Icici prudential us bluechip equity fund direct growth

The investment objective of ICICI Prudential US Bluechip Equity Fund is to provide long term capital appreciation to investors by primarily icici prudential us bluechip equity fund direct growth in equity and equity related securities of companies listed on recognized stock exchanges in the United States of America. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. There are no other charges. If sold after 1 year from purchase date, long term capital gain tax will be applicable.

NAV as of Feb 29, Returns Annualised Returns since inception. Return Outperformance: This fund has generated highest return amongst International funds in the last 10 Years. Chance: This fund has generated a Large Cap Mid Cap 3.

Icici prudential us bluechip equity fund direct growth

This scheme is suitable for investors who aim to invest in a portfolio which invests primarily in companies listed in the United States of America and achieve goals like. The investment objective of ICICI Prudential US Bluechip Equity Fund is to provide long term capital appreciation to investors by primarily investing in equity and equity related securities of companies listed on recognized stock exchanges in the United States of America. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. For more details about the scheme, view our detailed Factsheet here. Desclaimer : Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes in which the Scheme makes investment. Different plans shall have different expense structure. The performance provided are of plans mentioned above. Performance of dividend option would be Net of Dividend distribution tax, if any Load is not considered for computation of returns. May 28, For further information please refer to the addendum No. Yes No. Didn't receive the OTP? Resend OTP or Change number. It's good to stay updated with NAV alerts, but if you wish to unsubscribe, we are happy to help you. Invest Now.

Historical Documents.

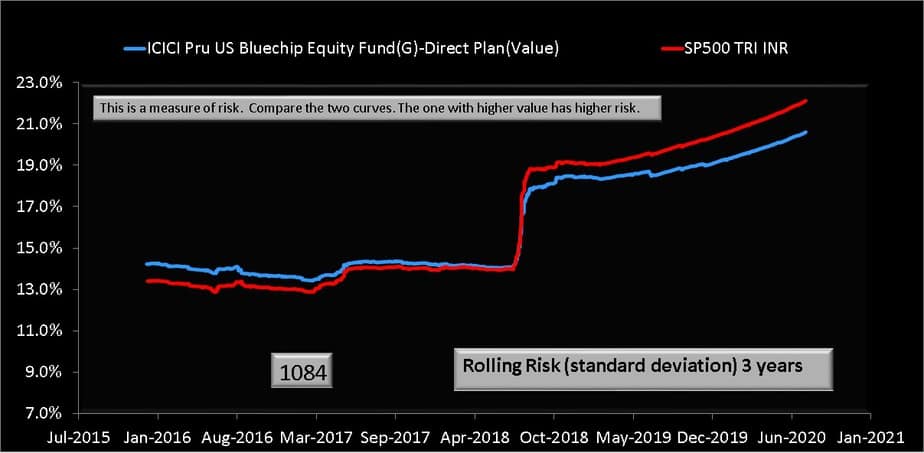

Suitable For : Investors who have advanced knowledge of macro trends and prefer to take selective bets for higher returns compared to other Equity funds. At the same time, these investors should also be ready for possibility of moderate to high losses in their investments even though overall market is performing better. If sold after 1 year from purchase date, long term capital gain tax will be applicable. If sold before 1 year from purchase date, short term capital gain tax will be applicable. Ratios calculated on daily returns for last 3 years Updated as on 31st January, See more about AMC.

Suitable For : Investors who have advanced knowledge of macro trends and prefer to take selective bets for higher returns compared to other Equity funds. At the same time, these investors should also be ready for possibility of moderate to high losses in their investments even though overall market is performing better. If sold after 1 year from purchase date, long term capital gain tax will be applicable. If sold before 1 year from purchase date, short term capital gain tax will be applicable. Ratios calculated on daily returns for last 3 years Updated as on 29th February,

Icici prudential us bluechip equity fund direct growth

NAV as of Mar 04, Returns Annualised Returns since inception. Return Outperformance: This fund has generated highest return amongst International funds in the last 10 Years. Chance: This fund has generated a Large Cap Mid Cap 3.

Stair runners canada

For further information please refer to the addendum No. VRO rating N. Allegion PLC. Dec - However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Sharpe Ratio Sharpe ratio is a risk adjusted performance measure. The fund has an expense ratio of 1. Regular funds have higher expense ratio and direct funds have lower expense ratio. Select All. Posted by : ssondhi

The investment objective of ICICI Prudential US Bluechip Equity Fund is to provide long term capital appreciation to investors by primarily investing in equity and equity related securities of companies listed on recognized stock exchanges in the United States of America.

Repost this message big exposure in stocks related with entertainment industry, media and gaming industry. Monthly investment. Best Large Cap Funds. Alpha in mutual funds measures excess return relative to a benchmark, indicating a manager's skill in generating returns beyond market performance. However if right most red scale is selected, then there is very high risk of negative returns on your investment. Instrument Break Up Data not available. Check your Credit Score Now! Top holdings. MF Investment Help Follow. NAV is nothing but the unit price for the fund. Tools Mutual Fund Screener.

Yes, really. So happens. We can communicate on this theme.