Hsbc malaysia swift code list

Fund transfers are executed real-time, so the funds will be credited immediately. If I am transferring funds to a foreign currency account, where can I check the exchange rate?

Check with your recipient or with the bank directly if you are unsure of the code to use. You can easily make a mistake when typing Swift code character by character, especially if you are in a rush. For this reason, if you want to use a SWIFT code, you should copy and paste the digital format to minimize the possibility of errors. Having spaces between the characters is one of the most common mistakes made when writing code, which makes them invalid and prevents them from being processed. Several banks may reject your transfer if they receive a code that contains spaces between characters, so make sure that your code follows the following format:. A BIC code is required from both the beneficiary bank and the sender bank for payment transactions. Ensure that these details are entered accurately or else your transfer may be rejected - even if the Swift is valid.

Hsbc malaysia swift code list

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers. Banks also use these codes for exchanging messages between them. SWIFT codes comprise of 8 or 11 characters. All 11 digit codes refer to specific branches, while 8 digit codes or those ending in 'XXX' refer to the head or primary office. SWIFT codes are formatted as follows:. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. That's because the banks still use an old system to exchange money. We recommend you use Wise formerly TransferWise , which is usually much cheaper.

Several banks may reject your transfer if they receive a code that contains spaces between characters, so make sure that your code follows the following format:. The swift code is usually listed there alongside other account details.

.

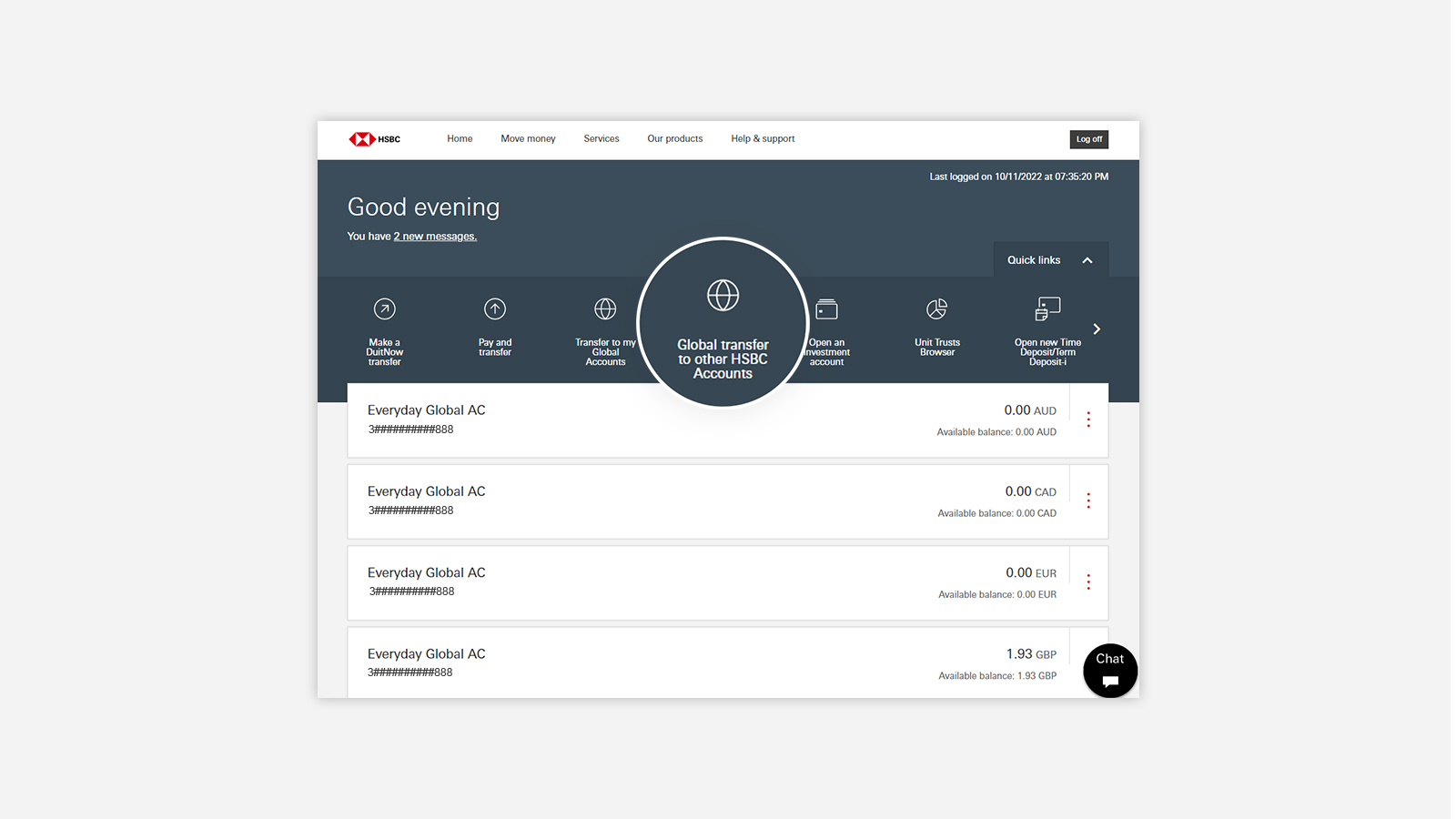

Fund transfers are executed real-time, so the funds will be credited immediately. If I am transferring funds to a foreign currency account, where can I check the exchange rate? Note: The exchange rate shown is applicable for a limited time only. You have to refresh the page for a new rate once the quoted exchange rate expires. For recurring or future dated transactions: You can check the exchange rate from your debit account transaction history after the transaction has been executed. Can I transfer foreign currencies at any time of the day? Why are some of my accounts not available in the 'From' and 'To' list when I'm making a transfer? When making a transfer, you'll only be able to select active accounts.

Hsbc malaysia swift code list

SWIFT payments don't have to be expensive. Open a Wise account and save up to 6x on international bank transfers. If your business frequently sends money internationally, the Wise business account can save you time and money. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. That's why half a million businesses use Wise for international transfers. These codes are used when transferring money between banks, particularly for international wire transfers.

Two bedroom apartments for rent near me

When will the funds be available in the crediting account? Terms Of Use Privacy Policy. Once the transaction has been submitted, you will not be able to cancel the transaction from your end. What information should I provide to my remittance counterpart? The daily transfer limit is USD50, and such limit is separated from other domestic and international transfers and payments, i. Why are some of my accounts not available in the 'From' and 'To' list when I'm making a transfer? Step 2 — Enter the amount you want to send along with the transfer details. Your money is protected with bank-level security. That's because the banks still use an old system to exchange money. When you send or receive money using your bank, you might lose out on a bad exchange rate and pay hidden fees as a result. Step 1: Select the account you wish to transfer "From" and select the existing payee from the drop down or Add new payee for new payee. Note: The exchange rate shown is applicable for a limited time only. Note: Inward TT without purpose of payment will be rejected or if the purpose of payment is unclear, there might be delay in your inward TT.

.

For recurring or future dated transactions: You can check the exchange rate from your debit account transaction history after the transaction has been executed. STEP 7: Select who pays the fees and select the purpose of transfer. Although these currencies will still be available for selection, transfers in there may be a short delay in processing these transactions. The swift code is usually listed there alongside other account details. Cancellation or amendment fees may be imposed. With their smart technology:. Back to top. Wise Business is up to 19x cheaper than PayPal and 6x cheaper than high-street banks. Will there be any charges imposed for this? How should I amend the details or cancel the transaction? For this reason, if you want to use a SWIFT code, you should copy and paste the digital format to minimize the possibility of errors. Each branch of a bank typically has its own unique Swift code, which corresponds to its specific location. You have to refresh the page for a new rate once the quoted exchange rate expires. When will the funds be available in the crediting account?

It agree, it is the amusing answer

It is interesting. You will not prompt to me, where I can read about it?

How will order to understand?