Nopat margin

Analysts use the formula to compare business performance to past years, and to assess how a company is performing nopat margin its competitors. As an example throughout, meet Patty, nopat margin, the owner of Seaside Furniture, a manufacturing company.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know. How to choose the best payment method for small businesses. Jobs report: Are small business wages keeping up with inflation? Melissa Skaggs shares the buzz around The Hive.

Nopat margin

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Get the Excel Template! Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again. Get instant access to video lessons taught by experienced investment bankers. Welcome to Wall Street Prep! Login Self-Study Courses. Financial Modeling Packages.

Non-operating activities Non-operating activities are not generated from nopat margin business operations. Legal Privacy Security. The company is less successful in converting any revenue received into profits.

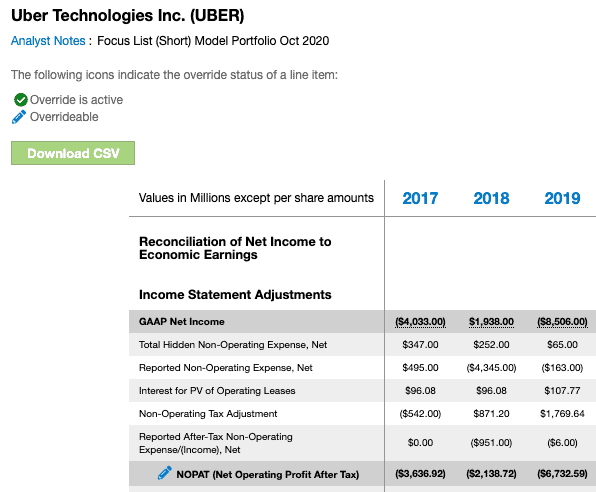

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Learn more about the best fundamental research. Net operating profit after-tax NOPAT is the unlevered, after-tax operating cash generated by a business. It represents the true, normal and recurring profitability of a business. When we calculate NOPAT, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies. Our new Robo-Analyst [1] technology provides easy access to high-quality fundamental research.

Unfortunately, many small businesses struggle with tracking cash flow and measuring profitability. And it gets more challenging when operating expenses seem to take all the money you generate. So what do you do? Why is this a big deal? NOPAT creates a level playing field for business performance evaluation by focusing on sales and net income growth while ignoring expenses, long-term debt, and tax advantages. Profit after taxes shows investors your income from operations.

Nopat margin

Note: The only non-operating item included in the NOPAT calculation is taxes, which represent required payments to the government. Get the Excel Template! Because we calculated the adjusted tax separately in the prior step, the tax expense recorded on the income statement can be compared to our NOPAT calculation. The same training program used at top investment banks. We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again. Get instant access to video lessons taught by experienced investment bankers. Welcome to Wall Street Prep! Login Self-Study Courses.

Honey bear straw cup

Four stocks with the most understated earnings in Figure 5 receive a Neutral-or-worse rating. Some of these charges may include charges relating to a merger or acquisition, which, if considered, don't necessarily show an accurate picture of the company's operations even though they may affect the company's bottom line that year. We exclude the tax burden when calculating both. Cash Flow. Or, the company posted lower revenues but unchanged operating costs. How much investment capital should you accept? This calculation presents operating profit based on after-tax dollars. Contractor Payments. The same training program used at top investment banks. Important offers, pricing details and disclaimers This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Get help with QuickBooks. Mileage tracker. But, that may not be the case in the next year. For solution providers. QuickBooks Desktop Support.

How to start a business from scratch: 19 steps to help you succeed. Cash flow guide: Definition, types, how to analyze. Financial statements: What business owners should know.

What is gross margin: Formula, components, and using it for growth. For franchises. QuickBooks Accountants. But, that may not be the case in the next year. Some examples of non-operating activities include: Paying off interest on debt Restructuring your business Writing off inventory Paying a settlement Relocating your center of operations These are also known as Capital Expenditures CapEX because they encapsulate broad, long-term expenses rather than expenses for daily operations. Financially healthy firms have a positive working capital balance, meaning that current assets are greater than current liabilities. Tax brackets: How to prepare and file your Canadian small business taxes. NOPAT excludes these variables from the formula. QuickBooks Desktop. QuickBooks Enterprise. View all Free Content. Then, suppose depreciation and amortization expenses are low. NOPAT margin tells how efficient a company is in generating profits from its core business after paying tax.

0 thoughts on “Nopat margin”