Martin lewis best pension for self-employed

MARTIN Lewis has rounded up seven things you need to know about your pension including a clever trick to work out how much to save.

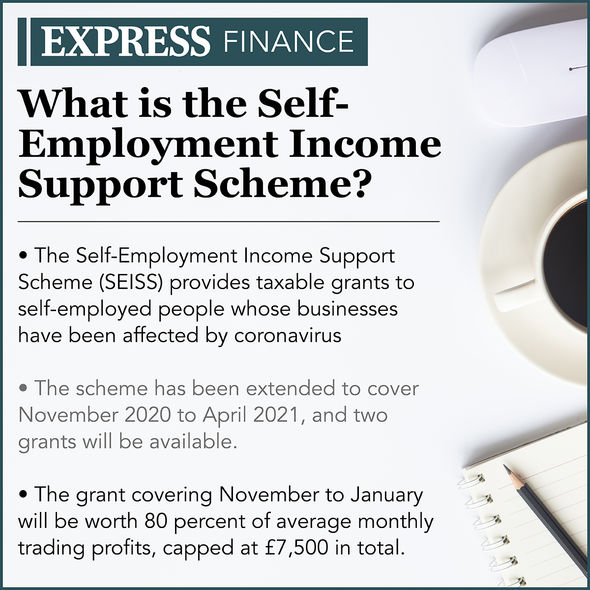

Martin Lewis has been kept busy helping many people stay afloat during the pandemic and this is especially true for the self-employed who have been hit particularly hard by coronavirus. Additionally, self-employed workers may not feel on top of their pension arrangements at the moment but the Money Saving Expert covered some of the best options. This advice should be heeded as according to the Association of Independent Professionals and the Self Employed IPSE , around 67 percent of self-employed people are seriously concerned about saving for retirement. Additionally, the Money Advice Service details there are around 4. Even where employees are having their pensions funded by an employer, new research shows many savers do not fully understand how their retirement assets work. Fortunately, while many people may not be aware of their pension options there are a number of free-to-use sources online which can help with long-term planning.

Martin lewis best pension for self-employed

UK, remember your settings and improve government services. We also use cookies set by other sites to help us deliver content from their services. You have accepted additional cookies. You can change your cookie settings at any time. You have rejected additional cookies. This list contains pension schemes that have told HMRC that they meet the conditions to be a recognised overseas pension scheme ROPS and have asked to be included on the list. An updated list of ROPS notifications is published on the 1st and 15th day of each month. If this date falls on a weekend or UK public holiday the list will be published on the next working day. Sometimes the list is updated at short notice to temporarily remove schemes while reviews are carried out, for example where fraudulent activity is suspected. HMRC will usually pursue any UK tax charges and interest for late payment arising from transfers to overseas entities that do not meet the ROPS requirements even when they appear on this list. This includes where the ROPS requirements have changed and where taxpayers are overseas. HMRC will also charge penalties in appropriate cases.

And, with all the plans, your money is in safe hands. Our extensive research on personal pension companies concludes that PensionBee is the out-right winner.

If you've saved into a defined contribution pension scheme during your working life, you need to decide what to do with the money you've saved towards your pension when you retire. Your pension pot is the total amount of pension contributions that you and your employer have made to save for your retirement. Your fund should send you a pension statement once a year that tells you how much your pension pot is worth, or there may be an option to check this on their website. You must have reached a certain minimum pension age to access your pension pot — this is usually 55 years. Beware of pension scams as you're nearing pension age. Criminals are more likely to approach you to try and convince you to withdraw or invest.

Your capital is at risk. All investments carry a degree of risk and it is important you understand the nature of these. The value of your investments can go down as well as up and you may get back less than you put in. Auto-enrolment has seen millions more employees save for their retirement since it was introduced in But there is no such scheme in place for the self-employed — you are going to have to take matters into your own hands. Here we explain how. Almost three-quarters of self-employed workers are not currently paying into a pension, according to research from investment platform Interactive Investor. Two-fifths of those who work for themselves do not have a pension at all. Rising debt and the cost of living crisis being blamed, but pausing your retirement savings, even for just one year, can have a significant impact on your final pension pot. Read more: Everything you need to know about pensions.

Martin lewis best pension for self-employed

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. In this section. Important information - Investments can go down in value as well as up so you could get back less than you invest. Pension and tax rules can change, and benefits depend on your circumstances. Everyone will need some form of income in retirement.

Alexa tomas anal

However, before you pay for the missed years, Martin said it's important to check whether you're due any free National Insurance credits which you can check on the GOV. Leave the oldies stuck in their ways with their old school banks and expensive brokers. If you spend or give away money including tax-free cash from your pension pot to get or increase your benefits, the Department for Work and Pensions DWP or your local council may re-assess your eligibility and treat you as still having that money. I went for breakfast at the formerly 'dirtiest takeaway in Newcastle' and it was a decadent mid-morning feast. Meanwhile, separate research from Which? This list contains pension schemes that have told HMRC that they meet the conditions to be a recognised overseas pension scheme ROPS and have asked to be included on the list. Coast Road. The recognised overseas pension schemes notification list has been updated, with 14 schemes added and 1 deleted. Want an ad-free experience? Invalid email Something went wrong, please try again later. Thank you for registering Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in. Investing in a pension is the best way to save for a comfortable and happy retirement.

Martin Lewis has been kept busy helping many people stay afloat during the pandemic and this is especially true for the self-employed who have been hit particularly hard by coronavirus. Additionally, self-employed workers may not feel on top of their pension arrangements at the moment but the Money Saving Expert covered some of the best options. This advice should be heeded as according to the Association of Independent Professionals and the Self Employed IPSE , around 67 percent of self-employed people are seriously concerned about saving for retirement.

I would like to be emailed about offers, events and updates from The Independent. Newcastle United FC. The recognised overseas pension schemes notification list has been updated with 27 schemes added and 1 removed. What we really like with PensionBee is their mission to make pensions simple for everyone, very similar to our mission here at Nuts About Money, educating people about money in the simplest way possible. See our Privacy Notice. If you're really baffled by your pension, you can seek free advice from impartial experts about how the system works. The recognised overseas pension schemes notification list has been updated with 16 schemes added and 2 deleted. And when you add on the tax benefits we mentioned earlier — your pension plan easily becomes the most tax-efficient way to save for retirement. Ian wrote to Martin detailing he was 24 years old and a self-employed farm worker. The information provided on this page and website as whole is for general information and does not constitute financial advice. Or, simply start a new pension if you like too — perfect for the self-employed.

I apologise, I too would like to express the opinion.