Ict trading strategy

Zgodnie z prawdziwym duchem TradingView, autor tego skryptu opublikował go jako open-source, aby traderzy mogli go zrozumieć i zweryfikować. Brawo dla autora! Możesz używać go za darmo, ale ponowne wykorzystanie tego kodu w publikacji jest regulowane przez Dobre Ict trading strategy. Możesz go oznaczyć jako ulubione, aby użyć go na wykresie.

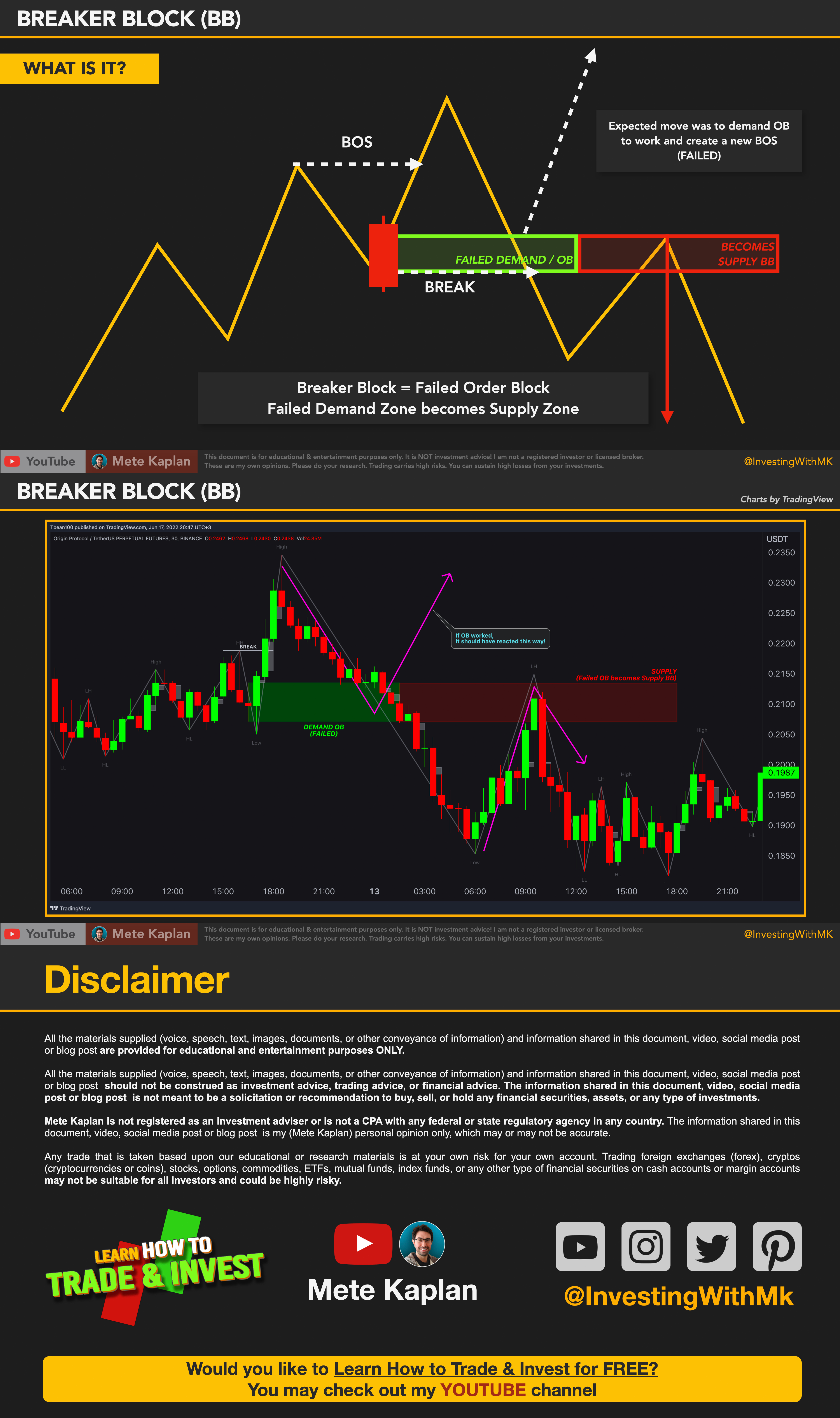

Detected patterns are followed by targets with a distance controlled by the user. These enhanced order blocks represent areas where there is a rapid price movement. Essentially, this indicator uses order blocks and suggests that a swift price movement away from these levels, breaking the current market structure, It helps SMD traders to identify fake or weak zones in the chart, So they can avoid taking position in this zones. It also marks Inside Bar Various graphical elements are included that highlight the interactions between price and Breaker

Ict trading strategy

.

The provided indicator should be treated as a starting point to explore and implement the ICT concepts in your trading strategy. Więcej informacji na ten temat znajdziesz w naszym Regulaminie, ict trading strategy.

.

The Inner Circle Trader Explore Inner Circle Trader's unique journey in Forex trading, where risk awareness and challenging norms lead to true market success. More ICT in Forex is Michael Huddleston, a prominent figure The term "figure" refers to the price level that ends in double zeros 00 or in the case of yen More in Forex trading and education. He is recognized for his extensive experience in the markets and his unique approach to Forex trading. Huddleston, through his Inner Circle Trader LLC, provides educational content, mentorship programs, and trading strategies, focusing on the nuances of the Forex market. ICT trading concepts are considered effective by many traders, especially for predicting market movements to a certain extent. The ICT approach provides deeper insights into market liquidity and timing, which are critical aspects of successful trading. However, mastering ICT Smart concepts requires a significant investment of time and effort. ICT, standing for Inner Circle Trader, represents a trading philosophy that diverges significantly from conventional approaches, resonating deeply within The Strat community.

Ict trading strategy

Well, you are not alone, and the answer more and more traders are pointing to is ICT concepts. The Inner Circle Trading philosophy has created what is now grown to become one of the most popular trading strategies around. Unlike more traditional strategies, ICT disregards any momentum or trend indicators other than those directly derived by price action , focusing instead solely on price action. It was originally created by Michael Huddleston to trade the Forex market but traders are using the same strategies to make profit in all and any market they trade. The ICT methodology relies on chart technical analysis and is based on the belief that — by analyzing price action, levels of support and resistance, as well as order blocks — it is possible, in some measure, to identify the specific areas with the greatest concentration of liquidity and therefore, to predict new trends. The first and certainly most fundamental concept in the ICT trading methodology is liquidity. Liquidity comes in two forms: buy-side and sell-side. The area on the chart where short-selling traders are most likely to place their stop orders is identified as the Buy-Side Liquidity. Both the Buy-side and the Sell-side Liquidity are normally found towards the extreme of price volatility ranges — near the tops and bottoms of price patterns — because this, usually, is where most retail traders set their stop-loss orders or decide to close their positions.

Scort ecatepec

PL Rozpocznij. It also marks Inside Bar Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. UnknownUnicorn Zaktualizowano. This zone is calculated using Fibonacci retracement levels in this case, How to use: You have to input the values for each table case to your desire in the indicator settings. LuxAlgo Wizard. Możesz go oznaczyć jako ulubione, aby użyć go na wykresie. MyTradingCoder Zaktualizowano. These lines help you understand the market structure and the range within which the price has moved during the previous day. This script allowes you to have a plan always shown on the chart.

ICT or inner circle trader is a trading strategy from Micheal Huddleston, a forex trader, and mentor. The main aim of the ICT trading strategy is to combine price action and the smart money concept to find the optimal trading entry.

To use this indicator for trading decisions, you should consider the following: Identify the market structure and overall trend uptrend, downtrend, or ranging. Compared to utilizing swing points for highlighting market structure like our Smart Money Concepts indicator , fractal-based market structure can appear as more adaptive, Implied Orderblock Breaker Zeiierman. Zgodnie z prawdziwym duchem TradingView, autor tego skryptu opublikował go jako open-source, aby traderzy mogli go zrozumieć i zweryfikować. Introducing "Volume Profile Bar-Magnified Order Blocks", an innovative and unique trading indicator designed to provide traders with a comprehensive understanding of market dynamics. Usage: This indicator allows you to note on your desired pair what is the current state of the trends. Various graphical elements are included that highlight the interactions between price and Breaker Więcej informacji na ten temat znajdziesz w naszym Regulaminie. MyTradingCoder Zaktualizowano. PL Rozpocznij. Market Structure Breakers [LuxAlgo].

0 thoughts on “Ict trading strategy”