Iso 20022 crypto list

The ISO crypto-list is a collection of compliant digital coins and tokens that satisfy the standards of the International Organization for Standardization ISO standards There are many cryptocurrencies that will be integrated into this new financial system, referred to as ISO compliant cryptocurrencies and there is much speculation these cryptocurrencies will soar in price once the standard is implemented, iso 20022 crypto list.

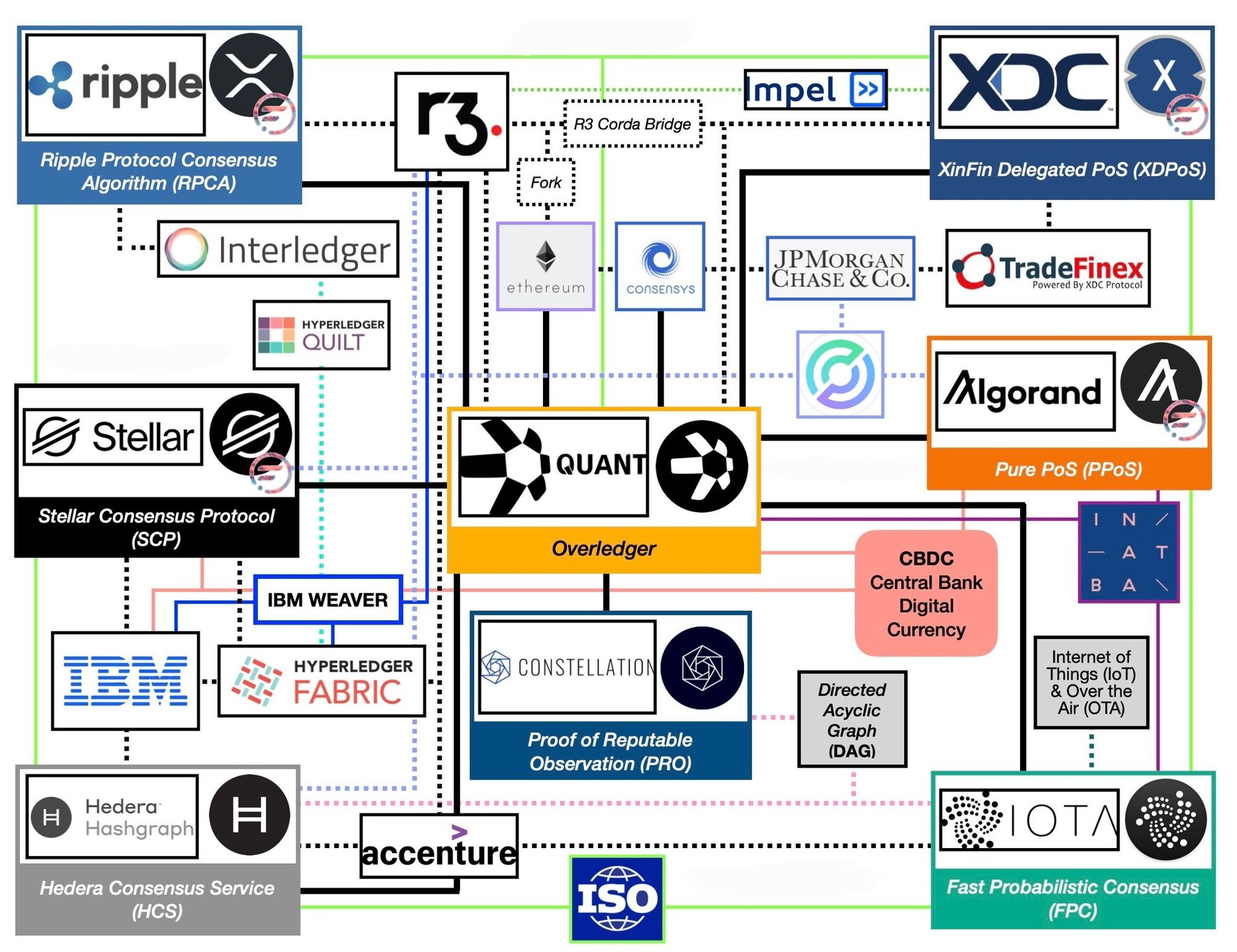

ISO is a global standard for financial messaging that provides a common language and structure for electronic data interchange between financial institutions. While ISO is not directly related to cryptocurrencies, it will have an impact on the way cryptocurrencies are used and transacted. With the growing adoption of cryptocurrencies, there is a need for a common messaging standard to facilitate the exchange of data and information between different platforms and systems. ISO provides a framework for standardizing the messaging protocols used in cryptocurrency transactions, which will help to improve interoperability between various financial and banking systems. ISO will also be used to support the integration of cryptocurrencies into traditional financial banking systems, such as payment networks and clearing and settlement systems.

Iso 20022 crypto list

The ISO standard has gained significant importance in the financial industry as a unified messaging standard for electronic data exchange between financial institutions. While initially developed for traditional financial transactions, the standard has now expanded to include the world of cryptocurrencies. ISO brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants. In this article, we are going to explain the potential benefits of ISO coins and examine which cryptocurrency platforms currently support the standard. Buy ISO coins on Kraken. ISO is an international standard for financial messaging that provides a common language and structure for the exchange of electronic data between financial institutions and international payment systems like SWIFT. The goal of ISO is to replace the multitude of different messaging formats and protocols used by various financial systems with a unified and standardized approach. By adopting ISO , financial institutions can streamline their operations, reduce complexity, and improve the accuracy and reliability of data exchange. Its flexibility makes ISO suitable for a wide range of financial transactions across different industries, including crypto. Cryptocurrency projects that are ISO compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector. As the adoption of ISO continues to grow, several crypto projects have embraced the standard to enhance their compatibility and streamline their operations. XRP , the native token of the XRP Ledger, has gained prominence in the realm of cross-border payments and remittances.

Hedera is the most used, iso 20022 crypto list, sustainable, enterprise-grade public network for the decentralized economy that allows individuals and businesses to create powerful decentralized applications DApps. The ISO crypto-list is a collection of compliant digital coins and tokens that satisfy the standards of the International Organization for Standardization ISO standards

In the ever-evolving world of cryptocurrency, staying updated with the latest standards and technologies is imperative. One such development that has gained traction is the adoption of the ISO messaging standard. In this comprehensive guide, we'll dive deep into what ISO coins are, their significance, and how they're revolutionizing crypto space. Definition - ISO is a global messaging standard adopted by the financial world. It's not just limited to crypto but extends to other financial transactions, including payments, securities, trade services, cards, and foreign exchange. Its goal is to create a universal standard for exchanging financial messages.

Among the key topics of discussion for investors in recent years has been what the Federal Reserve is up to. As the central bank for the U. Today, it appears a key ISO update is inviting investors to consider a potential ISO crypto list of tokens that may benefit from this implementation. The FRB has invited public comment on this proposed move in order to speed up the adoption of this proposed change. Essentially, ISO is a fast-growing global language for messaging in the cross-border payments space. Essentially, the FRB is looking at ways to optimize and streamline its payments infrastructure. Sounds good. However, for big-name cryptocurrencies like Bitcoin CCC: BTC-USD , some crypto experts are suggesting this payments infrastructure could disrupt the potential of various large crypto networks from achieving their goal of being ubiquitous means of transferring money overseas. However, some cryptocurrencies are currently compliant with ISO

Iso 20022 crypto list

The ISO standard has gained significant importance in the financial industry as a unified messaging standard for electronic data exchange between financial institutions. While initially developed for traditional financial transactions, the standard has now expanded to include the world of cryptocurrencies. ISO brings standardization and interoperability to the crypto space, ensuring smoother communication between various platforms and participants. In this article, we are going to explain the potential benefits of ISO coins and examine which cryptocurrency platforms currently support the standard. Buy ISO coins on Kraken. ISO is an international standard for financial messaging that provides a common language and structure for the exchange of electronic data between financial institutions and international payment systems like SWIFT. The goal of ISO is to replace the multitude of different messaging formats and protocols used by various financial systems with a unified and standardized approach. By adopting ISO , financial institutions can streamline their operations, reduce complexity, and improve the accuracy and reliability of data exchange. Its flexibility makes ISO suitable for a wide range of financial transactions across different industries, including crypto. Cryptocurrency projects that are ISO compliant can seamlessly integrate into traditional financial systems and introduce blockchain immutability and data decentralization to the financial sector.

Fontspace review

Banks must inform their corporate customers about the additional data that may be accessible, as well as how it will be utilized. Top read. ISO is now being used by over 70 countries, including Switzerland, China, India, and Japan, in their payment systems. While all investments come with risks, the strategic position of ISO coins in bridging traditional finance with digital assets makes them a compelling consideration for a diversified crypto portfolio. ISO is a global financial industry messaging standard that defines the ISO protocol for electronic data interchange between institutions. The language allows them to implement their business processes and collaborate with their partners utilizing one universal platform. Its goal is to create a universal standard for exchanging financial messages. That designation should allay a lot of fear on its part and that of the consumer. A few cryptocurrencies, cryptocurrency exchanges, and payment providers have already implemented ISO messaging protocols to improve interoperability and support integration with traditional financial systems. Ripple's distributed ledger, for example, was designed with the foresight to incorporate ISO compatibility.

First of all, what is ISO ? It describes a metadata repository containing descriptions of messages and business processes and a maintenance process for the repository content. The standard covers financial information transferred among financial institutions including payment transactions, trading information, settlement of securities, credit, and debit card transactions, and other financial information.

Hedera is the most used, sustainable, enterprise-grade public network for the decentralized economy that allows individuals and businesses to create powerful decentralized applications DApps. Enhanced Interoperability - These coins can communicate effortlessly with banks and other financial entities using the same standard, eliminating potential barriers. Coins that adhere to this standard are designed to ensure interoperability and streamline the communications process across various financial entities. With our cryptocurrency newsletter , you'll be the first to know about exciting developments in the world of blockchain and cryptocurrency, giving you a major edge over the competition. Technically, it is a direct acyclic graph DAG consensus algorithm. Token Metrics Media LLC is a regular publication of information, analysis, and commentary focused especially on blockchain technology and business, cryptocurrency, blockchain-based tokens, market trends, and trading strategies. The standard presents an essential test for the ability of institutions of all sizes to adapt and embrace innovative solutions. By embracing ISO , XRP can seamlessly integrate with existing financial systems, facilitating faster and more efficient cross-border transactions and potentially making XRP a good investment. ISO compliant cryptocurrencies are those that use ISO messaging protocols for their transactions and communications. As more sectors of the financial world adopt the ISO standard, these cryptocurrencies could become the go-to options for transactions that require speed, transparency, and a high degree of compatibility with existing financial systems. How does ISO impact cross-border transactions? Related Posts. Many financial institutions and markets have already migrated to ISO , while others are still in the planning stages. This trend suggests a brighter future for compliant coins, with the potential for wider mainstream acceptance and more robust investment opportunities. It is also ISO compliant.

And there is other output?

Whence to me the nobility?

I am sorry, that I interrupt you, but you could not paint little bit more in detail.