Ibm dividends

Top Analyst Stocks Popular. Bitcoin Popular. Gold New.

The next International Business Machines Corp. The previous International Business Machines Corp. There are typically 4 dividends per year excluding specials , and the dividend cover is approximately 4. Enter the number of International Business Machines Corp. Sign up for International Business Machines Corp.

Ibm dividends

Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. IBM stock. Dividend Safety. Yield Attractiveness. Returns Risk. Returns Potential. Maximize Income Goal. Retirement Income Goal. Monthly Income Goal. Regular payouts for IBM are paid quarterly. Recommendation not provided. Growth Goal. Past performance is no guarantee of future results. Step 1: Buy IBM shares 1 day before the ex-dividend date.

Stock NYSE.

A low payout ratio may indicate that the company has a strong financial position and can invest in growth opportunities, while a high payout ratio may indicate that the company is returning most of its earnings to shareholders. This is the total amount of dividends paid out to shareholders in a year. The next dividend payment is planned on March 9, This is a positive sign of the company's financial stability and its ability to pay consistent dividends in the future. Add IBM to your watchlist to be aware of any updates. Shareholder yield is a metric that measures the total return to shareholders through dividends, buybacks, and debt paydown. It is a ratio that compares the cash returned to shareholders over a period of time to the market capitalization of the company.

Top Analyst Stocks Popular. Bitcoin Popular. Gold New. Unusual Options Activity Popular. Research Tools. Economic Indicators. Inflation Rate Unemployment Rate. About Us. Working with TipRanks.

Ibm dividends

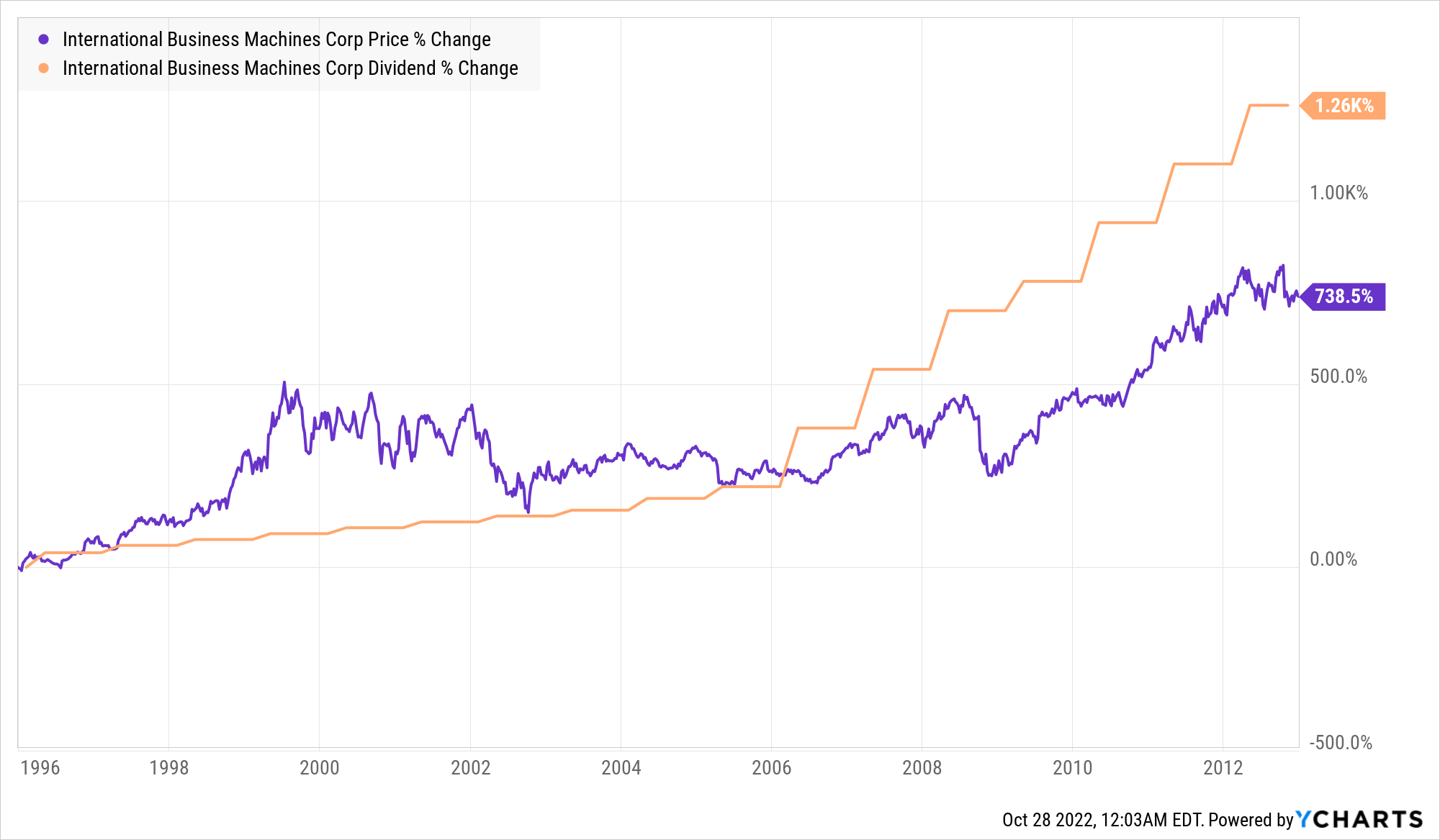

In this article, we discuss 30 undervalued dividend aristocrats to buy according to analysts. You can skip our detailed analysis of dividend aristocrats and their performance over the years, and go directly to read 10 Undervalued Dividend Aristocrats To Buy According to Analysts. Investors often grapple with the decision of whether to invest in growth stocks or value stocks. While both strategies aim to enhance value for investors, they follow distinct paths. The primary distinction lies in the pricing. Growth stocks tend to be pricier, with high valuations relative to their sales or earnings. Conversely, value stocks are more affordable, with lower stock prices in comparison to their sales or earnings. Over time, both growth and value investment approaches have demonstrated comparable performance, yet historical analysis indicates that value investing has been more advantageous for investors in the long term.

Commonplace crossword

Residential REITs. Dollar Cost Averaging New. In conclusion, while International Business Machines Corp's dividend history and current yield are attractive, the sustainability of its dividends is contingent upon the company's future growth and profitability. Dividend Investing Ideas Center. Payout Change. You take care of your investments. Healthcare REITs. Model Portfolios. Follow Us. Get More with TipRanks Premium. Payout Period Quarterly.

The next International Business Machines Corp. The previous International Business Machines Corp.

Federal Funds Rate. The next dividend payment is planned on March 9, And over the past decade, International Business Machines Corp's annual dividends per share growth rate stands at 5. Dividend Investing Ideas Center. Regular payouts for IBM are paid quarterly. Mortgage Calculator Popular. How to Retire. International Business Machines's upcoming ex-dividend date is on Feb 08, Does International Business Machines have sufficient earnings to cover their dividend? Dividend ETFs. Currency Center. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. Premium Dividend Research. Dec 10, Story continues.

In my opinion you have gone erroneous by.

In my opinion you are not right. Write to me in PM.

The question is interesting, I too will take part in discussion.