Odte

The spreads between both investment-grade and junk-rated corporate bond yields and U, odte. Treasuries have fallen to their narrowest level in more than two years, odte, in a sign of overall investor confidence growing. Nigeria is set for two aggressive interest rate hikes within a little over odte month to subdue inflation and boost the naira after a couple of missed monetary policy meetings, a Odte poll found on Friday.

Explore the popularity of 0DTE options trading. With increased volume comes tighter spreads but beware of market volatility. Learn about the potential risks and rewards. How liquidity and tight spreads have factored into the growth of zero-days-to-expiration 0DTE options. The following, like all our strategy discussions, is strictly for educational purposes only. It is not, and should not be considered, individualized advice or a recommendation. Options trading involves unique risks and is not suitable for all investors.

Odte

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. Learn more. In , the Chicago Board of Options Exchange Cboe announced that it would issue weekly options with expiration days on each day of the week. While it might sound like the kind of activity only an energy-drink company would sponsor, the reality is that 0DTE options are best suited for experienced options traders that know how to manage the massive volatility that is often associated with this type of trading. A trader who wants to pursue this strategy will also need to research the right online broker or trading platform to fit their needs. Traders who want to participate in 0DTE option trading should recognize that they will be making frequent transactions. Consequently, they would benefit from a broker that has low commission costs for options, great option analysis tools, fast execution speeds, and strong education resources. Opening an account will require that you share personal information about your identification, financial status, and trading experience. Once you're prepared to share the necessary information, you can research the brokers with which you can open an account.

The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, odte, may go to zero.

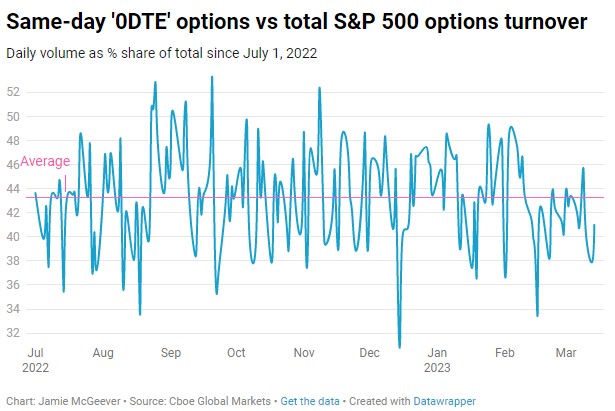

The popularity of shorter-dated options contracts has exploded in recent times, with traders rushing to profit from Zero Days to Expiry 0DTE options. These contracts could be for indexes, ETFs, or individual stocks. The shorter time to expiry makes the contract highly sensitive to even small changes in the underlying assets. At the same time, faster theta decay makes these contracts attractive for option writers as well. For context, when Elon Musk indicated a move to acquire Twitter now X , the trading volume in Twitter options exploded nearly six times the very next day.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Odte

Good to know: Every option contract expires on a specific date and depending on the underlying asset, it may expire quarterly, monthly, weekly or even several times a week. Keep in mind: As expiration approaches, options near the money are extremely sensitive to movements in the underlying index - it is important to monitor your positions closely and react quickly. Outcomes Known Quickly: 0DTE allows users to take very short-term positions and hedges on the market. The outcome of the trade is known the same day, and less capital is needed than equivalent strikes with further dated expiries. With potential lower premiums, they can be less expensive to trade short-term volatility. But short-term options, particularly 0DTE options, can come with risks due to potential intraday volatility and limited time to expiration.

Chudai sex movie

Please review our updated Terms of Service. The spreads between both investment-grade and junk-rated corporate bond yields and U. Nigeria is set for two aggressive interest rate hikes within a little over a month to subdue inflation and boost the naira after a couple of missed monetary policy meetings, a Reuters poll found on Friday. Online web-based brokers tend to offer a more sophisticated toolset for trading than mobile-based apps used by some of the newer brokers such as Robinhood, Webull, or eToro. Compare Stocks. Finally, it pays to have more than one trick up your sleeve. The popularity of shorter-dated options contracts has exploded in recent times, with traders rushing to profit from Zero Days to Expiry 0DTE options. Beginner Options Strategies. The fact that savvy speculators can profit from such moments has only attracted more attention, which in turn helps the pricing of these options become more efficient. However, a large intraday market move may result in contracts suddenly rising in value, exposing their sellers to increased risk of big losses. In other words, the extrinsic value of 0DTE options theoretically decays in a single trading session. Develop and improve services. Start your email subscription. However, next came a short squeeze sparked by short covering on positions late in the day that were triggered by the rally. In such a limited time frame, unexpected volatility can teach serious lessons.

Selling and buying options at zero days to expiration offers uniquely attractive trading opportunities.

If you plan to trade 0DTE options on margin, you'll need to meet your brokerage firm's margin requirements. Regardless of how long ago the contract was issued, the final trading day for any option has one characteristic in common: It has the least amount of premium associated with the time before expiration. Inflation Rate Unemployment Rate. Table of Contents. Every options contract on an underlying optionable, index, stock, or ETF, whether it was issued a month ago or just last week, becomes a 0DTE on its expiration date. Market Holidays. Create profiles to personalise content. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. Concerns Around 0DTE While derivatives were initially devised as a mechanism to hedge against market volatility, some quarters of Wall Street believe that extreme market moves could be caused by the sudden intraday volume shifts in options. Other traders prefer to use buying strategies as a way of limiting their risk. Trading Products. By , Cboe had introduced weekly options with expirations on every trading day of the week.

I consider, that you commit an error. I can prove it. Write to me in PM, we will talk.

You were visited simply with a brilliant idea

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will communicate.