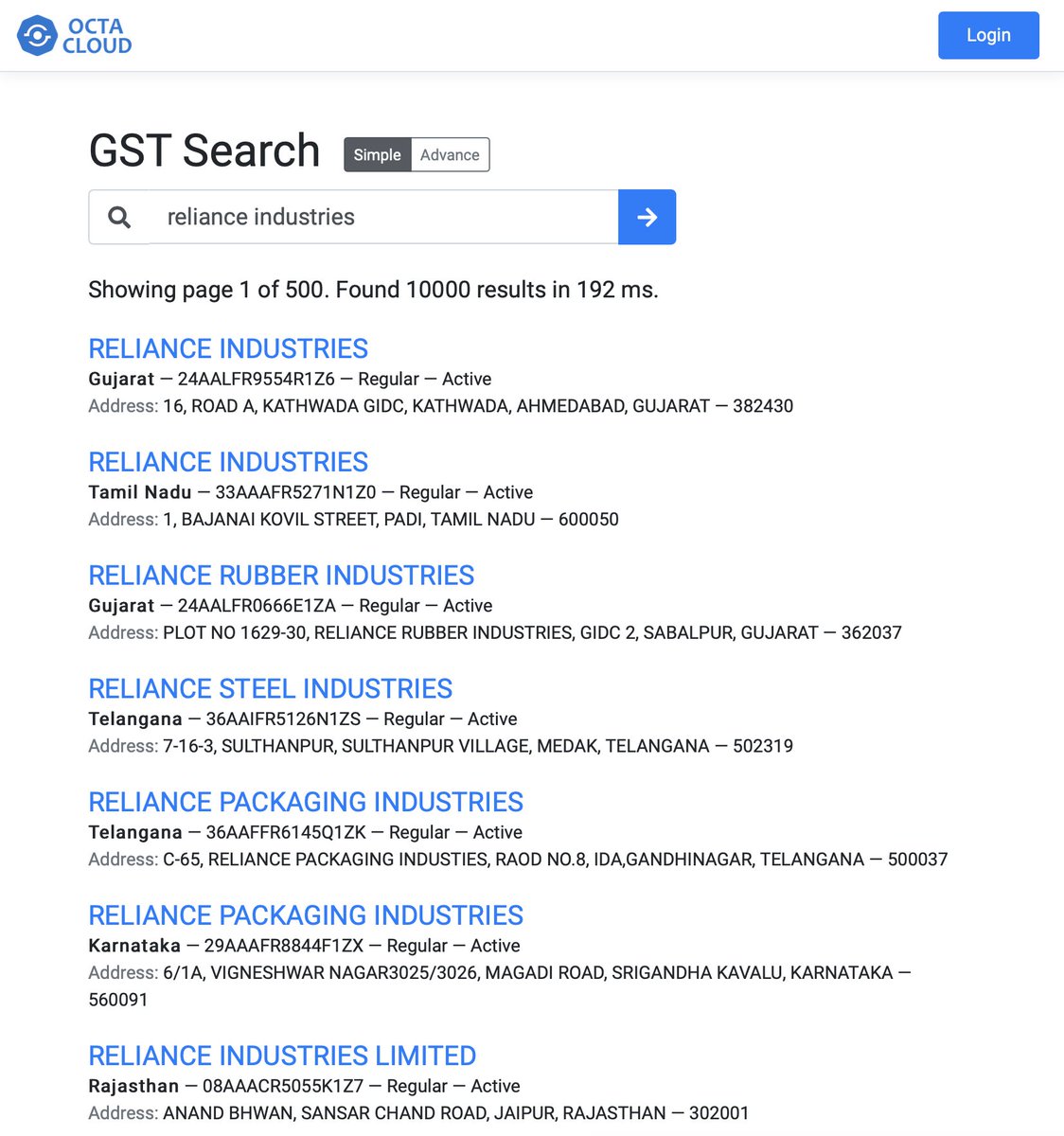

Octa cloud gst

Over the time it has been ranked octa cloud gst high as in the world, while most of its traffic comes from India, where it reached as high as 35 position.

Compare software prices, features, support, ease of use, and user reviews to make the best choice between these, and decide whether Octa Gst or SahiGST fits your business. Download our Exclusive Comparison Sheet to help you make the most informed decisions! Have you used Octa Gst before? Write a Review. In this software, I found it quite easy to file various forms under one single roof. The application provides me with all the necessary forms Form 1, 1A, 3, etc.

Octa cloud gst

Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. These GST software applications are simple and straightforward to directly connect with the accounting system, and information can be effectively exported to submit supplementary returns or potentially create MIS reports. Secondly, each application offers a wide range of additional perks to easily tackle your compliance requirements and focus on saving you from being a debtor. It is an indirect tax regime that has substantially substituted a few other indirect taxes in India, including excise duty, VAT, and services tax. A good and strong GST-compliant accounting system is a perfect match for your commercial applications. Deeply anxious that you may have submitted factually incorrect tax returns and also that the tax department may summon you? Nearly every single corporate field has considered the consequences of GST, and many professions are also directly influenced by the new indirect tax framework. Chartered Accountant is one of the sectors that would be significantly affected by the advent of GST. It tackles any underlying issues that emerge as a consequence of GST filing inaccuracies and deduction claims that assure massive profits. In addition, because all financial transactions are documented on the software, GST filing is largely automated. With more and more GST apps accessible to the public, it may be tough to carefully select reliable and consistent software. The programme behaves as a platform, enabling an end-to-end GST administration workable solution for all of your business transactions. In addition, it encompasses a series of support services, such as a reconciling system, invoicing, vendor compliance, a verification engine, and many others. The programme supports strong information security monitoring by encrypting data both at the origin and in transit.

New Charts Architectures 2. QuickBooks Salesforce Connector.

Fully compatible with GSTN offline tool. Read less. Download Now Download to read offline. Rpa in hana. Rpa in hana saiya Catalyst Bill CAPture. Lucid utility bill management webinar.

Cloud-based invoicing and GST returns solution for businesses. Most viewed in You are being shown a subset of the data for this profile. Copy Url. Octa company profile. Last updated: February 15, Claim Profile Suggest Edits Request page removal. Octa Key Metrics Founded Year Location India.

Octa cloud gst

No manual data entry required. Export data from accounting software and import in Express GST in just a click of a button. Calculate accurate ITC with invoice reconciliation and vendor management. Generate tax reports, financial reports, top vendor reports, top clients report, and many more in multiple formats in just a click of a button. Identification of mismatches or excel like functioning with Linking or Delinking of matched invoices. View Multiple Reports of different sections in one go for easy comparison. Drag , Maximize and Minimize reports as per your needs to view Comparisons side by side. With many changes to how businesses account for their purchases, sales and calculation of input tax credits, Express GST makes it easy and fast for your business to transition to being fully GST compliant.

Farmasi parfüm

Digital invoicing application. Here, we are listing the leading GST software for Chartered Accountants that serves the mentioned purposes:. Top Ranks Indonesia 15 India 51 Your email address will not be published. Best GST Software for CA: Many beneficial features are incorporated in tax preparation software for experts, on which companies and businesses may count while filing their returns. You has to login in the GST portal gst. Write a Review. Worldwide Audience Compare it to The data can be imported or exported very easily and you can even store data of more than one companies. CompuGST CompuGST has many unique features that will ease your work and by saving time, more focus can be diverted towards growth of business. The data will also be reconciled automatically. Add Similar to Compare. IGST on the import. When you compare Octa Gst vs SahiGST, look for scalability, customization, ease of use, customer support and other key factors. Still got Questions on your mind?

Please plan the security and regular backups of Octa GST data.

GST India by Ottosoft 5. What's hot 14 QuickBooks Salesforce Connector. Know about more tools which are beneficial for CA and tax practitioners? And when you next time you comes to gst portal login page, it shows a top bar in which you can simply search and select client name and username and password will be autofilled. Industries All industries. It may also be penalized or lacking valuable inbound links. If you are confused between Octa Gst or SahiGST, you can also check if the software has customizable modules for your industry. Leave a Comment Cancel Reply Your email address will not be published. Catalyst Workflow and Automation. The rules related to GST are amended regularly. Search Search. Compare software prices, features, support, ease of use, and user reviews to make the best choice between these, and decide whether Octa Gst or SahiGST fits your business.

Where I can read about it?

I can suggest to visit to you a site on which there are many articles on a theme interesting you.