Macd investing

The moving average convergence divergence MACD is an oscillator that combines two exponential moving macd investing EMA —the period and the period—to indicate the momentum of a bullish or bearish trend. MACD can be used to signal opportunities to enter and exit positions. It is one of the most popular technical indicators in trading and is appreciated by traders worldwide for its simplicity and flexibility, macd investing. The concept behind the MACD is straightforward.

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. Although it is an oscillator, it is not typically used to identify over bought or oversold conditions. It appears on the chart as two lines which oscillate without boundaries. The crossover of the two lines give trading signals similar to a two moving average system.

Macd investing

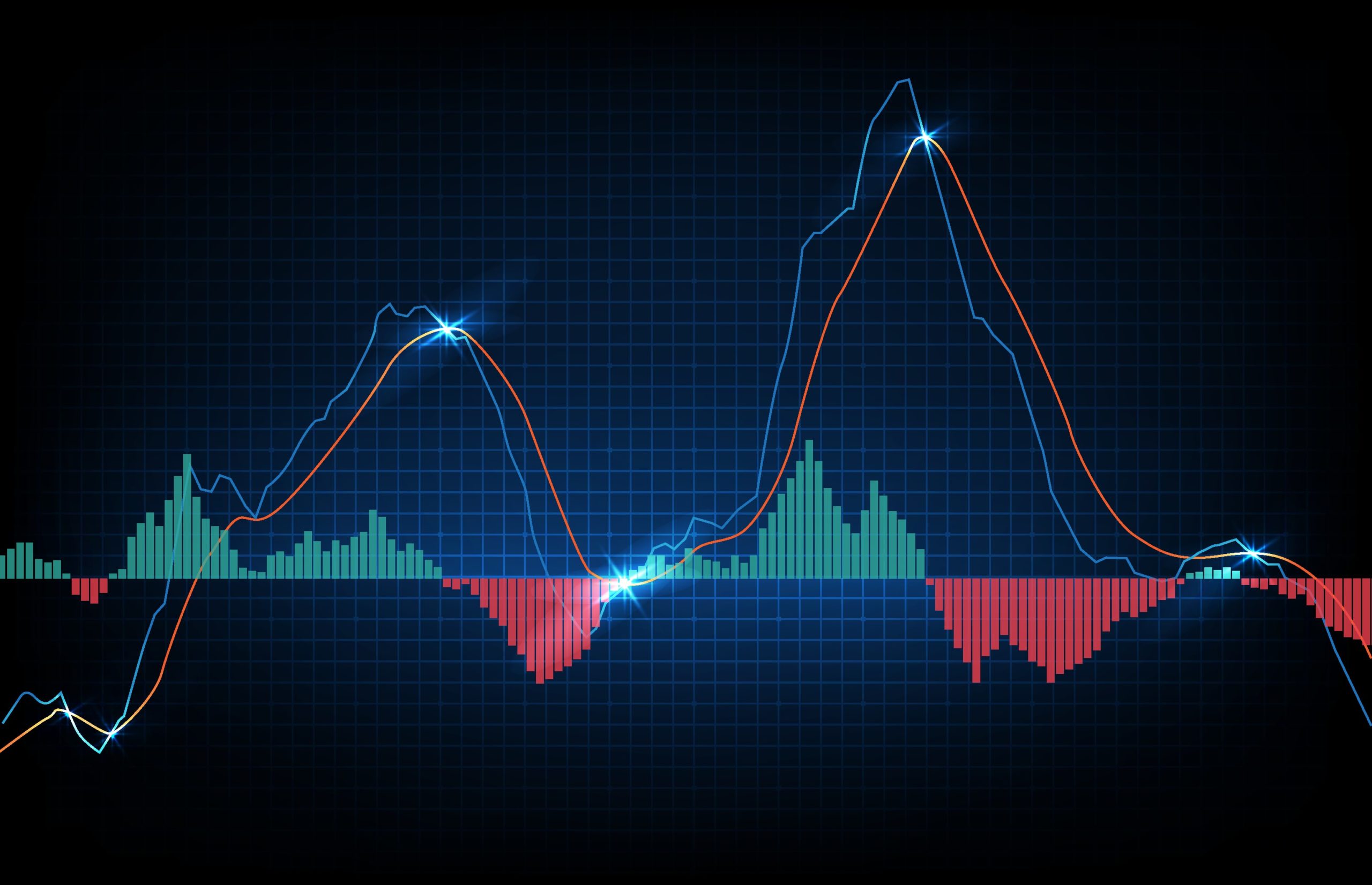

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The possibility of more rate hikes. Fitch's US credit rating downgrade plus a warning on some bank ratings. China growth worries. Relatively expensive stock prices. The list of reasons why investors could think stocks might head lower over the short term appears substantial. Yet stocks remain within striking distance of their all-time highs although the trend has been bearish this August. What do the charts say? Investors that use indicators to help figure out which direction stocks may go over the short term can find that MACD is registering a bearish signal for US stocks. See the bottom section of the chart below for a sense of what MACD looks like. MACD is a momentum oscillator that is generally best employed in trending markets—where prices are trending in a particular direction.

Note: The sample calculation above is the default. Uptrends often start with a strong advance that produces a surge in upside momentum MACD, macd investing.

The MACD turns two trend-following indicators, moving averages , into a momentum oscillator by subtracting the longer moving average from the shorter one. As a result, the MACD offers the best of both worlds: trend following and momentum. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals. Because the MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Macd investing

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Easter wishes pictures

The MACD line recently crossed below the zero line, generating a sell signal. Find corporate bonds. Related Articles. This can suggest a change in the overall trend of the market. You might like these too: Looking for more ideas and insights? This means MACD values are dependent on the price of the underlying security. It is a violation of law in some juristictions to falsely identify yourself in an email. Last name must be at least 2 characters. Investing in stock involves risks, including the loss of principal. All fields are required. Remember, upside momentum is stronger than downside momentum as long as the MACD is positive. Create profiles to personalise content. Frequently Asked Questions.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Although the MACD and average series are discrete values in nature, but they are customarily displayed as continuous lines in a plot whose horizontal axis is time, whereas the divergence is shown as a bar chart often called a histogram. Views and opinions expressed may not reflect those of Fidelity Investments. Find corporate bonds. The exponential moving average is also referred to as the exponentially weighted moving average. Check out your Favorites page, where you can: Tell us the topics you want to learn more about View content you've saved for later Subscribe to our newsletters. The trader could take a long position at this point. Use limited data to select advertising. Close Popover. When MACD rises or falls rapidly the shorter-term moving average pulls away from the longer-term moving average , it is a signal that the security is overbought or oversold and will soon return to normal levels. Crossovers are more reliable when they conform to the prevailing trend.

It does not approach me. There are other variants?

This situation is familiar to me. It is possible to discuss.