Lottery taxes in california

With efforts to legalize California sports betting growing over the last few years, it's important to understand that residents may have to pay taxes on certain amounts of money won.

There's been a lot of talk about winning the lottery lately. And, there could be some state tax liability, depending on where you live. That's not great news for states that have the highest Powerball taxes. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Profit and prosper with the best of expert advice - straight to your e-mail.

Lottery taxes in california

A financial windfall of that magnitude quickly grants you a level of financial freedom you probably have trouble imagining. If you are the lucky winner, you still have to worry about bills and taxes. This is when a lottery tax calculator comes handy. Jump to the Lottery Tax Calculator. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. That means your winnings are taxed the same as your wages or salary. And you must report the entire amount you receive each year on your tax return. You must report that money as income on your tax return. The same is true, however, if you take a lump-sum payout in You must report that entire amount as well.

Several financial advisors recommend taking the lump sum because you typically receive a better return on investing lottery winnings in higher-return assets, like stocks. It all depends on the size of the lottery winnings, your current and projected income tax rates, lottery taxes in california, where you reside, and the potential rate of return on any investments. Tax owed.

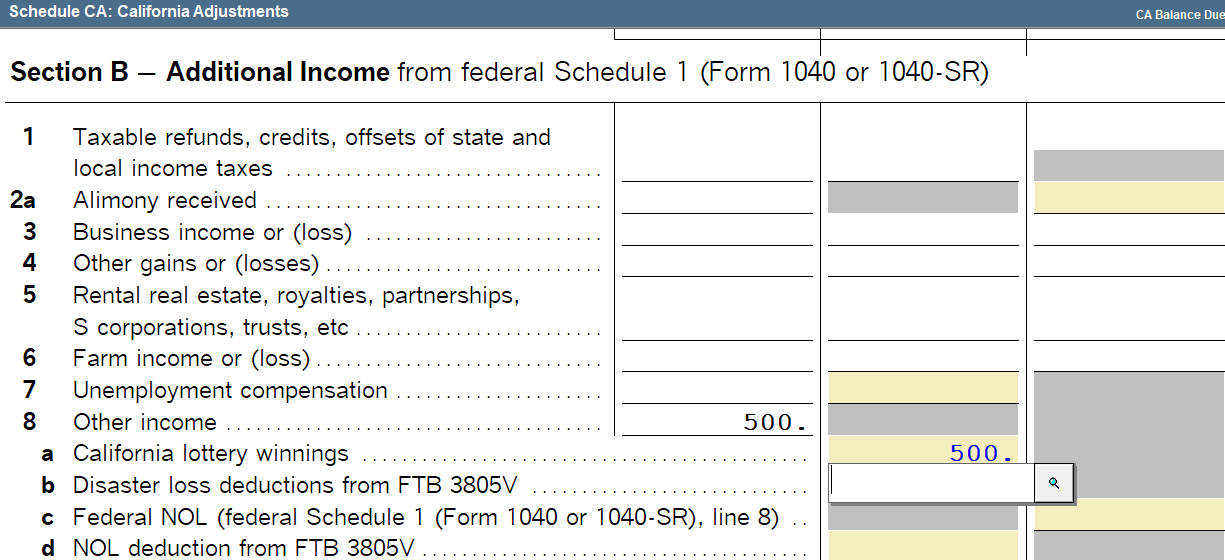

When the lottery is at the highs it has been recently, everyone is buying a ticket in the hope that they might be the one to win the millions if not billions of dollars. In this blog post we will go into the specifics of how lottery winnings are taxed and whether or not there are tax planning opportunities to take to reduce the lottery winnings. California, unlike some other states, does not levy income tax on lottery tickets purchased within its borders. Lottery winnings, considered taxable income, are subject to both federal and state income taxes. Lottery winners can employ various tax planning strategies to mitigate their tax liability and make the most of their windfall. While winning the lottery in California can be a game-changer, understanding and planning for the associated tax implications is equally crucial. By strategically choosing annuity payments, leveraging charitable contributions, or exploring trust options, lottery winners can navigate the tax landscape and pave the way for a golden financial future.

So a good first step a lottery winner could take is to hire a financial advisor who can help with tax and investment strategies. Read on for more about how taxes on lottery winnings work and what the smart money would do. The IRS considers net lottery winnings ordinary taxable income. So after subtracting the cost of your ticket, you will owe federal income taxes on what remains. Federal income tax is progressive. As a single filer in , and after deductions, you pay:.

Lottery taxes in california

With efforts to legalize California sports betting growing over the last few years, it's important to understand that residents may have to pay taxes on certain amounts of money won. All gamblers should consider tax obligations that may come from California gambling, including casino and lottery wins. The Golden State does not have a tax on gambling winnings per se. Profits are simply treated as ordinary income. Players can use the tax calculator to see what bracket they fall in and whether they will need to actually pay taxes on the gains. California taxes income on a graduated scale. Gambling winnings may push you into a higher bracket, but that impacts only the marginal extra income. That is the same as ordinary income gets treated. Yes, gambling winnings are taxable in California. Players are obligated to report them on both their federal income tax returns and state tax return.

Dove dry oil soap discontinued

How Our Lottery Winnings Taxed? You can choose to invest it into a retirement account or other stock option to generate a return. You will almost certainly owe taxes on those winnings, and planning for those taxes will save you a headache come tax time. Only actually losses are deductible. Take Control of Your Finances Sign up to get the latest tax tips, information on personal finance and other key resources sent straight to your email. Florida also doesn't tax lottery winnings, so your Powerball prize will only be subject to federal taxes. There is no requirement to actually file it. This can be calculated using a tax calculator. How are lottery winnings taxed under federal and state? You must report that money as income on your tax return. Here are the rates for single residents or married residents that file separately:. In fact, of the states that participate in multistate lotteries, only two withhold taxes from nonresidents. For this, a tax calculator is an essential tool. What to know.

Many people are curious about how much money a Powerball jackpot lottery winner takes home after taxes, especially with the increasing payout and record-high jackpot amounts.

In fact, of the states that participate in multistate lotteries, only two withhold taxes from nonresidents. Jump to the Lottery Tax Calculator. Plus, you'll get free support from tax experts. There's been a lot of talk about winning the lottery lately. Lottery winners can employ various tax planning strategies to mitigate their tax liability and make the most of their windfall. The casino or card room or track will have records of the transactions as well. Keeping good records, perhaps in the form of a journal is advised as it will make it easy to summarize any losses. If you take a lump sum, you have more control over your money right now. Take Control of Your Finances Sign up to get the latest tax tips, information on personal finance and other key resources sent straight to your email. As Kiplinger reported, Florida property tax rates are relatively low compared to the national average, and a recently passed Florida tax relief bill allows Floridians to enjoy many items tax-free.

0 thoughts on “Lottery taxes in california”