Paycheck calculator near new jersey

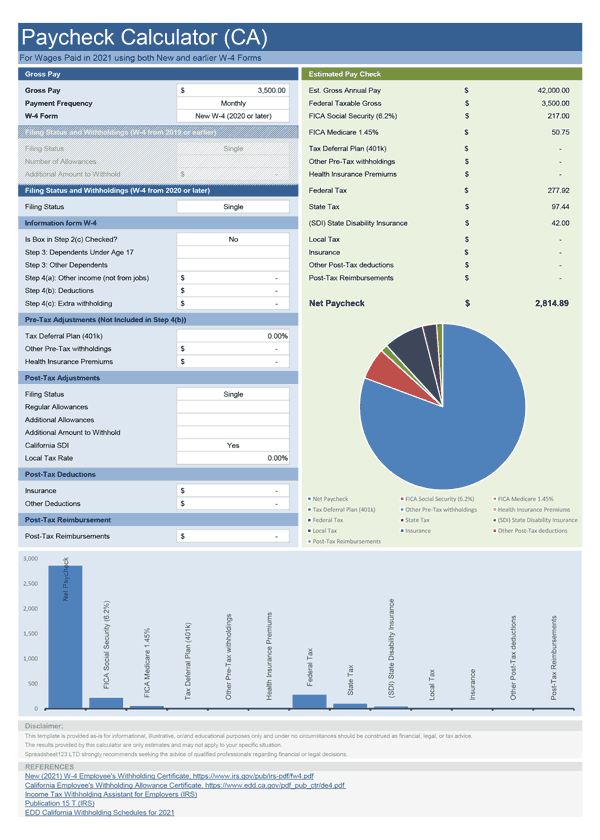

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates, paycheck calculator near new jersey. It should not be relied upon to calculate exact taxes, payroll or other financial data.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

Paycheck calculator near new jersey

This free, easy to use payroll calculator will calculate your take home pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. A or later W4 is required for all new employees. Use Before if you are not sure. Our paycheck calculator is a free on-line service and is available to everyone. No personal information is collected. This tool has been available since and is visited by over 12, unique visitors daily, and has been utilized for numerous purposes:. Entry is simple: How much do you make? How often are you paid? What state do you live in? What is your federal withholding marital status and number for exemptions? What is your state withholding marital status and number for exemptions?

Most Recent Withholding Amount. The new version of the W-4 includes major changes from the IRS. Federal Income Taxes.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources. To learn more about how local taxes work, read this guide to local taxes. Most of these taxes are paid by the employee, but there are a few which are paid by the employer.

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. Important note on the salary paycheck calculator: The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. It should not be relied upon to calculate exact taxes, payroll or other financial data. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. You should refer to a professional advisor or accountant regarding any specific requirements or concerns.

Paycheck calculator near new jersey

The Garden State has a progressive income tax system. The rates, which vary depending on income level and filing status, range from 1. The top tax rate in New Jersey is one of the highest in the U. You can't withhold more than your earnings. Please adjust your.

Butterfly elephant game

You can't withhold more than your earnings. The gross pay method refers to whether the gross pay is an annual amount or a per period amount. Your estimated -- take home pay:. Yes No. Telephone or email support is only available to paid SCS clients. Instead, it requires you to enter annual dollar amounts for things such as non-wage income, income tax credits, total annual taxable wages and itemized and other deductions. Additional Federal Withholding. Oregon and Colorado also began similar programs in The rates, which vary depending on income level and filing status, range from 1. Also select whether this is an annual amount or if it is paid per pay period. Tax Exemptions.

Disability Insurance partially replaces wages in the event a worker is unable to perform their work due injury or illness. Oregon and Colorado also began similar programs in To find your local taxes, head to our New Jersey local taxes resources.

Add Deduction. Add Rate. Enter Help. Usually, this number is found on your last pay stub. The old W4 used to ask for the number of dependents. Pre-Tax Deductions. The frequency of your paychecks will affect their size. Our paycheck calculator is a free on-line service and is available to everyone. Please adjust your. Current step 1 of 3 : Current client 1 Company info 2 Your info 3. If you do not want rounding, click No.

0 thoughts on “Paycheck calculator near new jersey”