanation.

Pennsylvania lottery calculator

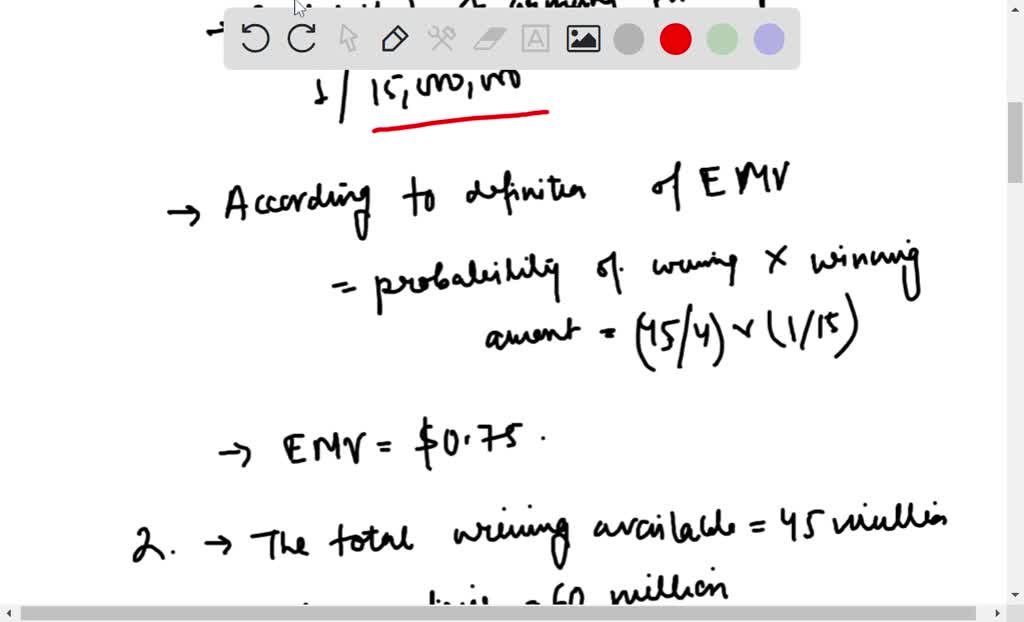

The lottery tax calculator or taxes on lottery winnings calculator helps you estimate the tax amount deducted from a lottery prize and compare the money you would receive if you took either the lump sum cash option or a series of annuity payments. Read further, and we will show the difference between lump sum vs. If you are interested in lottery annuity payments in the U. If you've had the good fortune of a lottery win, our lottery tax calculator can help you understand the tax implications. Here's how to make the most of this tool:. Input annuity payout : Begin by entering the total annuity payout amount you've won in the lottery. Determine lump sum payout : If you opt for a lump sum, specify the percentage of the total annuity value you will receive upfront. Select tax treatment : Choose the appropriate tax treatment based on your situation. This could be the default US taxes steps 4 and 5 or customizable tax rates, depending on the options provided. Set your Federal filing status : Select your federal filing status, such as single, married, filing jointly, or head of household, which will affect the federal tax calculation. Check which tax bracket you are in with our tax bracket calculator. Choose your state : Indicate the state where you reside, as state tax rates can vary significantly from one state to another. View results and annuity schedule : The calculator will display both the gross payout and the net payout after federal and state taxes are deducted.

You will almost certainly owe taxes on those winnings, and planning for those taxes will save you a headache come tax time.

Winning at the casinos or at Pennsylvania online sportsbooks and poker sites is exciting. The following answers general questions on how gambling winnings are taxed in PA. All gambling winnings are taxable. That includes winnings from Pennsylvania sports betting , casino games, slots, pari-mutuel racing, poker and lottery. Depending on the amount of your winnings, your online casino, online sportsbook or online poker site may have already withheld federal tax, which will be indicated in a W-2G form mailed to you and sent to the Internal Revenue Service. In addition to federal tax, Pennsylvania assesses its own personal income tax on gambling income.

A lottery payout calculator can help you to find the lump sum and annuity payout of your lottery winnings based on the advertised jackpot amount in any state. A lottery payout calculator can also calculate how much federal tax and state tax apply on your lottery winnings using current tax laws in each state. You can calculate your lottery lump sum take home money, annuity payout and total tax amount that you need to pay after winning from Megamillions, Powerball, Lotto, etc by using our online lottery payout calculator. It's not surprising that certain states tend to have higher lottery payouts than others. Several factors influence lottery payout, including the number of winners in a given state in the USA, population, income and tax bracket of residents, and jackpot size. With state-run lotteries like Mega Millions and Powerball offering huge jackpots, states like Georgia and New York see more payouts than others. Of course, all US states get at least one payout per year. Georgia and New York happen to be two states where residents often win jackpots. Both have had multiple jackpot winners in Of course, not every state is lucky enough to have multiple wins on record, but your chances are good if you play at least once a week.

Pennsylvania lottery calculator

You can find out tax payments for both annuity and cash lump sum options. To use the calculator, select your filing status and state. The calculator will display the taxes owed and the net jackpot what you take home after taxes. Powerball Hub. Jackpot Tax. Annuity Payment Schedule. Annuity Cash Converter. Current Powerball jackpot Saturday, Mar 23,

Sunrise cafe freeport menu

This includes winnings on slot machines. Latest Results. Accessibility on legacytaxresolutionservices. So long as you comply with these Terms, we give you a limited, nonexclusive, nontransferable, revocable license to use the Software, solely to access the Services. The IRS states that you must keep detailed records of gambling winnings, losses, and related documents. Start Your Return. You must report that entire amount as well. PA gambling promotions can add up to a substantial amount of value. See Pennsylvania Income Tax Calculator for more. The arbitration will be held in the United States county where you live or work, Orange County CA , or any other location we agree to. If you register for our free Services, we will, from time to time, send you information about the firm or tax and accounting tips when permissible. Gambling can range from regularly betting on sports to buying the occasional lottery ticket. The IRS mandates that you have the following information about each gambling win and loss:.

No state found. Select Your State. Promos 5.

How do I deal with lottery taxes? What happens if I don't report my gambling winnings? Updated for tax year What are the benefits of taking a lump sum payment versus annuity payments? You should always consult a tax professional when submitting any tax returns. See how the tax brackets of two of the most common filing statuses single filers and those who are married filing jointly and rates work below, based on filing status. You will likely receive a Form Misc. Choose your state : Indicate the state where you reside, as state tax rates can vary significantly from one state to another. To use the calculator, you would select your state, indicate your tax filing status, add the amount of the other taxable income outside of gambling, enter the amount you won, and press calculate. All gambling winnings are taxable. People also viewed…. Scoring a big win at a land-based casino or winning big through an online sports betting establishment is exhilarating. You can also share Your Stuff with other users if you choose. Therefore, they do not affect your Social Security benefits.

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will talk.