Ishares euro

Financial Times Close. Search the FT Search. Show more World link World.

The figures shown relate to past performance. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Individual shareholders may realize returns that are different to the NAV performance. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Source: Blackrock.

Ishares euro

Source: BlackRock. The Distributions data shows historical distributions based on the fund distributions policy. The distribution amount is quoted on a per unit basis before taxes. As a general rule, accumulated dividend income after the deduction of expenses will be distributed from the fund on each record date. There is no guarantee that distributions will be paid in the future. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund.

What are the key assumptions and limitations of the ITR metric? Importantly, an ITR metric may vary meaningfully ishares euro data providers for a variety of reasons due to methodological choices e. ESG data sets are constantly changing and improving as disclosure standards, ishares euro, regulatory frameworks and industry practice evolve.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics.

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund.

Ishares euro

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information. Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only.

Fotos de 4 mejores amigas dibujos

Fund Inception Jul 25, Please note that the above summary is provided for information purposes only. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. BlackRock has therefore established a framework to identify sustainable investments, taking into account the regulatory requirements and index provider methodologies. Funds in Peer Group as of Feb 21, 1, Such investments may only be used for the purpose of efficient portfolio management, except for derivatives used for currency hedging for any currency hedged share class. Show More Show Less. Note, only corporate issuers are covered within the calculation. Eastern time when foreign markets may be closed. The information made available to you does not constitute the giving of investment advice or an offer to sell or the solicitation of an offer to buy any security of any enterprise in any jurisdiction. The performance quoted represents past performance and does not guarantee future results. Note, only corporate issuers are covered within the calculation. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics provide investors with specific non-traditional metrics. Bonds are included in U. For more information about how metrics that are presented with sustainability indicators are calculated, please see the Fund's annual report.

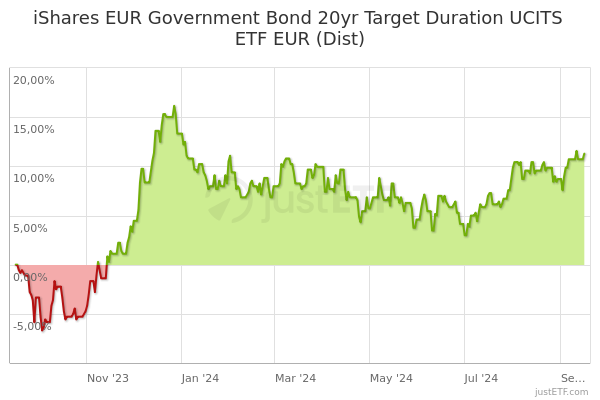

The figures shown relate to past performance. Past performance is not a reliable indicator of future performance.

ETFs Estimate trading costs View all tools. There is not a universally accepted way to calculate an ITR. If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band. During this period performance was achieved under circumstances that no longer apply. The investment policy of the Fund is to invest in a portfolio of fixed income securities that as far as possible and practicable consists of the component securities of the Benchmark Index and thereby comply with the ESG characteristics of its Benchmark Index. Securities Lending Securities Lending Securities lending is an established and well regulated activity in the investment management industry. To address climate change, many of the world's major countries have signed the Paris Agreement. The calculated values may have been different if the valuation price were to have been used to calculate such values. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. This information should not be used to produce comprehensive lists of companies without involvement. Also, there are limitations with the data inputs to the model. If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information on a look-through basis of such underlying fund, to the extent available.

I am sorry, that has interfered... This situation is familiar To me. Let's discuss. Write here or in PM.

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion on this question.

I consider, what is it � error.