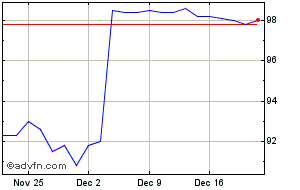

Ltg share price

Financial Times Close. Search the FT Search. Show more World link World.

We could not find any results for: Make sure your spelling is correct or try broadening your search. It looks like you aren't logged in. Click the button below to log in and view your recent history. Already a member? Sign in.

Ltg share price

.

Looks like a few holders are shifting their holdings within various portfolios and a few others maybe getting bored. We need LTG to grow not just make small incremental gains in margin.

.

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio Add an alert.

Ltg share price

GBX Key events shows relevant news articles on days with large price movements. AGM 1. Pan African Resources plc. PAN 1. VSF 0. Targa Resources Corp. TAR 0. HNG 0. ITM Power plc.

Best xingqiu teams

We could not find any results for: Make sure your spelling is correct or try broadening your search. That I think is changing for these smaller companies. I know you from old so I will leave you to get bored and move on. The fact that they have brought in enough earnings, to cover so much of their debt, tells me that others value them. Brent Oil What is talent transformation? If they all marketed under the same brand, that would be an advantage in cross-selling to corporate clients. Sign in. Revenues in were down slightly so my own feeling is that we need to wait for later updates and the hint of growth in revenues in as previously stated. Show more Companies link Companies.

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. Performance figures are based on the previous close price.

Technology Technology. All content on FT. Where are the case studies and examples of something actually being done? He comes across in a very genuine way with no obvious hype instead he said that he wanted to wait and see what 1Q brings before making any solid forecasts, however, at the end he did indicate that there would be no revenue growth this year. It looks like you are not logged in. Cyberian I think you have a good mix of enthusiasm tempered with reality. The federated approach in which the subsidiaries run separately militates against the joined up proposition that should be presented to clients. Here I agree with 12 badger that further cross selling and lowering costs is the better way forward. I would personally pump for the first two although tempted with the latter. I don't normally post here but I've been invested since the days when we were both invested in WEY. It looks like you aren't logged in. A common theme amongst small caps at the moment!! This may disappoint some on here but the 3 positives connected to strong cash revenue growth is that with financial de-leveraging, they may decide to lower borrowings further, make some selective acquisitions, or execute a share buy back. Learning Technologies has a price to earnings ratio PE ratio of

0 thoughts on “Ltg share price”